Netflix Finishes 2023 with Strong Growth

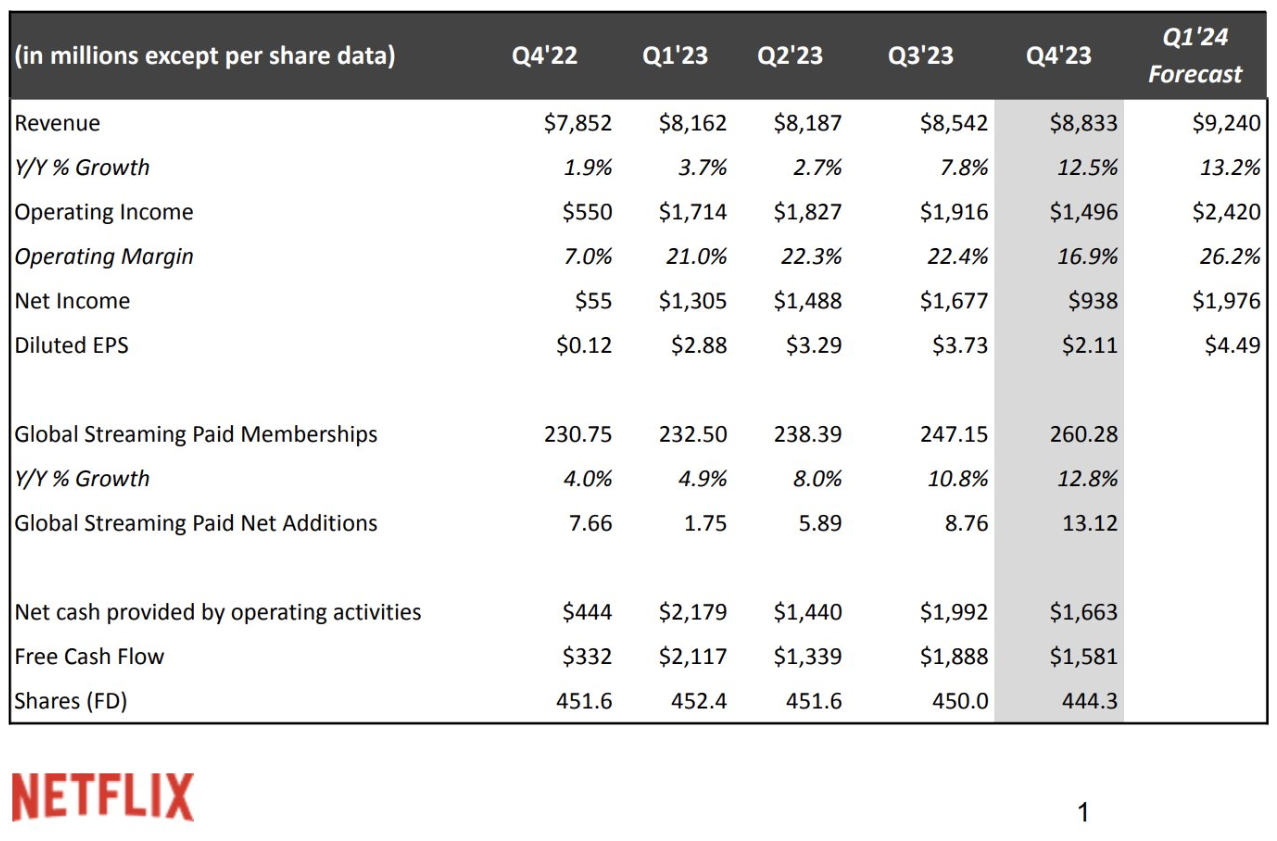

Netflix announced its fourth-quarter 2023 financial results, which were strongly positive, looking at key metrics for the streaming company. The company's revenue was $8.83 billion, up 12% year over year. Operating income was $1.5 billion, and earnings per share (EPS) were $2.11. EPS was a slight disappointment, but the number of new users for Q4 beat all records.

Netflix's subscriber base grew by 13.12 million to 260.28 million. This was the third consecutive quarter in which the company reported subscriber growth. The company is back on track, even with rising subscription costs. The margin is disappointing, but a very strong Q1 2024 is expected.

Netflix is the leader in the streaming video market, but in recent years it has faced growing competition from companies like Disney+, HBO Max, and Amazon Prime Video. In 2022, the company reported its first decline in subscribers in a decade.

Netflix predicts that first-quarter 2024 revenue will be $9.24 billion and EPS will be $4.49.

Source: Netflix

Source: Netflix

Stocks of the The company are up 7.5% in after-hours trading. The US100 is up thanks to Netflix. It is worth noting that Disney's shares have been lagging behind for many months. Source: xStation5

The company are up 7.5% in after-hours trading. The US100 is up thanks to Netflix. It is worth noting that Disney's shares have been lagging behind for many months. Source: xStation5

MIDDAY WRAP: Mixed sentiment in Europe, declines on U.S. indices

Wells Fargo: Q4 was disappointing, but the forecasts for 2026 spark the imagination 💡🏛️

Saab shares surge as Scandinavian rearmament drives demand 📈

Will the U.S. Supreme Court decision shake Wall Street? 🗽 These stocks could benefit