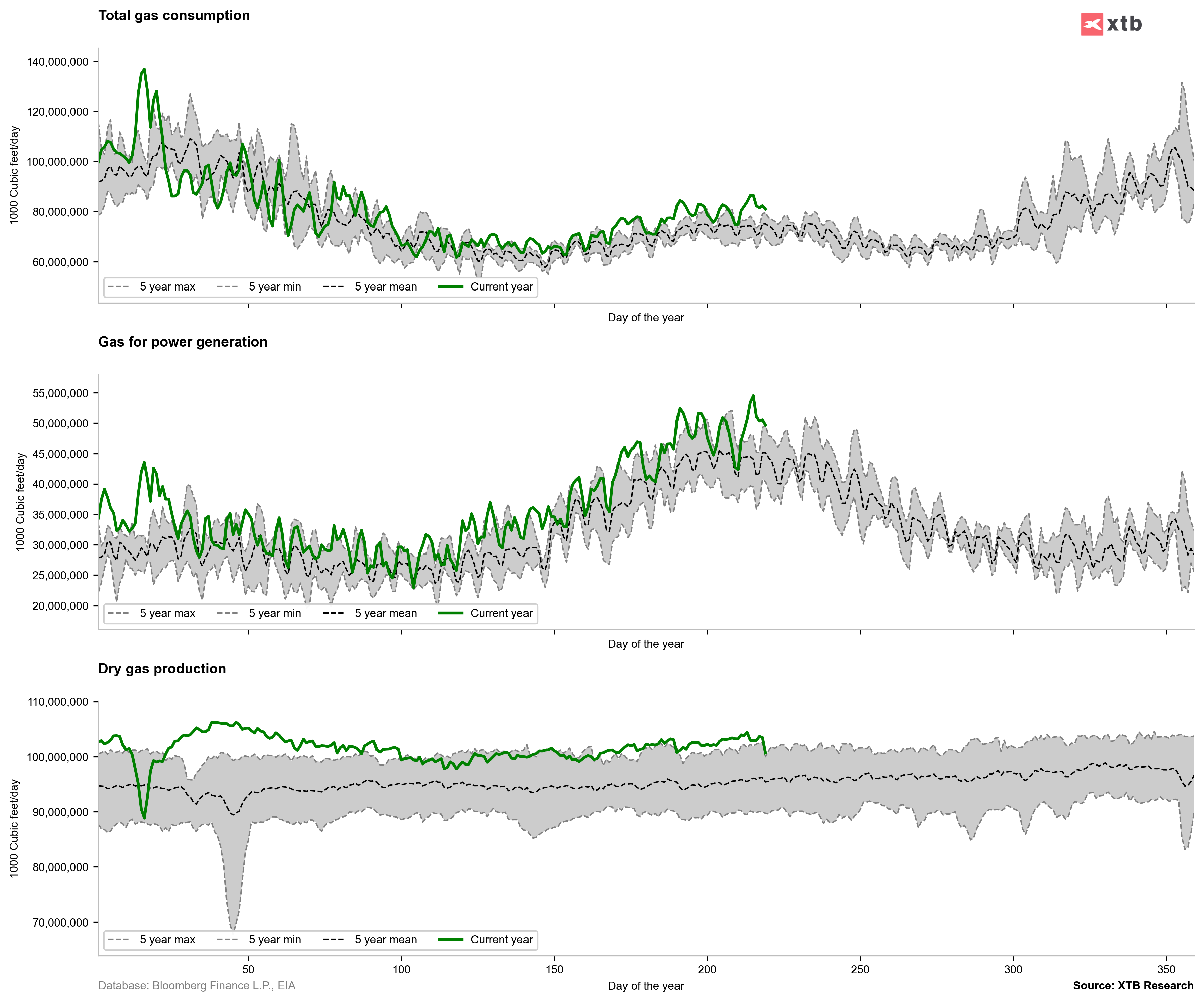

Natural gas (NATGAS)-based contracts are gaining more than 5% during Wednesday's session as the disparity between supply and demand for the commodity continues. Despite large gas inventories in the U.S., data for the past few days indicate that the rate of shrinkage is increasing relatively quickly. The supply-demand balance came out below the range of the 5-year average this week, and the demand for gas itself in the context of electricity generation is growing.

