US natural gas prices have been dropping significantly over the past few days. NATGAS dropped below $5 per MMBTu and is now testing a key long-term upward trendline. If sellers managed to push the price below this hurdle, we cannot rule out a pullback towards the price range that was normal for 2016-2021 period - $2.00-3.00 per MMBTu.

Situation on the NATGAS chart starts to look like price crashes following previous strong rallies (2012-2015 and 2018-2020). Prices dropped below the base of the upward wave following a rally back then. In such a scenario, and in case price break below $4.90-5.00 support zone, a pullback towards the $3.50 area maybe on the cards. However, are fundamentals also looking so bad? Source: xStation5

Situation on the NATGAS chart starts to look like price crashes following previous strong rallies (2012-2015 and 2018-2020). Prices dropped below the base of the upward wave following a rally back then. In such a scenario, and in case price break below $4.90-5.00 support zone, a pullback towards the $3.50 area maybe on the cards. However, are fundamentals also looking so bad? Source: xStation5

Weather

The United States are facing a winter attack right now. Should the situation from 2020 repeat, a strong price rally in the next few trading sessions cannot be ruled out. Of course, a spot prices range to as high as $30-50 per MMBTu depening on the hub what is caused by sudden increase in demand. However, it should be noted that spot prices depend on current, temporary consumption, while futures price take into account average consumption over a certain period of time.

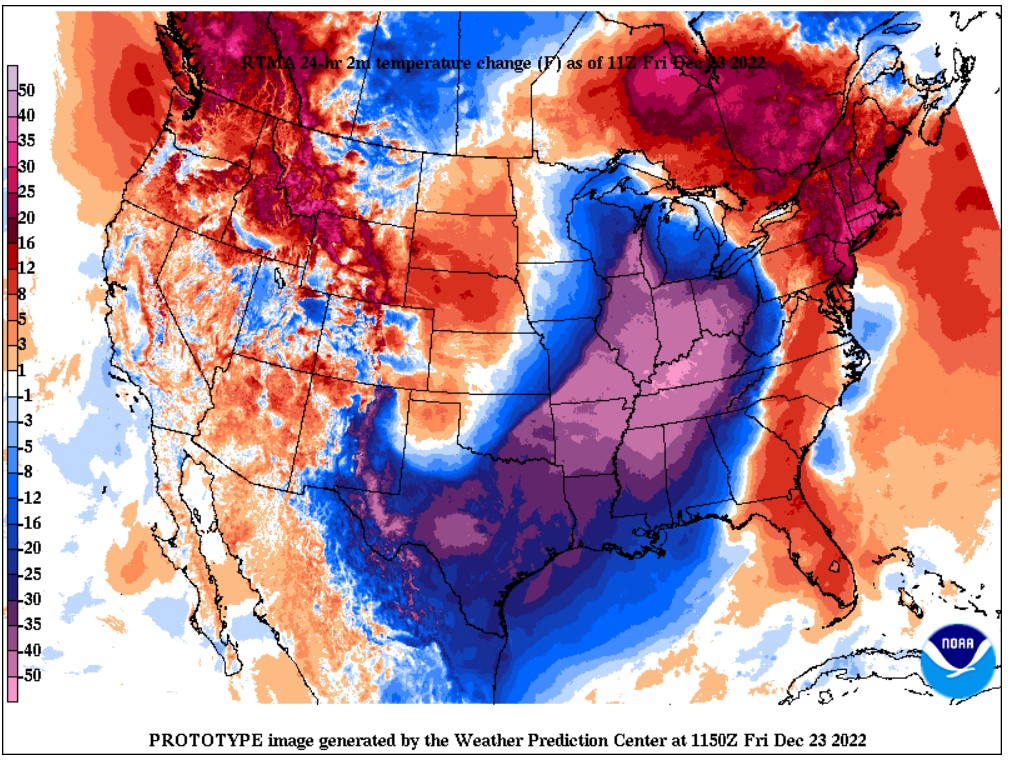

Current weather in the US can be described as a winter attack. Peak snowfall and lowest temperatures are expected around Christmas Eve. On the other hand, forecsats for the coming week are left unchanged - warming is expected. Source: NOAA

