- Indices from Asia-Pacific launched new week's trading lower. Nikkei drops 0.6%, S&P/ASX 200 is down 0.8%, Kospi and Nifty 50 decline 0.1% while indices from China trade 0.4-1.2% lower

- US index futures are trading around 0.2-0.4% lower while DAX futures drop 0.2%

- JPY and GBP are the best performing major currencies, while NZD and CAD lag the most

- Energy commodities pull back - oil is down 0.3% while US natural gas prices drop 3% on warmer weather forecasts

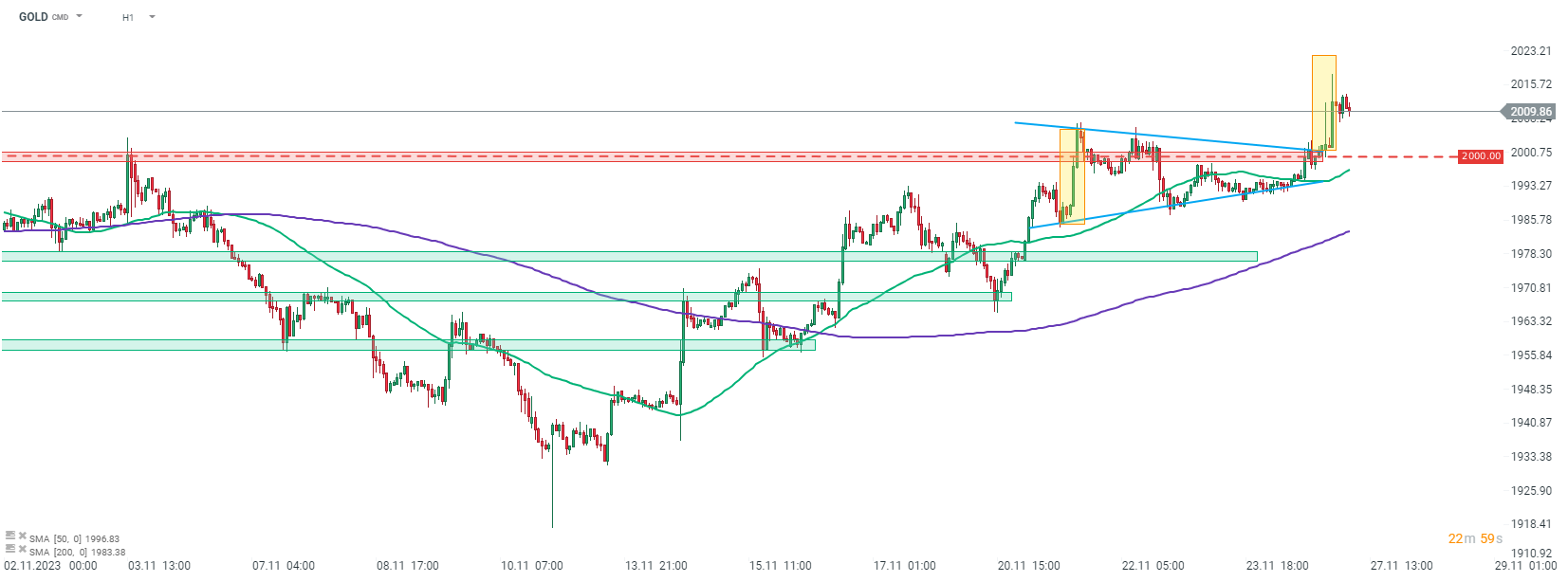

- Precious metals continue to climb - gold gains 0.4% and trades above $2,000 per ounce. Silver gains 1.3% and platinum trades 0.4% higher

- Cryptocurrencies pull back - Bitcoin drops 0.7%, Ethereum trades 1.2% lower and Ripple slides 1.6%. Dogecoin bucks the trend and gains 3.6%

- According to Reuters report, Beijing exchanges asked major shareholders not to reduce holdings in listed companies to avoid damaging market sentiment

- ECB Nagel said that rate hikes are having an impact on the economy and inflation is slowing but is not yet where ECB wants it

- Profits of Chinese industrial firms dropped 7.8% YoY in January-October 2023 period, up from 9% YoY a month ago. Profits were 2.7% YoY higher in October alone

- Japanese PPI services inflation accelerated from 2.0 to 2.3% YoY in October (exp. 2.1% YoY)

GOLD managed to break above the psychological $2,000 area as well as above the upper limit of a short-term triangle pattern. Source: xStation5

GOLD managed to break above the psychological $2,000 area as well as above the upper limit of a short-term triangle pattern. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report