Gas production fell sharply this week, although demand for the commodity remains elevated. Source: XTB

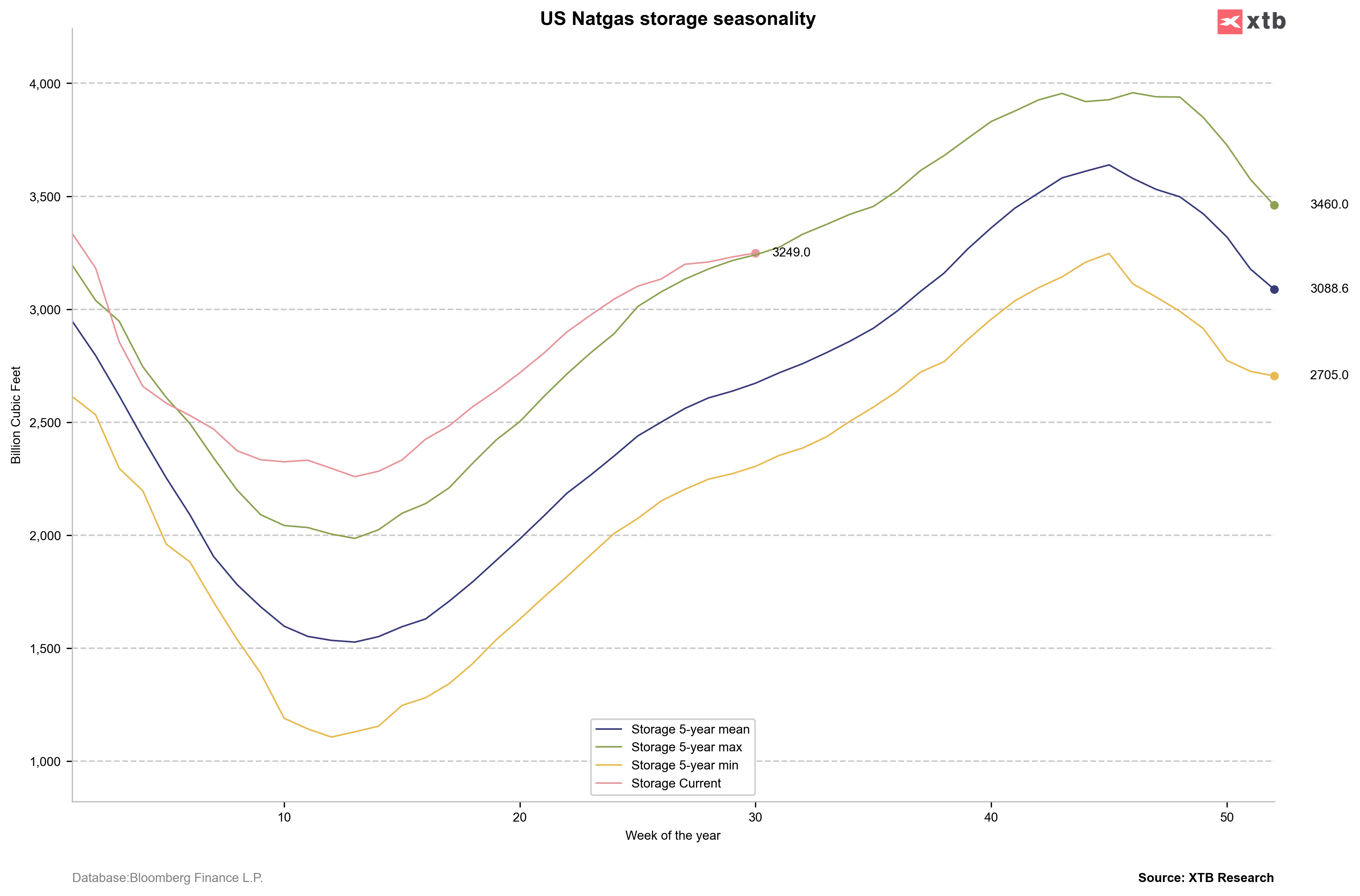

The slowdown in production has led, for the first time since January/February of this year, to rally overall inventories against the upper limit of the 5-year historical average. An extension of this trend could lead to concerns that such a sharp reduction in production could bring stocks back to the historical average, disrupting the pro-downturn paradigm that has kept NATGAS under pressure since the beginning of the year. Source: XTB

The slowdown in production has led, for the first time since January/February of this year, to rally overall inventories against the upper limit of the 5-year historical average. An extension of this trend could lead to concerns that such a sharp reduction in production could bring stocks back to the historical average, disrupting the pro-downturn paradigm that has kept NATGAS under pressure since the beginning of the year. Source: XTB

NATGAS is currently testing a zone of resistance set by the 50- and 100-day exponential moving averages. It is the reaction to these levels that may determine whether we are in for a reversal of the downtrend, or whether the supply side, however, will decide to push NATGAS back below the 2.10 zone. Source: xStation

NATGAS is currently testing a zone of resistance set by the 50- and 100-day exponential moving averages. It is the reaction to these levels that may determine whether we are in for a reversal of the downtrend, or whether the supply side, however, will decide to push NATGAS back below the 2.10 zone. Source: xStation

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74