Current weather in the US can be described as a winter attack. Peak snowfall and lowest temperatures are expected around Christmas Eve. On the other hand, forecsats for the coming week are left unchanged - warming is expected. Source: NOAA

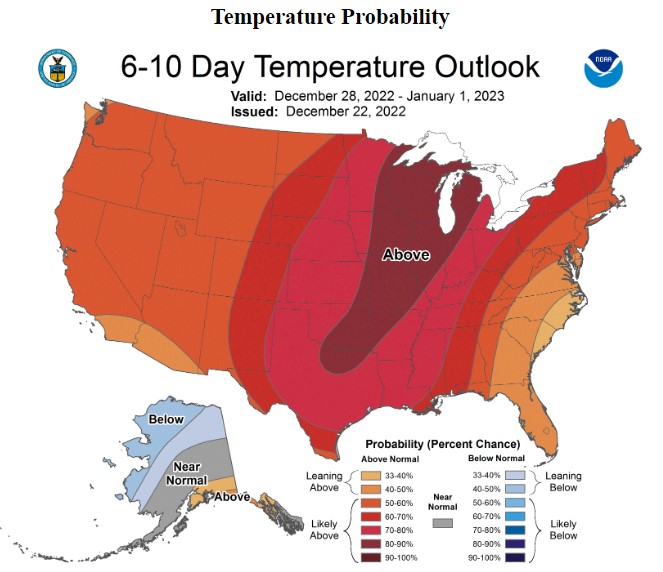

Weather forecasts for the end of the next week are left unchanged - it should be warmer. NOAA

Significant consumption

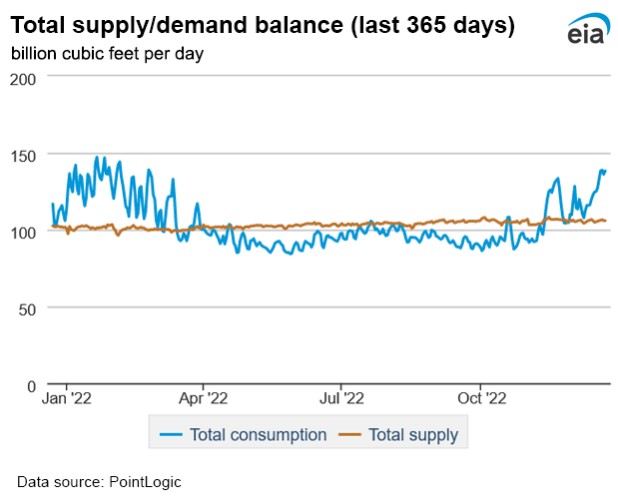

When we take a look at data on current gas consumption in the United States we can see that it has increased significantly in recent days and is much higher than it was a year ago.

US gas consumption is currently near last heating season's peaks. Source: EIA

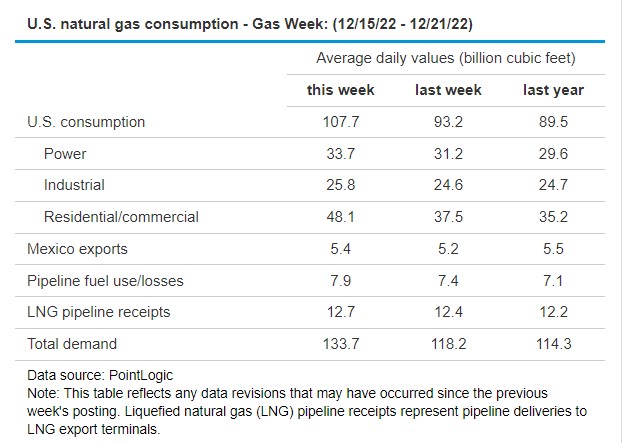

It can be seen that there is a significant increase in demand for heating (residential/commercial). Source: EIA

Drop in natural gas prices is driven by disappointment in yesterday inventories report. Stockpiles dropped les than expected. Overall, level of stockpiles is very higher but it cannot be ruled out that prices will jump again this year, should high levels of consumption persist.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30