- Wall Street indices traded lower yesterday. S&P 500 dropped 0.38%, Dow Jones moved 0.16% lower and Nasdaq declined 0.13%. Small-cap Russell 2000 was the outperfromer and closed 0.6% higher

- Indices from Asia-Pacific traded mixed today - Nikkei gained 0.2%, S&P/ASX 200 gained 0.1%, Nifty 50 traded flat and Kospi dropped 0.9%

- Indices from China traded slightly higher today

- DAX futures point to a lower opening of the European cash session today

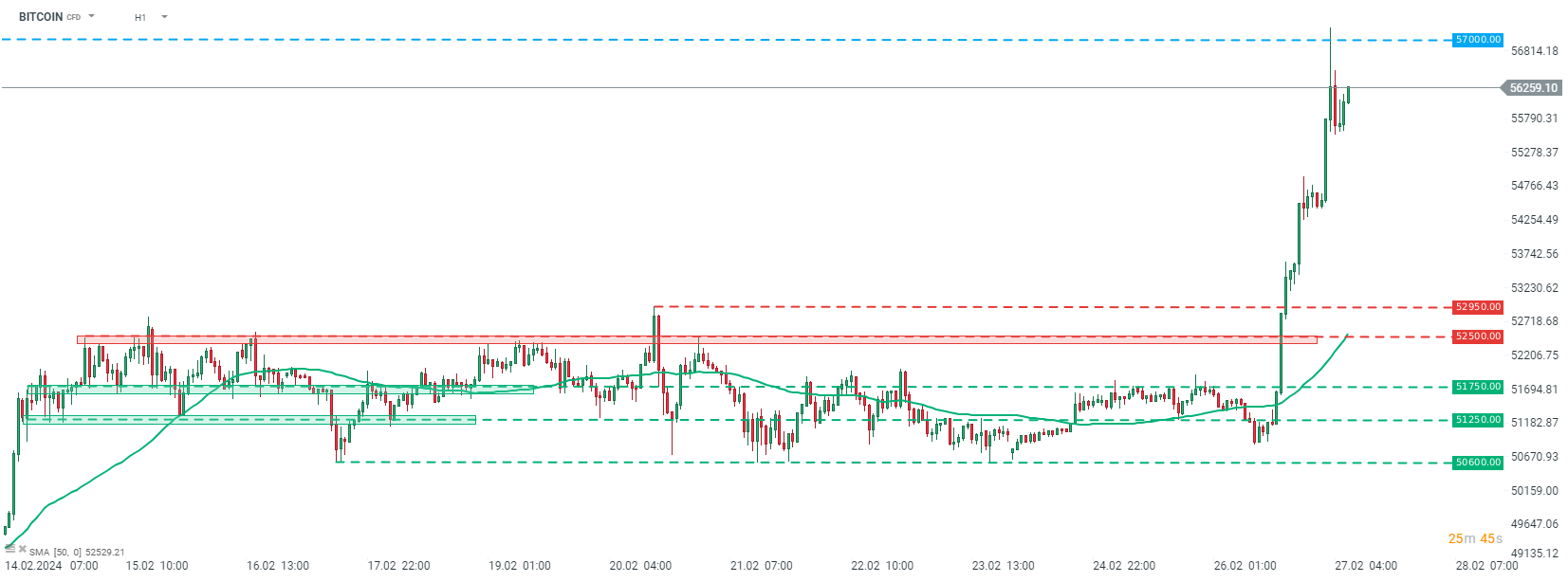

- Bitcoin rallied yesterday. Gains accelerated after the coin broke above the $53,000 mark. A daily high was reached above $57,000 during the Asia-Pacific session earlier today. However, prices has pulled back slightly from this area since

- Fed Schmid said that Fed should be patient on cuts as it is not out of high inflation yet. Schmid also said that it would be a mistake to cryptocurrencies as currencies

- Japanese core CPI inflation slowed from 2.3% to 2.0% YoY (exp. 1.8% YoY). Headline CPI inflation slowed from 2.6% to 2.2% YoY

- According to ABC media report, China will remove tariffs on Australian wine at the end of March when it reviews imposts

- Energy commodities trade mixed - oil trades a touch higher while US natural gas prices drop around 1%

- Precious metals are trading slightly higher - gold gains 0.1%, silver adds 0.2% and platinum jumps 0.5%

- AUD and JPY are the best performing major currencies, while NZD and CHF lag the most

BITCOIN extended yesterday's gains and climbed above $57,000 mark during the Asia-Pacific session today. However, the coin has pulled back around $1,000 from the highs later on. Source: xStation5

BITCOIN extended yesterday's gains and climbed above $57,000 mark during the Asia-Pacific session today. However, the coin has pulled back around $1,000 from the highs later on. Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

Crypto news: Bitcoin gains almost 2% despite the war in the Middle East 📈

Jane Street: Legendary market maker in the court

Morning Wrap: Nvidia's brilliant results drag the market down (27.022026)