-

US indices finished yesterday's trading higher. S&P 500 gained 0.85%, Dow Jones moved 0.61% higher, Nasdaq rallied 1.55% and Russell 2000 jumped 1.88%

-

Stocks in Asia are rallying for the second day in a row. Nikkei, Kospi and indices from China trade around 1% higher. S&P/ASX adds 0.2%

-

DAX futures point to a slightly higher opening of the European cash session

-

Chinese President Xi Jinping may not attend G20 meeting in late-October

-

US President Biden will deliver a speech on Afghanistan withdrawal deadline today

-

Iran resumed fuel exports to Afghanistan

-

Cryptocurrencies pulled back after it was reported that Coinbase is experiencing issues

-

Premier of New South Wales (Australia) is expected to announce loosening of restrictions for fully vaccinated citizen in the second half of the week

-

New Zealand retail sales increased 3.3% QoQ in Q2 2021 (exp. 2% QoQ)

-

Bitcoin trades slightly above $49,000 mark

-

Precious metals trade mixed - gold, silver and platinum pull back slightly while palladium gains

-

Brent, WTI and industrial metals trade higher

-

AUD and NZD are the best performing major currencies while JPY and CHF lag the most

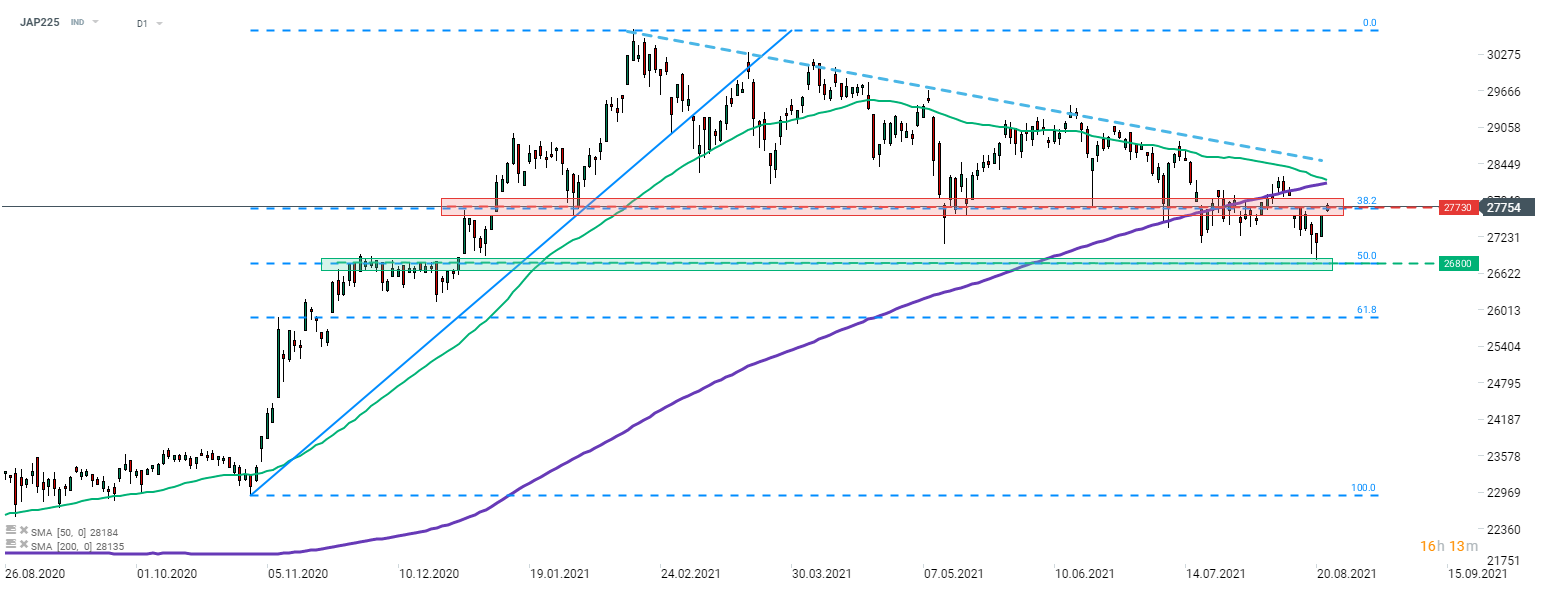

After a positive reaction to the 26,800 pts support zone, Nikkei (JAP225) launched a recovery move. The index is currently testing the resistance zone at 27,730 pts, marked with the 38.2% retracement of the upward move launched in November 2021. Source: xStation5

After a positive reaction to the 26,800 pts support zone, Nikkei (JAP225) launched a recovery move. The index is currently testing the resistance zone at 27,730 pts, marked with the 38.2% retracement of the upward move launched in November 2021. Source: xStation5

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