Nvidia (NVDA.US) shares rose more than 5% after Jefferies maintained a Buy rating and lifted its price target on the semiconductor stock to $854 from $740. "We see NVDA as a major beneficiary of the 4th Tectonic Shift in Computing, in which parallel processing captures share in the computing market," Jefferies' Mark Lipacis said. "We think NVDA's decade-long investment in CUDA has resulted in a multi-year competitive advantage." Company's chief financial officer, Colette Kress told Lipacis that it was possible for the company to break out software sales as a revenue line item once it becomes a meaningful portion of the business. Nvidia also expects that its Arm acquisition will close in the early part of 2022.

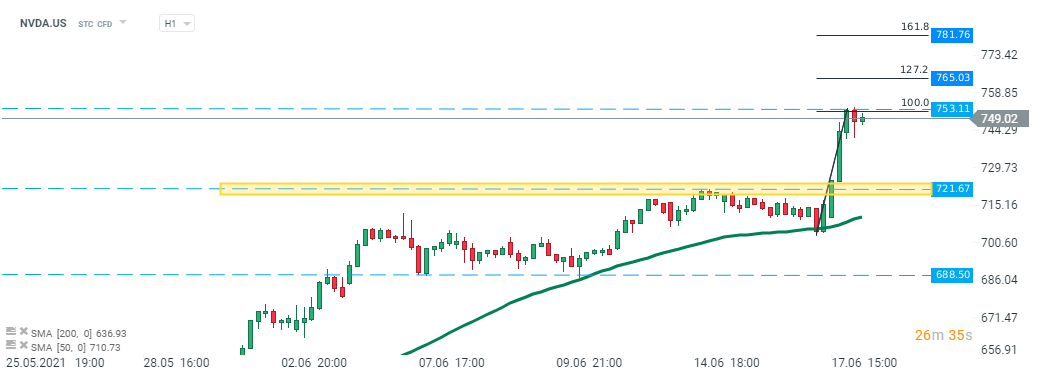

Nvidia (NVDA.US) stock bounced off 50 SMA ( green line) during yesterday’s session and hit a new all-time high around $753 per share. If the current sentiment prevails, then the next target for bulls is located at 127.2 and 161.8 external Fibonacci retracements of the recent upward wave. However if sellers will manage to regain control then nearest support lies at $721.67 per share. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