-

Wall Street indices finished yesterday's trading with big losses. S&P 500 dropped 2.01%, Dow Jones declined 1.56% and Nasdaq plunged 2.98%. Russell 2000 dropped 1.86%

-

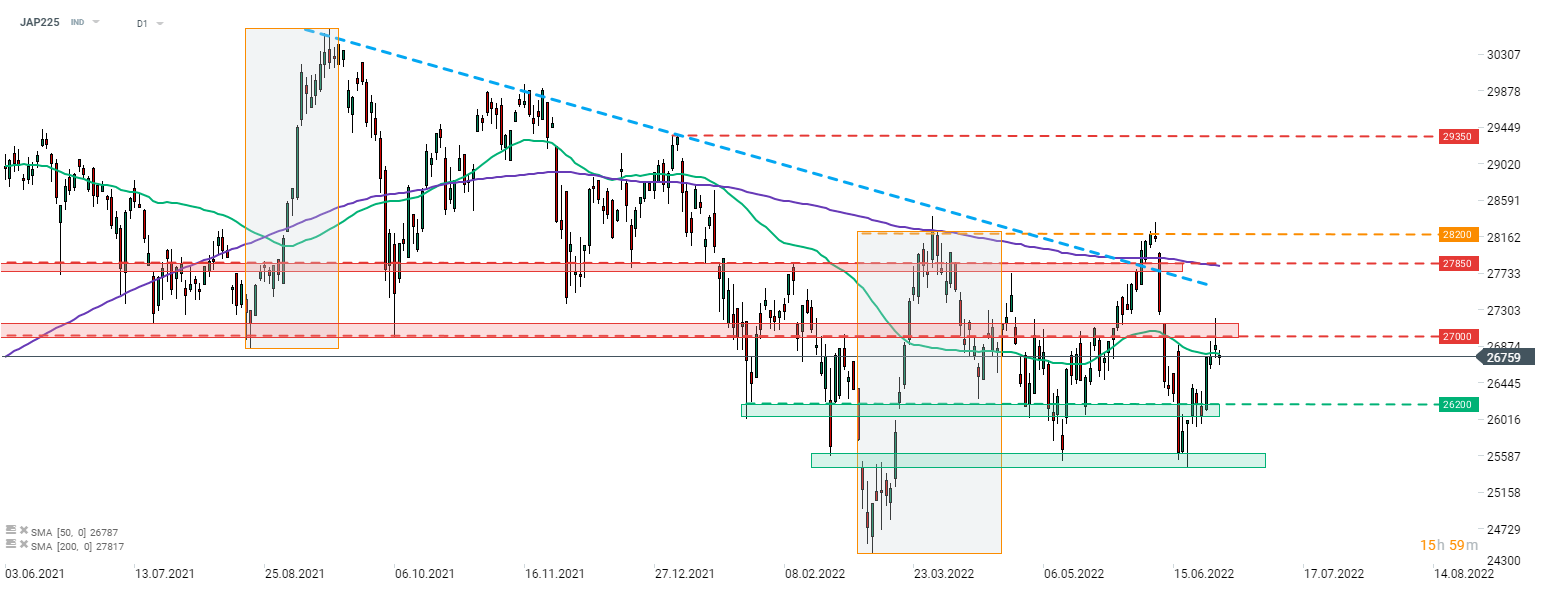

Indices from Asia followed the US lead and also moved lower. Nikkei dropped 0.9%, S&P/ASX 200 declined 0.7% and Kospi traded 1.6% lower. Indices from China traded 0.7-1.5% lower

-

DAX futures point to a lower opening of the European cash session today

-

After negotiations Turkey dropped its opposition to Finland and Sweden joining NATO. Official announcement is expected during Alliance's summit that begins today

-

Reuters reported that talks between G7 countries and China and India on Russian oil price cap were positive and productive

-

Australian retail sales increased 0.9% MoM in May (exp. 0.3% MoM)

-

Japanese retail sales increased 3.6% YoY in May (exp. 3.2% YoY)

-

API report pointed to a 3.8 million barrel drop in US oil inventories (exp. -0.6 mb)

-

Cryptocurrencies are pulling back with declines ranging from 1-6%. Bitcoin drops 1.5% and tests $20,000 area

-

Oil is trading slightly lower. Brent holds above $113 while WTI trades near $111.40

-

Platinum gains while gold and silver trade little changed

-

NZD and GBP are the best performing major currencies while EUR and AUD lag the most

Nikkei (JAP225) pulls back after a failed attempt of breaking above the resistance zone in the 27,000 pts area. Source:xStation5

Nikkei (JAP225) pulls back after a failed attempt of breaking above the resistance zone in the 27,000 pts area. Source:xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers