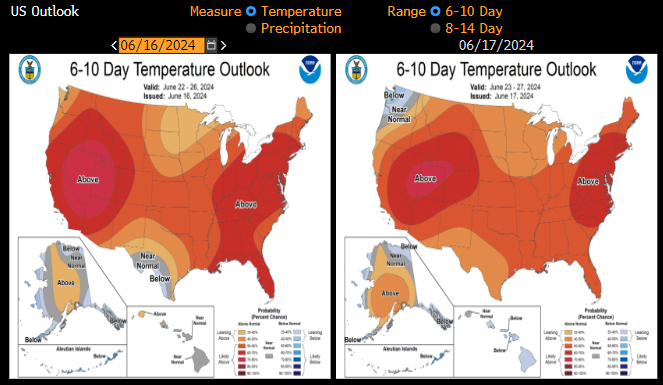

Futures on US natural gas (Henry Hub) gains today as extreme heat is expected to spread across the US states, increasing demand for cooling. Recently seen 4-days losing streak was stopped today, after profit taking from traders. NatGasWeather indicator suggesting cooling rains in Texas amid tropical storms in the Gulf of Mexico may be not enough to pressure NATGAS as it may also disrupt LNG logistics and exports. According to weather forecasts, heats are expected across all US states during June 18-24 with temperatures in upper 80s, 90s to 100s (F) (with relative colder weather in Texas).

US weather forecast signals spreading heat in northern and southern US states. Source: Bloomberg Finance L.P

Goldman Sachs commented that US gas may supply 60% of the power needed by US-based AI. Providing larger AI models will end in larger electricity demand. From the long term perspective, AI will increase demand on natural gas due to data centres activity. Wells Fargo analysts forecast that electricity demand in the US will grow up to 20% by 2030, citing AI as a main catalyst of this change. Analysts from S&P expect that global, overall electricity demand will rise by 33% until 2030. US gas production fell by approximately 9% this year. Gas output decreased to an average of 96.9 billion cubic feet per day in May from 98.1 billion cubic feet / day in April.

NATGAS opened higher today after the rollover, and futures jumped almost 2.5% since the new opening. Source: xStation5

NATGAS opened higher today after the rollover, and futures jumped almost 2.5% since the new opening. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