Summary:

-

US NFP: 312k vs 179k exp; Wages also beat forecasts

-

USD gains as yields rise; stocks dip in initial reaction

-

Strong report raises questions of whether good news is bad for US500

Following yesterday’s stellar ADP figure, the bar was set pretty high for a positive surprise out of this afternoon’s NFP release, but despite this, the report managed to clear it as the official December jobs report smashed forecasts both in terms of jobs added and wage growth. The non-farm employment change rose to 312k, its highest level since last February and comfortably above the consensus forecast of 179k. In fact the reading is the second highest in almost three years and marks a very impressive recovery after a slight disappointment was seen last time out. On this front there was also good news as the prior reading for the month of November was revised higher by 21k to 176k.

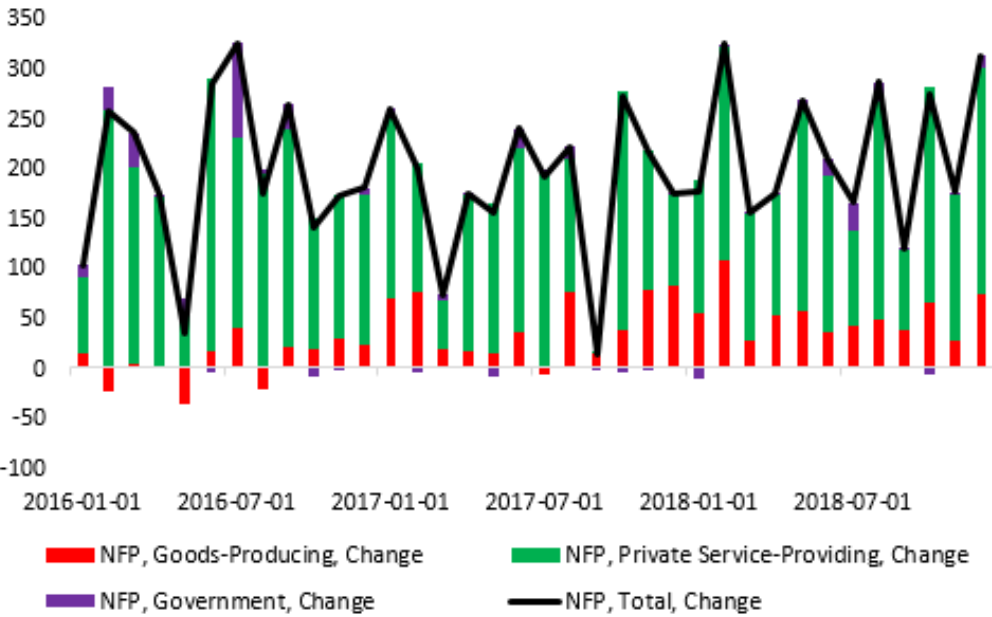

The latest NFP release was one of the best in several years with both the service and goods producing sectors contributing to the strong reading above 30k. Source; XTB Macrobond

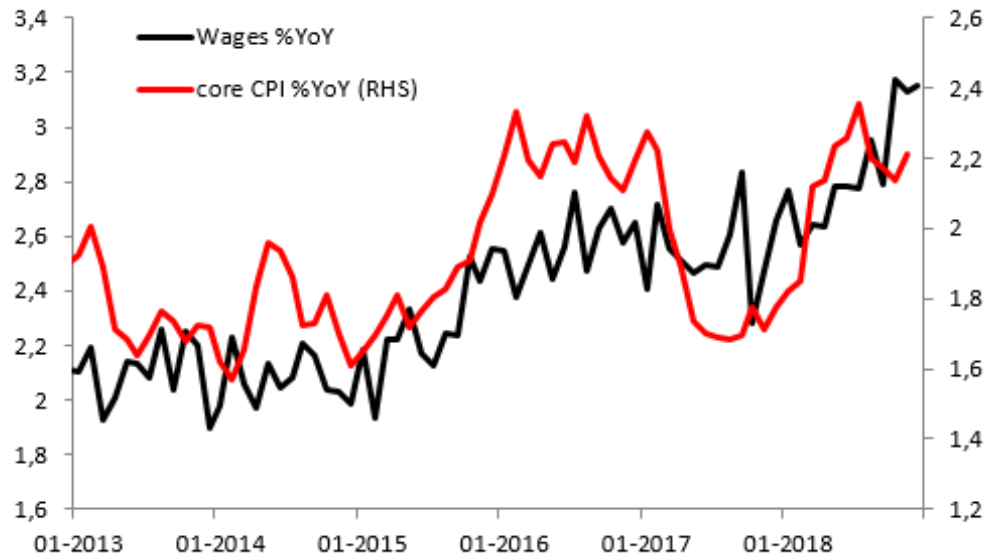

While the number of jobs added often makes the headlines, wage growth is seen by many as more important as it more directly links to inflation and therefore central bank policy. The US labour market has been strong for some time now, and even though the unemployment rate unexpectedly ticked higher to 3.9% from 3.7% it remains extremely low by historical standards - the rise itself was likely caused in no small part by a rise in the participation rate to 63.1% compared to 62.9% expected which is the highest since 2014 and obviously a good thing. On the wage front the Y/Y reading unexpectedly rose to 3.2% from 3.1%, with consensus calling for a drop to 3.0% in what is another boon for the US dollar. There is now a bit of a divergence opening up between wages and inflation (as measured by core CPI) and this could suggest the latter is due to accelerate - something which may cause the Fed to continue hiking rates despite the pressure to cease.

Wages also ticked up close to their highest level in recent years and this could well feed through to upwards pressure on inflation which would keep the pressure on the Fed to persist with rate hikes. Source: XTB Macrobond

In terms of market reaction it has been pretty clearly positive so far for the US dollar with the buck rising in recent trade and supported by an increase in US yields. As far as stocks are concerned it’s raised the old debate about whether good news is actually good news or whether good news is bad news once more. The initial reaction in the US500 showed the market dip lower and if this is a case of good news being bad, then it is likely because the report, and in particular the rise in wages, will likely deter the Fed from delivering a dovish shift anytime soon. Having said that, chair Powell is set to speak later this afternoon and it is worth keeping a close eye on what his view on the data is. Due to the often unpredictable nature of central bankers and considerable political pressure there’s a higher higher than usual chance that something unexpected is said.

Traders are left pondering whether good news is good, or if good news is in fact bad as far as US stocks are concerned after a strong allround NFP report. Source: xStation

Traders are left pondering whether good news is good, or if good news is in fact bad as far as US stocks are concerned after a strong allround NFP report. Source: xStation

The US500 remains delicately poised and the price action in the forthcoming cash session will likely determine where we go next. A break above 2523 would open up the way for a greater recovery but unless that happens the market remains under pressure. The bunching of the 8/21 EMAs is indicative of no clear trend and they may well give a clearer signal when the current range expands. Source: xStation

The US500 remains delicately poised and the price action in the forthcoming cash session will likely determine where we go next. A break above 2523 would open up the way for a greater recovery but unless that happens the market remains under pressure. The bunching of the 8/21 EMAs is indicative of no clear trend and they may well give a clearer signal when the current range expands. Source: xStation