-

Asia-Pacific (APAC) markets traded in a weaker mood today, following the momentum of yesterday's US session. Japan's Nikkei 225 is up by 0.56%, the Hang Seng index is down more than 1.10%, S&P/ASX 200 is trading lower by 0.35% and Korea's KOSPI is lower by 0.40%.

-

Stocks and bonds ticked lower across the region on Thursday due to signals of Chinese weakening and potential Fed interest rate hikes.

-

Japan, Australia, China, and South Korea saw decreasing shares, pushing regional equity market prices to March levels, indicating a significant 2-day drop.

-

Hong Kong's Hang Seng index fell, possibly entering a bear market, Tencent's revenue drop impacted Chinese IT stocks amid gloomy news.

-

China's real estate recession might be worse than official figures. Chinese investors protested outside the office of one of the country’s biggest shadow banks, in a rare show of public outrage after the firm skipped payments on dozens of investment products.

-

Oil prices dropped for a fourth day due to Chinese economy concerns and stricter US monetary policy fears.

-

Morgan Stanley downgrades China's 2023 GDP forecast to 4.7% (from 5%) and 2024 prediction to 4.2% (from 4.5%).

-

Australia's Unemployment Rate reaches 3.7%, slightly exceeding the forecast of 3.6%, with a Participation Rate of 66.7%.

-

China intervenes in FX markets to prevent yuan's decline towards its 2007 low.

-

Japan's Total Trade Balance stands at -78.7B, which is a significant deviation from the forecast of 47.85B. The annual export change indicates a decrease of -0.3%, and imports are lower by -13.5% compared to the previous year. Core Machinery Orders show a decrease of -5.8% year on year, which aligns exactly with the forecasts.

-

RBNZ's Governor Orr anticipates a recession as a minimum outcome, envisions a restrictive approach for 1-2 years, attributing uncertainties to guidance.

-

Cryptocurrencies are experiencing further declines as negative sentiment dominates the market. Bitcoin has fallen below $29,000 and is down by 0.30% today. Altcoins have decreased by 5% or more.

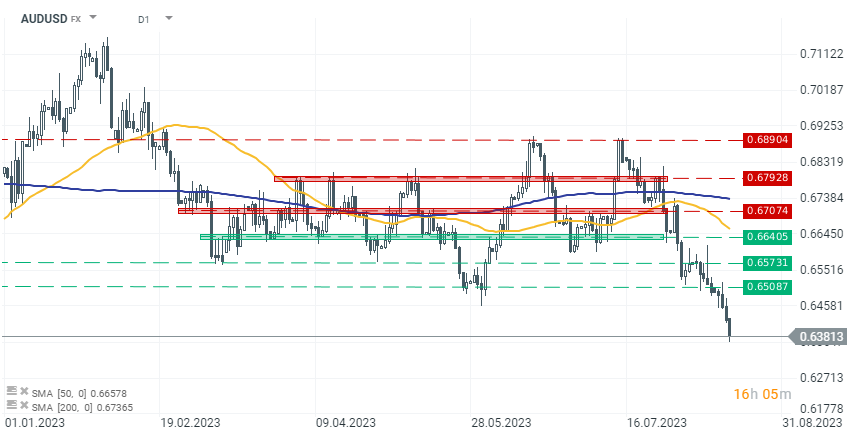

The Australian Dollar deepens its declines after worse-than-expected job market data. The AUDUSD is trading at its lowest level since November 2022.

The Australian Dollar deepens its declines after worse-than-expected job market data. The AUDUSD is trading at its lowest level since November 2022.

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!