While the majority of commodities trade under pressure today amid post-NFP USD strengthening, there is one commodity that visible bucks this trend - US natural gas prices (NATGAS). NATGAS gains over 3% today and trades at the highest level in 2 weeks. Weather forecasts for the United States can be named as a reason behind the move as they continue to point to a higher-than-average temperatures in key regions. This means that demand for air conditioning, and therefore power generated by gas-powered plants, will likely increase.

Forecast for the next 8-14 days an over 50% chance of above-average temperatures in the US Midwest region. Source: Bloomberg Finance LP

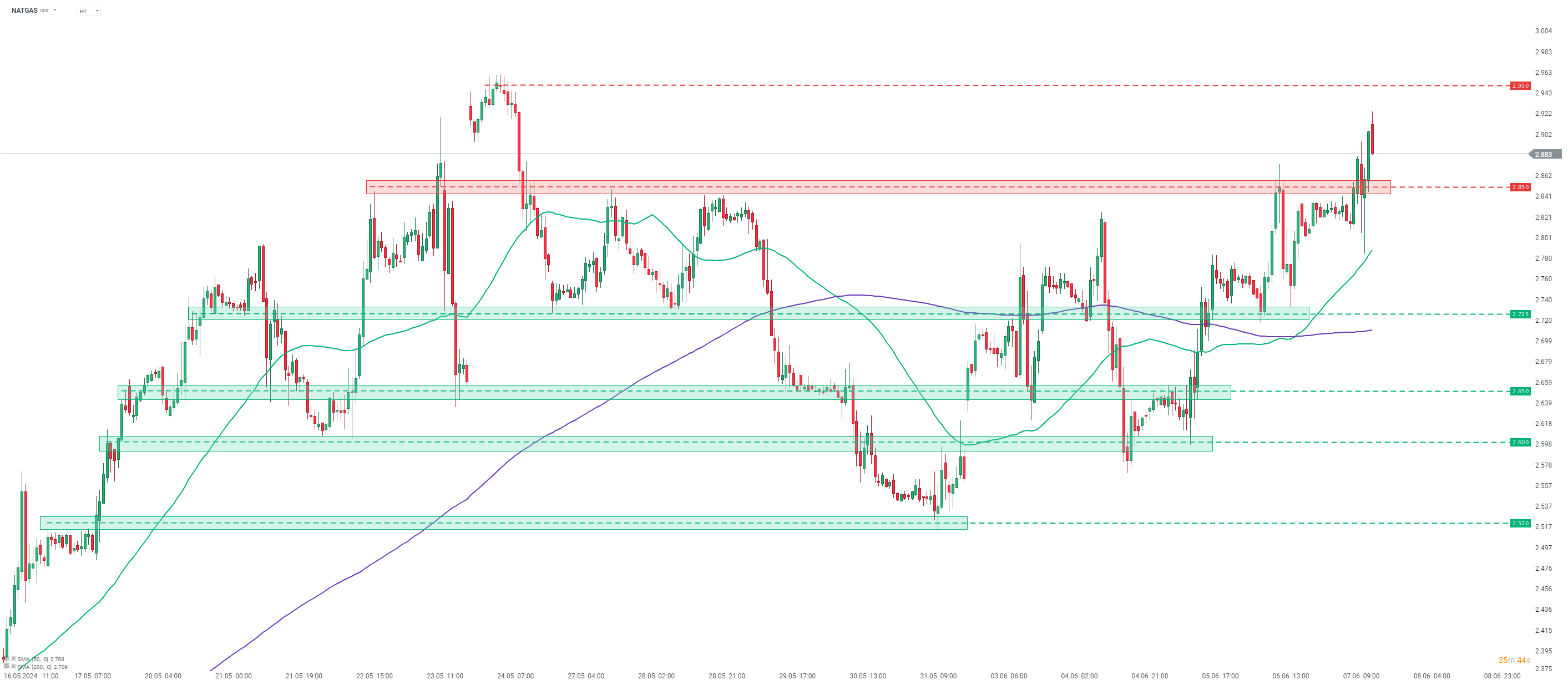

Taking a look at NATGAS chart at H1 interval, we can see that price jumped above $2.85 per MMBTu resistance zone today and is now trading over 15% above the local low from end of May. A daily high today was reached above $2.92, but price pulled back slightly. Nevertheless, NATGAS continues to trade 3% higher on the day. The next potential resistance zone to watch can be found in the $2.95 area, marked with late-May highs.

Source: xStation5

Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?