-

US indices finished yesterday's trading mostly lower. S&P 500 dropped 0.03%, Nasdaq declined 0.58% and Russell closed 0.74% lower. Dow Jones gained 0.29%

-

Stocks in Asia declined. Nikkei closed 0.19% lower while S&P/ASX 200 finished flat. Kospi trades 1.2% lower and indices from China decline during the first trading session after Lunar New Year

-

DAX futures point to a flat opening of the European session

-

FOMC minutes showed that central bankers think it will take some time to meet conditions to taper QE

-

Pfizer said that new data showed 1 dose of its coronavirus vaccine to be 93% effective after 2 weeks and urged countries to switch to single dosing. Moderna said that its vaccine works against all variants of the virus but results for South African strain are not clear

-

White House said it is engaged in addressing chip shortages on the automotive market

-

Draghi's government won confidence vote at the Italian Senate

-

Brent jumped above $65 as the energy crisis in the United States worsens. Texas authorities banned natural gas companies from exporting fuel outside of the state. US oil has dropped by almost 40% amid temporary shutdowns

-

Australian dollar gained following release of employment report for January. Employment increased 29.1k (exp. 40k) while unemployment rate dropped to 6.4% (exp. 6.5%)

-

API data showed 5.8 million barrel decline in the US oil inventories (exp. -2.2 mb)

-

Bitcoin trades slightly below $52,000 mark

-

Precious metals gain with silver being the exception

-

AUD and EUR are top performing major currencies while NZD and CHF lag the most

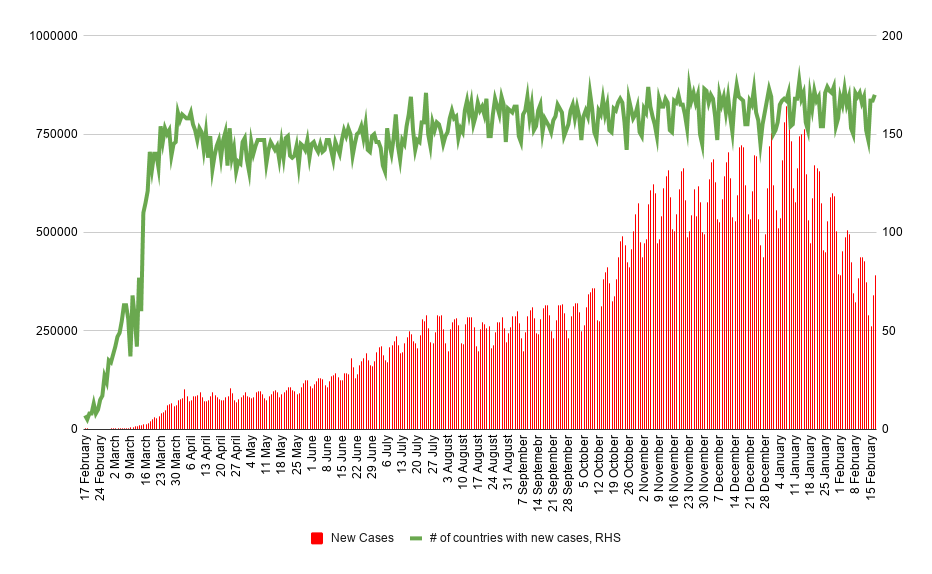

Over 390 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Over 390 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30