Talks between Iran and the United States in Vienna continue. Parties are said to be closing in on an agreement that will see sanctions on Iran lifted, which would pave the way for return of Iranian crude supply to the markets. Key points are said to be agreed on already and parties are now discussing details. Return of 2 million barrels of Iranian exports would push the oil market out of deficit. On the other hand, ongoing tensions in the Middle East may delay talks and, as a result, a deal may not be reached by tomorrow's deadline. However, negotiators are willing to negotiate beyond the deadline and until the deal is reached.

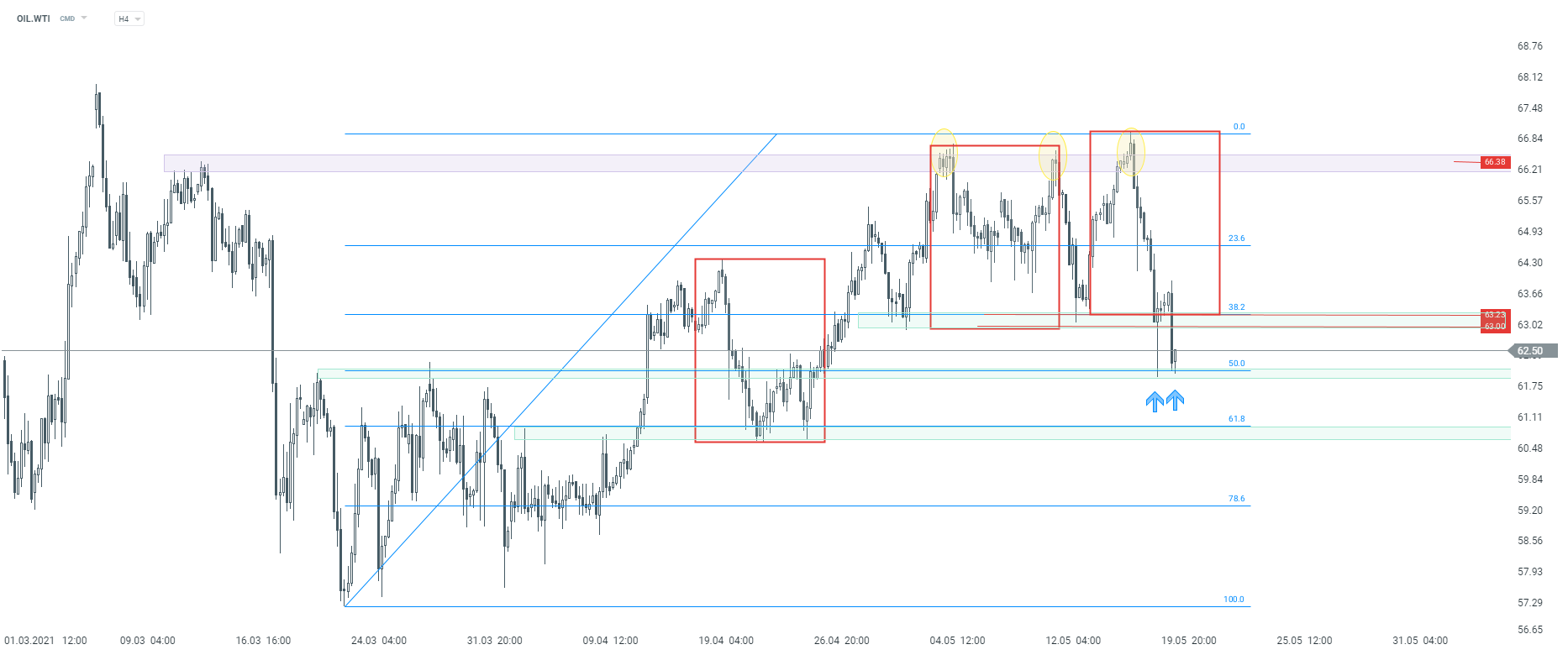

Oil bulls managed to defend support marked with 50% retracement. In case downward move resumes and deepens, the next support to watch can be found at 61.8% retracement. Key resistance zone to watch can be found in the $63 area. Source: xStation5

Oil bulls managed to defend support marked with 50% retracement. In case downward move resumes and deepens, the next support to watch can be found at 61.8% retracement. Key resistance zone to watch can be found in the $63 area. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?