Summary;

-

NFP employment change: 250k vs 190k exp

-

Average hourly earnings and unemployment rate inline

-

USD edging higher, Gold lower

The US jobs report from October has come in better than forecast with a lot to like about the latest read on the labour market. The headline employment change rose by 250k, its largest jump since the March release and well above the 190k expected. The prior reading was a disappointing 134k, and this was also revised lower to an even worse 118k in what is the worst part of the release, but on balance the good news seems to outweigh the bad. Further positives can be found in the participation rate ticking up to 62.9% from 62.7% prior and while the average earnings matched expectations, it did rise nonetheless. The unemployment rate remained unchanged at 3.7%.

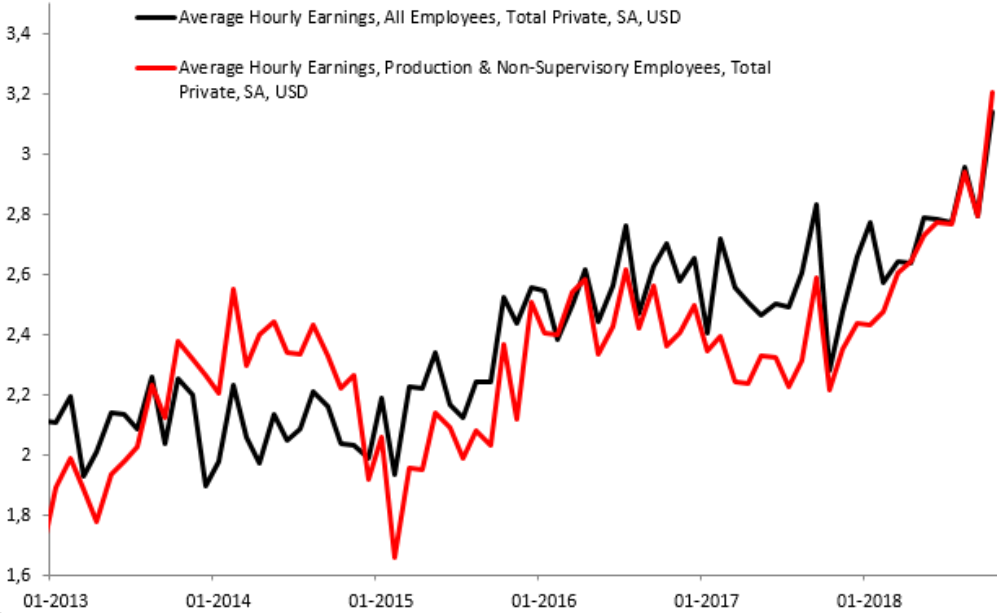

While the increase in wages was expected, this metric did rise strongly and is at its highest level in several years. Source: XTB Macrobond

