U.S. natural gas futures (NATGAS) are climbing 4% today, led by a sharp rally in the front-month January contract, which surged into expiration while later-dated contracts also climbed. The key bullish driver is a near-term colder weather outlook for the North and West, with forecasts pointing to a stronger cold push from December 31 into early January, supporting expectations for higher heating demand.

-

Another major tailwind remains exceptionally strong LNG demand, as U.S. export flows to global markets are running at record or near-record levels, helping absorb domestic supply.

-

These supportive factors are partly offset by solid U.S. production, which continues to provide a meaningful supply cushion, limiting how far prices can run.

-

The latest EIA storage report added fuel to the rally: for the week ending December 19, U.S. inventories posted a 166 Bcf withdrawal, bringing total storage down to 3,413 Bcf.

-

That drawdown pushed U.S. inventories slightly below the five-year average for the first time since April, signaling that the market is moving from comfortable supply conditions toward a tighter balance.

-

Storage is now estimated at 24 Bcf below the 2020–2024 seasonal norm, after being 32 Bcf above average just one week earlier — a notable swing that traders quickly priced in.

-

The withdrawal was close to expectations, coming in just under the Wall Street Journal analyst consensus of 169 Bcf, reinforcing confidence that cold-driven demand is beginning to show up.

-

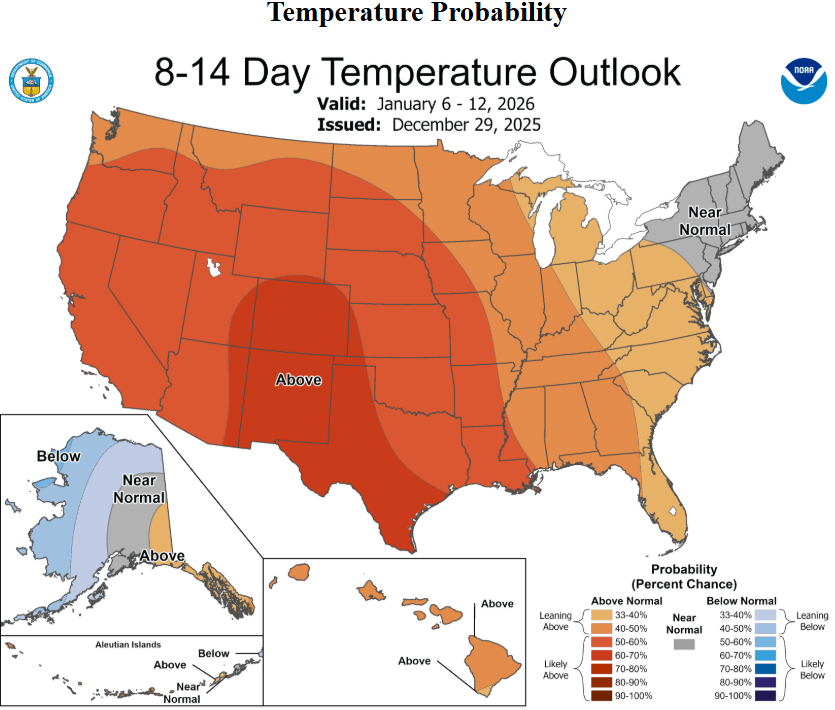

However, the rebound may be tested in the beginning of January, as Climate Prediction Center according to NOAA data signals warmer temperatures across the United States since 6 to 12 January 2026.

Source: NOAA, CPC

Natural gas futures climbs almost 4% today, rising to the highest level since 17 December. If the price will fall from todays level, test of $3.80 may be immitend. On the other side, if the price will continue to rise above EMA50 (orange line), fundamentals may support the trend even in January - especially if 6 - 12 January NOAA weather forecasts will change.

Source: xStation5

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)