-

US indices rallied yesterday. S&P 500 gained 1.38% and reached a fresh all-time high. Dow Jones gained 0.98%, Nasdaq moved 1.39% higher and Russell 2000 added 0.63%

-

Indices from Asia followed into footsteps of their US peers and also moved higher. Nikkei gained 1.4%, Kospi added 0.7% and indices from China traded 0.2-0.5% higher

-

DAX futures point to a slightly higher opening of today's European cash session

-

China has agreed to launch a military hotline with Japan and increase communication between the two countries. Hotline will be launched next year

-

Japanese industrial production increased 7.2% MoM in November (exp. 4.9% MoM)

-

Japanese unemployment rate for November increased from 2.7 to 2.8% (exp. 2.7%)

-

Precious metals trade mixed on the European morning. Gold and silver gain slightly while platinum and palladium pulls back. Palladium is taking a steep dive

-

Oil trades slightly higher. WTI tests $76.00 area while Brent trades near $78.50

-

Cryptocurrencies are pulling back. Bitcoin drops back below $50,000 while Ethereum pulled back below $4,000

-

EUR and AUD are the best performing major currencies while NZD and CHF lag the most

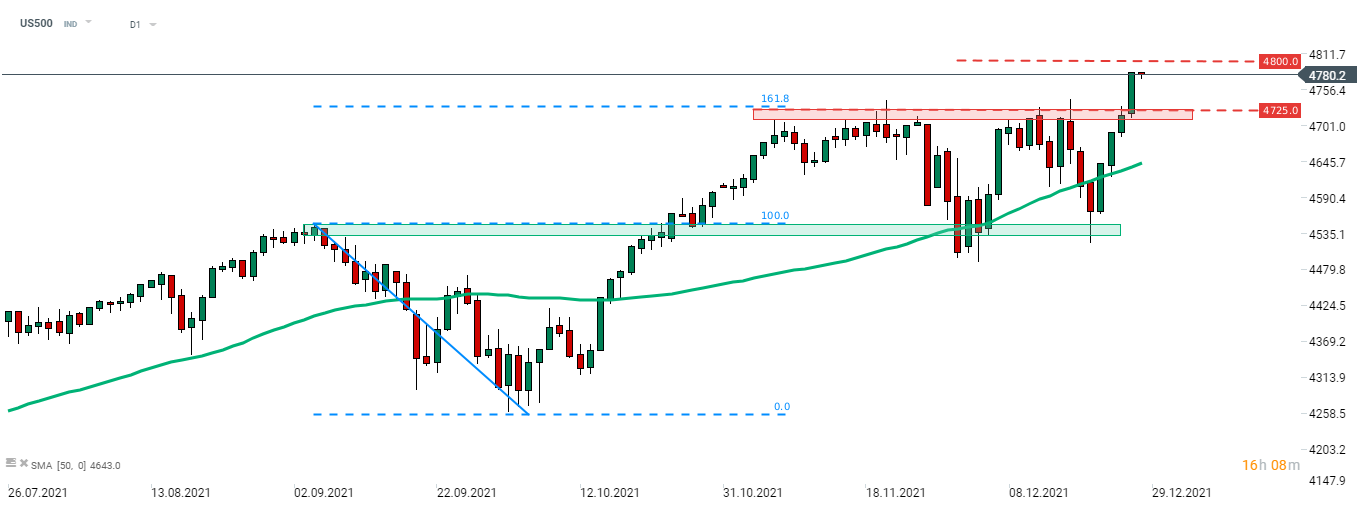

S&P 500 (US500) was one of the best performing US indices yesterday, gaining almost 1.4%. The index reached a fresh all-time high after breaking above the 4,725 pts resistance zone. However, traders should keep in mind that as liquidity conditions are thinner this week, moves may be more volatile. Source: xStation5

S&P 500 (US500) was one of the best performing US indices yesterday, gaining almost 1.4%. The index reached a fresh all-time high after breaking above the 4,725 pts resistance zone. However, traders should keep in mind that as liquidity conditions are thinner this week, moves may be more volatile. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022