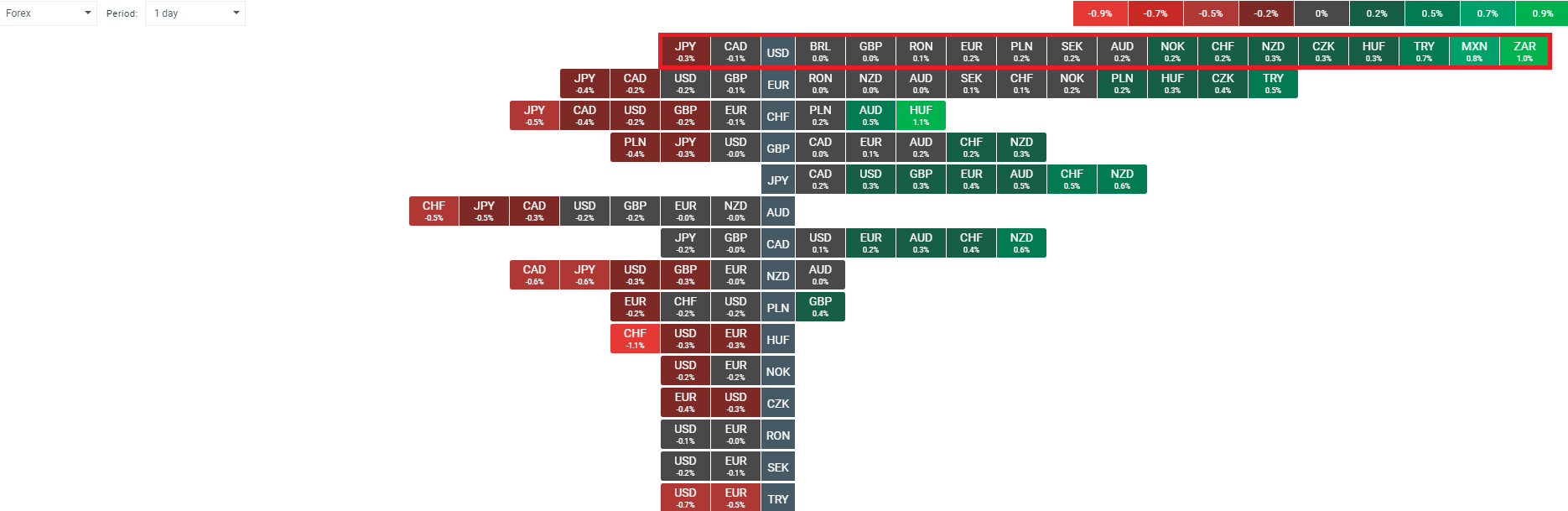

Given the overall solid feel of the data the market has reacted as expected with yields rising along with the US dollar while Gold fell lower. However, the moves have been fairly small and contained so far and a quick look at the heatmap reveals that the USD remains lower against most currencies on the day. Emerging market currencies seem to be the biggest gainers with the ZAR, MXN and TRY leading the way.

The USD is under pressure again today after Thursday’s losses, with the buck still lower despite receiving a boost from NFP. Source: xStation

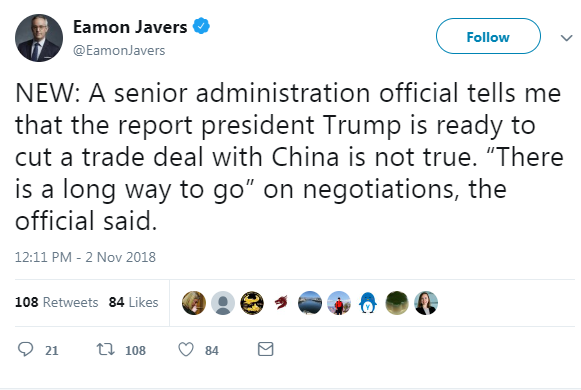

The reaction in stocks has been not so clear in the immediate reaction, with a tweet from a senior CNBC reporter just prior to the release muddying the waters. Stocks in general have had a good week with markets jumping to their highest levels earlier today following several reports from both the US and China that the country’s are moving closer together on a trade deal. However, this may be wishful thinking according to a prominent reporter, who has claimed via Twitter that “there is a long way to go” to reach an agreement.

This senior CNBC reporter has quoted senior White House staff in saying that a trade deal with China may be further away than some had hoped. If this is true, then the recent gains for stocks are vulnerable going forward. Source: Twitter

The bigger picture for stocks hasn’t changed too much despite the market being higher for a 4th consecutive day. Price is now back at the 21 EMA for the first time in almost a month but the recent selling since the above tweet and NFP have seen a wick appear above the D1 candle. The forthcoming US session could well be key to watch as how the market trades may set the tone heading into next week’s Midterms. Highs of 2766 are a possible resistance level to keep an eye on.

Despite the recent gains the US500 remains in a downtrend according to the EMAs with today’s peak of 2766 a possible resistance level to keep an eye on. Source: xStation

Despite the recent gains the US500 remains in a downtrend according to the EMAs with today’s peak of 2766 a possible resistance level to keep an eye on. Source: xStation