-

US indices finished yesterday's trading higher as traders looked past looming Fed's tightening. S&P 500 gained 1.13%, Dow Jones moved 0.74% higher and Nasdaq jumped 1.95%. Russell 2000 gained 1.08%

-

Stocks in Asia-Pacific traded higher as well. Nikkei rallied 3%, S&P/ASX 200 jumped 0.5% and Kospi added 0.9%. Indices from China traded 0.3-1.7% higher

-

DAX futures point to a higher opening of the European cash trading session today

-

Ukrainian President Zelensky is expected to take part in NATO summit online. However, it is not known whether he will only make an address or participate in the whole meeting

-

According to Wall Street Journal, Biden administration prepares to impose sanctions on more than 300 members of Russian parliament

-

A bipartisan group of US senators will discuss possibility of freezing Russian gold reserves, through ban on selling, with US Treasury Secretary Yellen

-

Fed's Mester said that may have to deliver a 50 basis point hikes more than once this year

-

Tangshan, a city in the Chinese Hebei province and a major steel hub, has been put under lockdown. Residents are forbidden from leaving their homes until lockdown ends (no date set yet)

-

United States agreed to remove tariffs on UK steel and aluminum and UK agreed to remove retaliatory tariffs on US

-

Oil trades slightly higher after Russia warned about a sharp drop in oil exports via the Caspian pipeline after infrastructure was damaged by a storm. It is said that 1 million barrels of daily exports could be in danger

-

According to Wall Street Journal, Chevron told US authorities that it can help Venezuela double its oil production

-

API report pointed to a 4.3 million barrel drop in US oil inventories (exp. +0.1 mb)

-

Precious metals trade mixed - gold and platinum pull back, palladium gains and silver trades more or less flat

-

GBP and JPY are the best performing major currencies while NZD and AUD lag the most

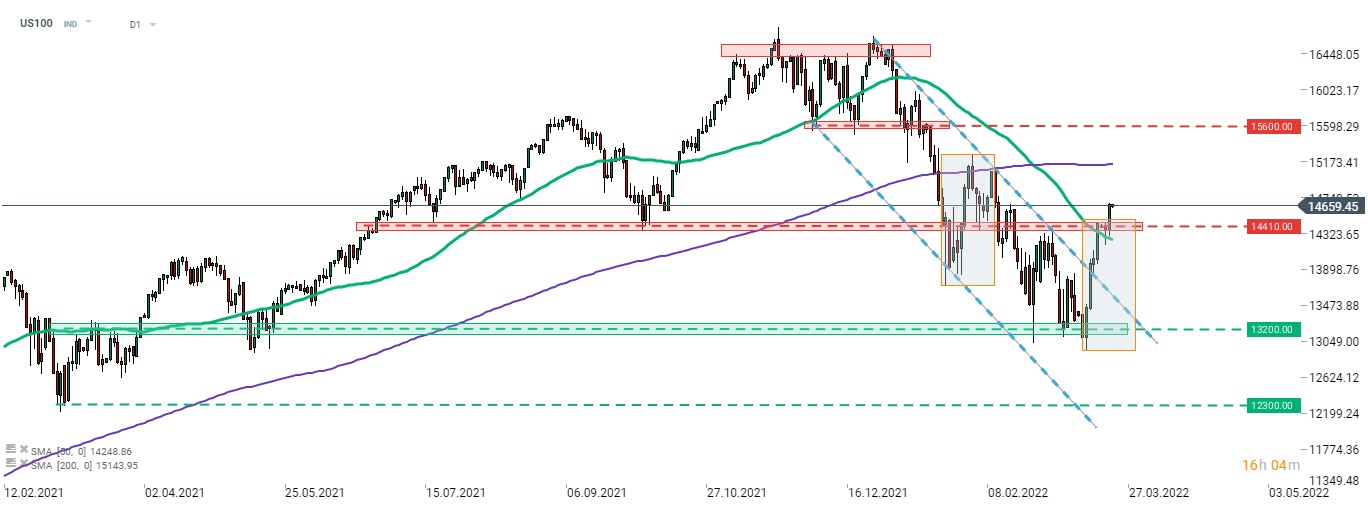

US tech shares were top performers on Wall Street yesterday with Nasdaq-100 (US100) jumping almost 2%. Index continues to move higher following a breakout from a downward channel. US100 managed to break above the resistance zone in the 14,410 pts area as well as the upper limit of the market geometry. A key resistance to watch for now is marked with the 200-session moving average (purple line, 15,150 pts area). Source: xStation5

US tech shares were top performers on Wall Street yesterday with Nasdaq-100 (US100) jumping almost 2%. Index continues to move higher following a breakout from a downward channel. US100 managed to break above the resistance zone in the 14,410 pts area as well as the upper limit of the market geometry. A key resistance to watch for now is marked with the 200-session moving average (purple line, 15,150 pts area). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers