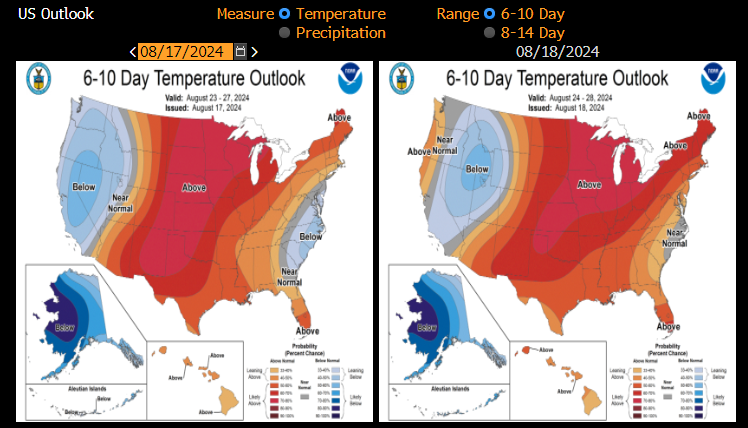

The price of natural gas (NATGAS) is up more than 5% today, recovering all losses from the end of last week. It's worth noting that prices reached their highest level since July last Thursday. The price increase is linked to forecasts of higher temperatures over the next 6-10 days, which could lead to increased demand for gas, currently around the 5-year average. Moreover, price in Europe approaches around 40 EUR/MWh. The extremely large contango in the market is also decreasing, indicating rising short-term demand.

Gas is rebounding today by over 5%. However, it is still about 3.5% below last week's highs. Source: xStation5

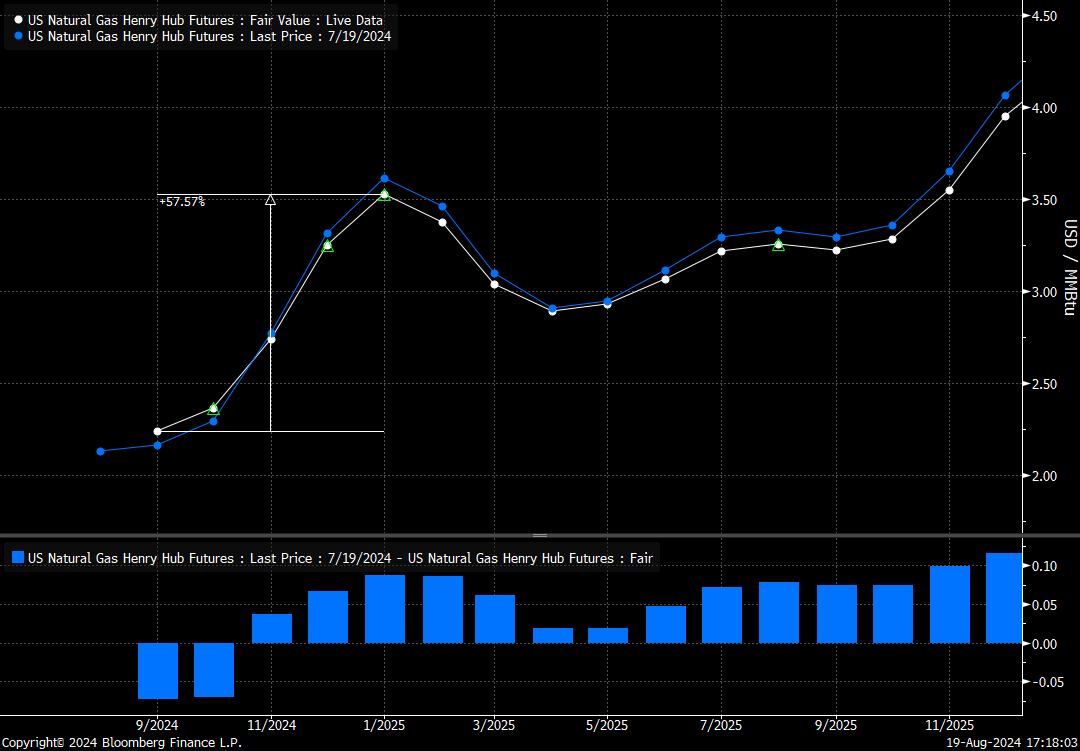

Contango has decreased by about 10 percentage points in the September-January period! This indicates an increase in short-term demand. It's also worth noting the upcoming contract rollover this week, expected to be around 5%. Source: Bloomberg Finance LP

The next 6-10 days are expected to be particularly hot in the central states. Over the 8-14 day period, it will be hot across the entire USA, though the deviations won't be extreme. Source: Bloomberg Finance LP

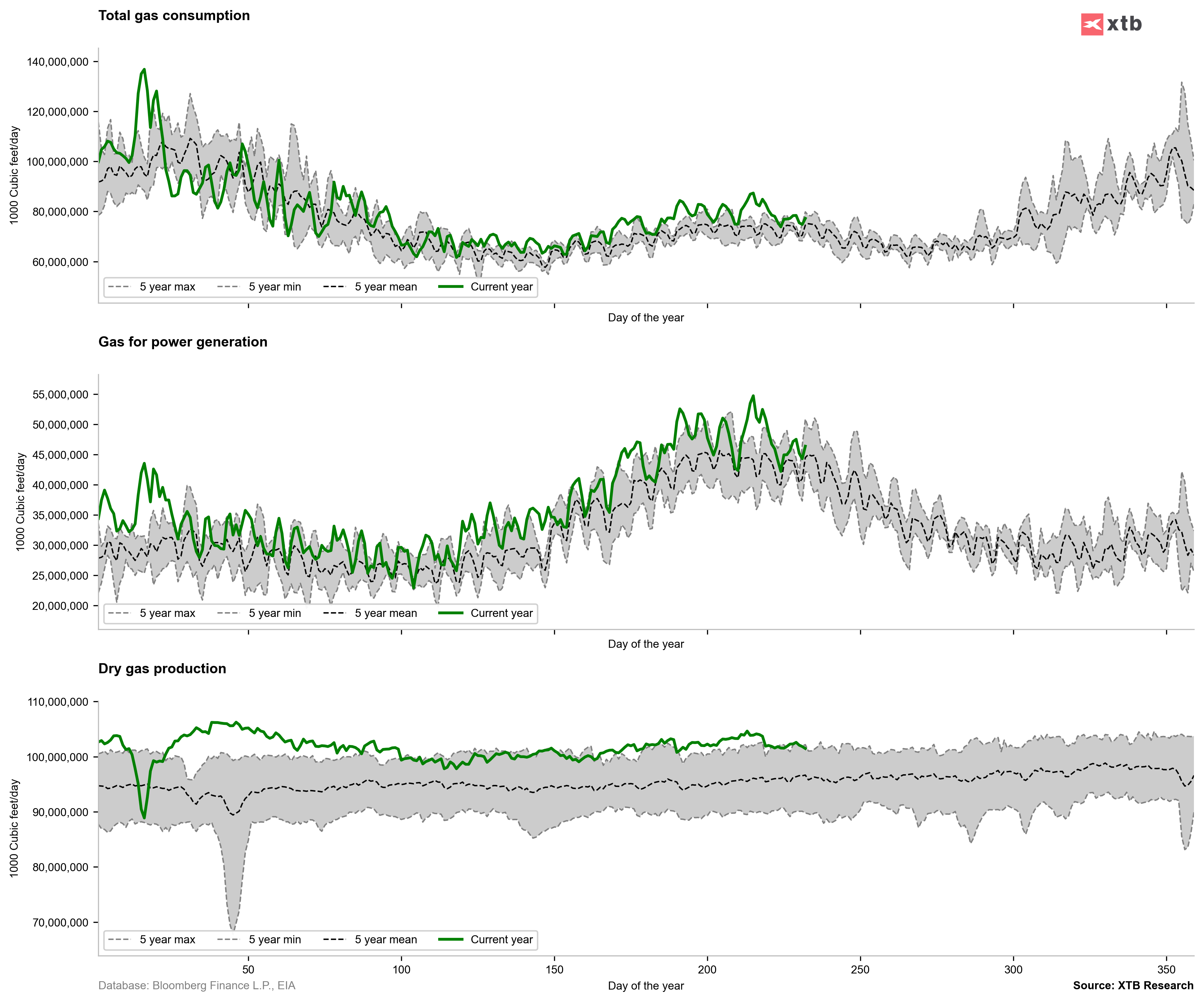

Gas consumption has returned to levels close to the last 5 years. On the other hand, production has also declined from extremely high levels, leading to very modest inventory growth. Current stockpiles are below the 5-year maximum. Source: Bloomberg Finance LP, XTB

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)