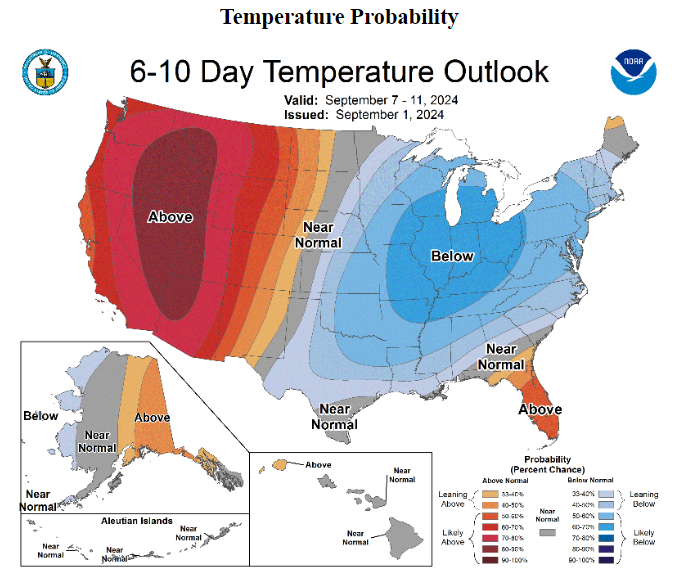

Gas prices are rebounding strongly in today's session, continuing the rebound started last week. Gas prices are up 2.7%, testing the vicinity of the $2.2/MMBTU level. Interestingly, we are seeing a marked change in the weather situation in the US. Almost all of the eastern and central states are experiencing cooler than normal temperatures. This, of course, means likely lower gas consumption due to the lack of need for air conditioners. Of course, there are also prospects that the heating season may start sooner, but such speculation is still about a month away. Nevertheless, the next rollout in about 2-3 weeks should bring a change of up to several percent.

Weather forecasts for 6-10 days ahead show cooler than standard temperatures. Source: NOAA

Gas prices are at their highest since August 26. It is worth mentioning that there is no session on Wall Street today, so the market will close earlier, at 7:30 p.m. BST. Prices are continuing the rebound from last week, so an attempt to go above the 50 and 100 period averages and test the neckline of a potential reversed SHS formation cannot be ruled out. The neckline is closer to the $2.3/MMBTU level.

Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!