-

US indices rallied during the first trading session after a long weekend. S&P 500 jumped 2.45%, Nasdaq moved 2.51% higher and Dow Jones added 2.15%. Russell 2000 gained 1.70%

-

Risk moods started to deteriorate during the Asian session. Nikkei and S&P/ASX 200 traded flat, Kospi moved 2.1% lower and indices from China traded 0.2-1.0% lower

-

DAX futures point to a lower opening of the European cash session today

-

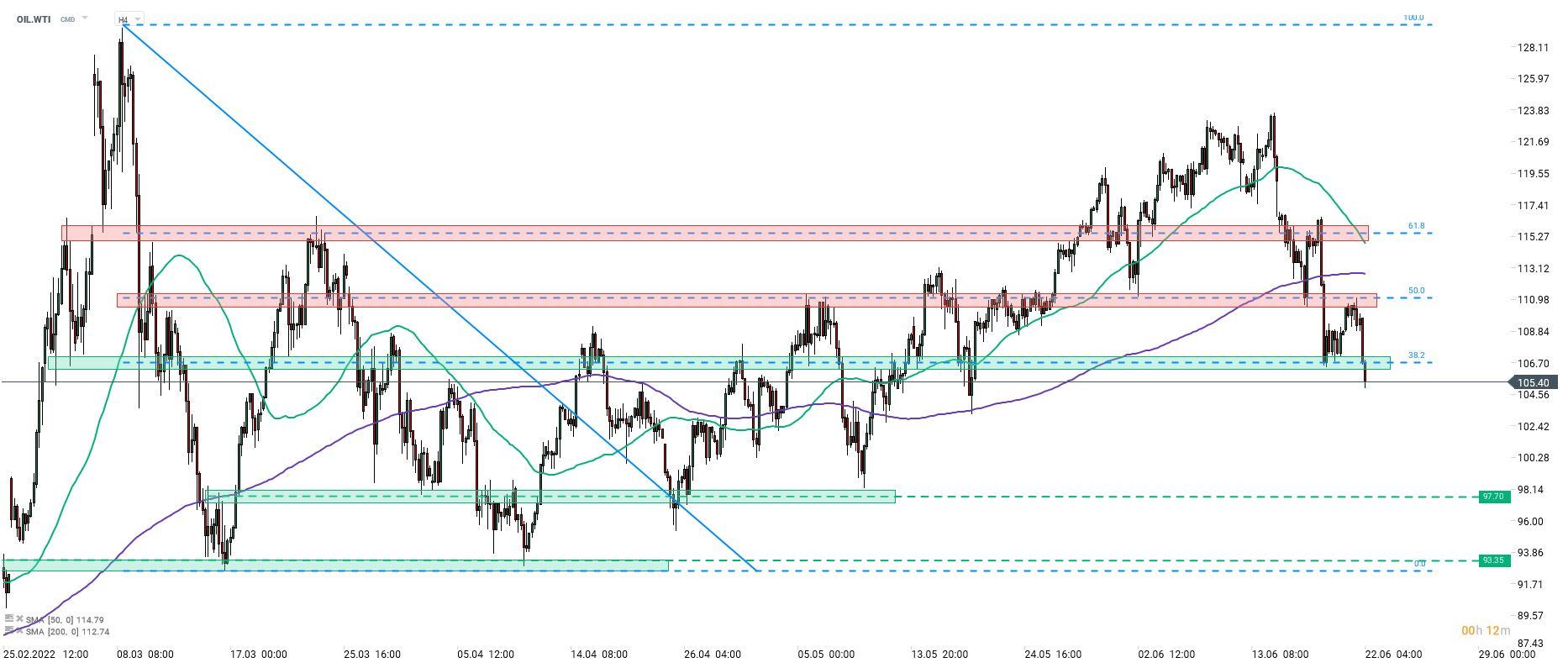

Oil took a hit overnight, dropping to the lowest level in a month. A move is puzzling as it was quite big but was not accompanied by any news that would justify it

-

Fed's Barkin said that he sees 50-75 basis point rate hike in July as reasonable

-

Heather Boushey, White House economist, is optimistic that recession in the United States can be avoided

-

Janet Yellen, US Treasury Secretary, said that she believes there is a path for soft landing and that recession is not the base case scenario for most economists

-

Cryptocurrencies are pulling back slightly. Bitcoin drops 2.4% and trades slightly below the $20,500 mark. Ethereum drops 2.8% and moves back below $1,100

-

Precious metals are pulling back amid USD strengthening. Silver is a top laggard with 1.4% drop. Gold, platinum and palladium trade around 0.4% lower

-

Risk-off flows can be spotted on the FX market this morning. JPY, USD and CHF are the best performing major currencies while AUD and NZD lag the most

Oil prices dropped to a 1-month low following a steep drop during the Asian session. Move is puzzling as there was no trigger for it. Overall fears of recession as well as profit taking from long positions are said to drive the move. Source: xStation5

Oil prices dropped to a 1-month low following a steep drop during the Asian session. Move is puzzling as there was no trigger for it. Overall fears of recession as well as profit taking from long positions are said to drive the move. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)