- US indices finished yesterday's trading higher with S&P 500 gaining 0.41%, Dow Jones moving 0.53% higher and Nasdaq adding 0.46%. Small-cap Russell 2000 gained almost 0.6%

- Indices from Asia-Pacific traded mixed today - S&P/ASX 200 dropped 0.6%, Kospi gained 0.2%, Nifty 50 traded 0.1% lower and indices from China gained 0.3-0.5%. Stock exchanges in Japan were shut for holiday

- DAX futures point to a flat opening of the European cash session today

- OPEC+ meeting has been delayed from November 26 to November 30 amid output disagreements among members

- According to exit polls, far-right populist Freedom Party has won the most seats in Dutch parliamentary elections. Referendum on EU exit is among Freedom Party's proposals

- Australian manufacturing PMI dropped from 48.2 to 47.7 in November. Services PMI dropped from 47.9 to 46.3

- Chinese National Development and Reform Commission said that it will increase regulation in iron ore spot and futures trading

- Major cryptocurrencies trade slightly lower - Bitcoin drops 0.5%, Ethereum and Dogecoin decline 0.3% while Ripple slides 1.1%

- Energy commodities pull back - oil trades 0.8% lower, while US natural gas prices drop 1%

- Precious metals benefit from USD weakness - gold and silver gain 0.3%, platinum adds 0.5% and palladium trades 0.2% higher

- AUD and NZD are the best performing major currencies, while USD and CHF lag the most

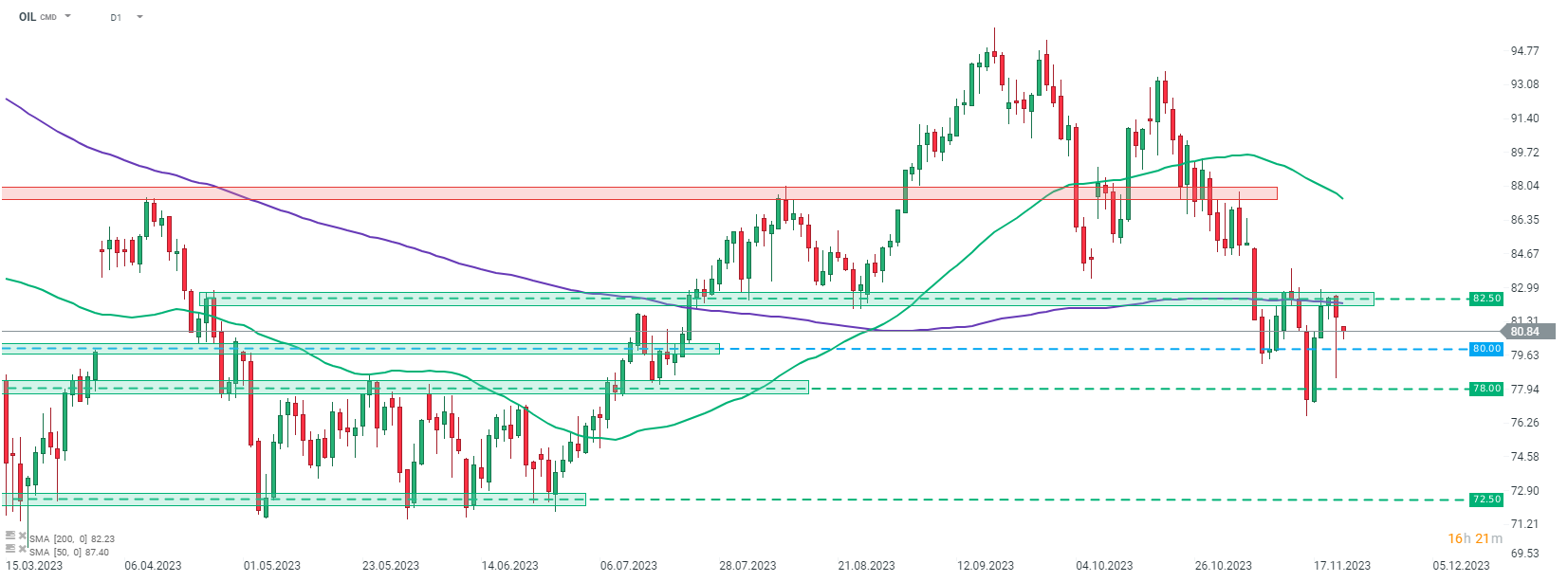

OIL continues to drop after failure to break above the $82.50 resistance zone, marked with 200-session moving average (purple line). Source: xStation5

OIL continues to drop after failure to break above the $82.50 resistance zone, marked with 200-session moving average (purple line). Source: xStation5

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts