Good morning. Yesterday's session on Wall Street ended in a relatively positive mood, with the major stock market benchmarks finishing higher. Nevertheless, yesterday's session was very volatile and much of the gains were erased. Volatility in the US put pressure on Asian markets, which are recording losses.

On the calendar today, first and foremost: PMI data for services and manufacturing in Europe, the US and the UK; retail sales in Canada and durable goods orders in the US.

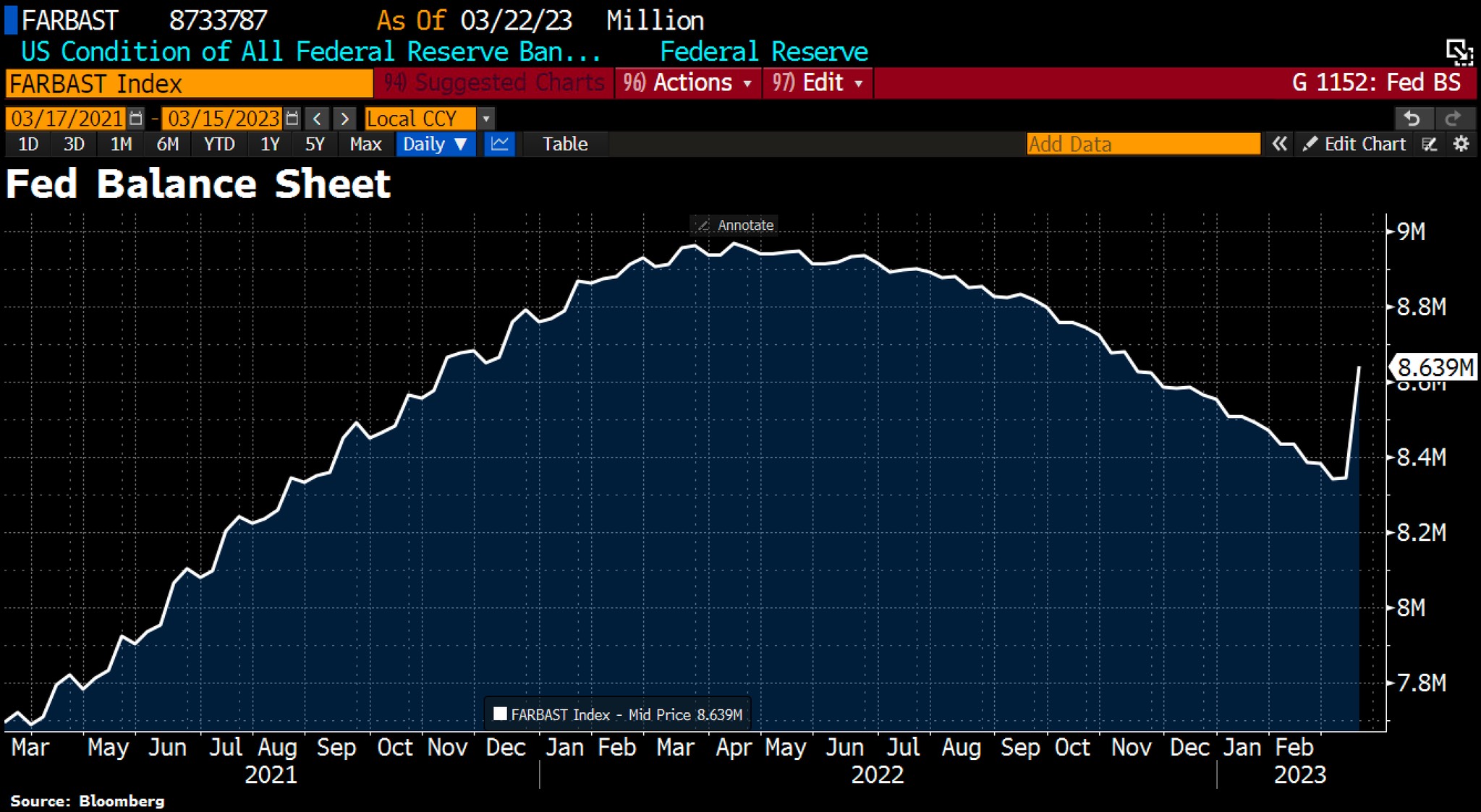

Investor attention is focused on the Fed's balance sheet, which continues to grow. Total assets increased by $94.5 billion to $8.734 trillion. Borrowing under the discount window fell to $110.2 billion from $152.8 billion, and funds against the new 'Bank Term Funding Program' jumped to $53.7 billion from $11.9 billion. Lending to banks under the FDIC jumped to $179.8 billion from $142.8 billion. At the same time, it is worth noting that the Fed has started to do repo with foreign banks. Short-term positive data for the market due to more excess liquidity in the sector.

Klaas Knot of the ECB Governing Council commented that it would be appropriate to raise interest rates at the May meeting

The US Department of Justice (DOJ) has launched an audit investigation into UBS and Credit Suisse. The regulator will investigate whether the Banks assisted Russian oligarchs in evading imposed sanctions.

The USDJPY pair continues its downward wave and has broken out to new six-week lows.

The Japanese yen is the best performing G10 currency in the FX market. The New Zealand dollar is the worst performer at the moment.

Economic data from Japan pleased investors. The CPI inflation reading for February showed a decline in inflationary pressures to 3.3% y/y against an earlier reading of 4.3% y/y. The underlying reading, on the other hand, came in line with expectations at 3.1% y/y. The January reading was 4.2% y/y.

Crude oil extended declines due to concerns about potential oversupply.

US Secretary of Energy, Ms Jennifer Granholm commented yesterday that it could take many years to replenish the Strategic Petroleum Reserve (SPR). Granholm told a House of Representatives hearing that the government wants to buy back oil at a price below $72 per barrel. On the other hand, Russia's Deputy Prime Minister Alexander Novak confirmed a smaller cut in oil production than previously indicated. Oil production is expected to reach 9.7 million barrels per day (previously it was 9.4 million barrels per day).

Precious metals are losing slightly ahead of the opening of the European session. Gold continues to remain close to the psychological barrier of 2 000 USD. Bitcoin, which is currently being considered by global capital as a safe haven, is behaving similarly. The major cryptocurrency remains above support at 28 000 USD.

Overall liquidity has increased by 366 billion USD in the last 2 weeks (a week ago it was 440 billion USD). However, this is short-term liquidity that will be reduced over time by the Fed. Source: Bloomberg

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report