Inflation expectations

- 1-year horizon: 3.4% (previously 3.2%)

- 5-year horizon: 3.0% (unchanged)

Labor market

- Average probability of higher unemployment in 1 year: 41.8% (previously 42.1%)

- Mean probability of losing job in 12 months: 15.2% (12M avg 14.3%)

- Mean probability of finding a job if current job is lost: 43.1% (series low)

Household finances

-

Probability that US stock prices will be higher in 12 months: 38.0%

The December New York Fed Survey of Consumer Expectations shows that short-term inflation expectations increased, while medium- and long-term expectations remained anchored.

One-year inflation expectations rose to 3.4% (from 3.2%), while three- and five-year expectations held at 3.0%. Uncertainty around inflation increased, although expectations for home price growth remained unchanged at 3%, and expectations for most commodity prices declined. In household finances, perceptions of credit availability deteriorated. The risk of delinquency rose to its highest level since early 2020, even as expectations for income and spending growth remained broadly stable. Sentiment toward the equity market improved slightly, with the probability that US stock prices will be higher in a year rising to 38%.

By contrast, labor-market prospects deteriorated markedly, representing the most concerning signal from the survey. Expectations of finding a job fell to a record low, while the perceived probability of job loss rose to 15.2%. This points to declining worker confidence and bargaining power. Although expectations for unemployment eased slightly, they remain elevated, and expected wage growth fell to 2.5%, below the 12-month average.

Overall, rising job-security concerns and weaker wage expectations suggest cooling labor demand, which could limit wage pressures and strengthen the case for deeper interest-rate cuts by the Federal Reserve.

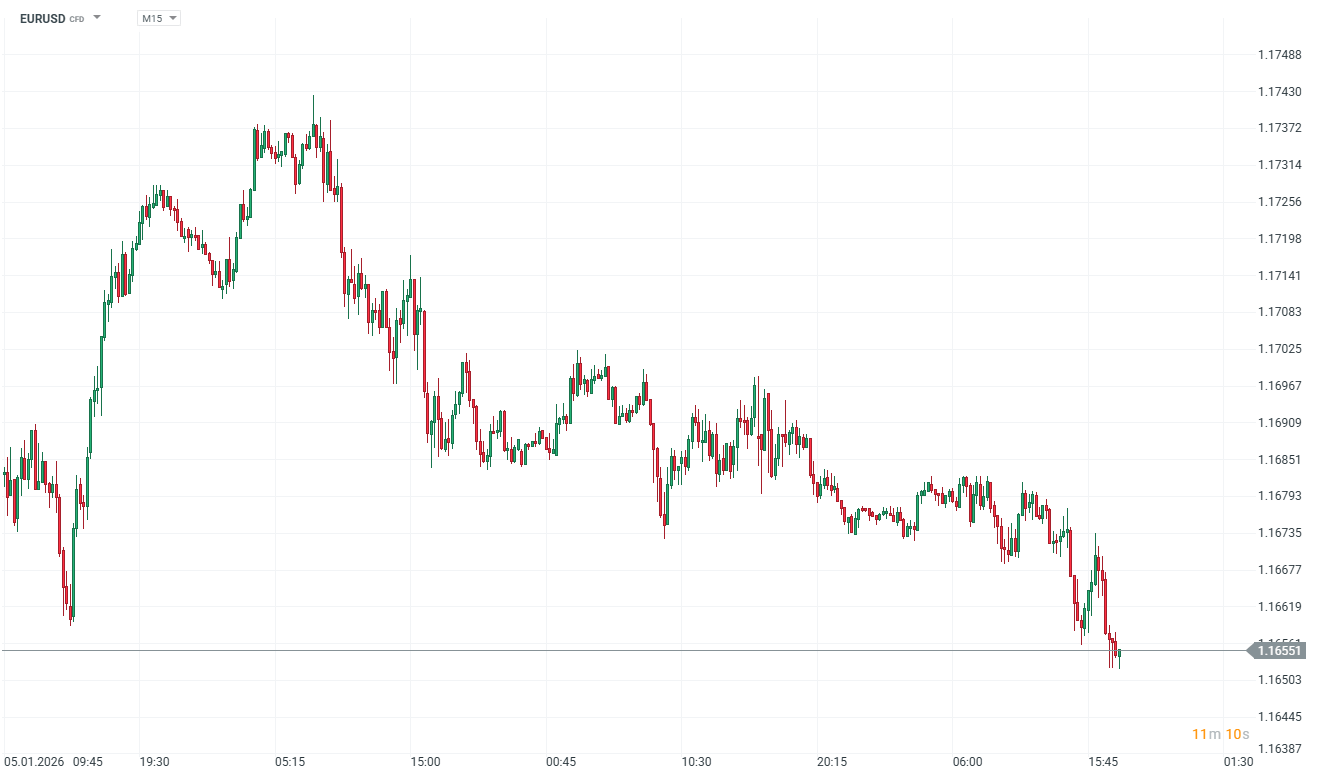

The US dollar is the strongest G10 currency today, partly supported by strong US trade balance data and a significant narrowing of the deficit. EURUSD is down 0.20%, while the USDIDX dollar index is up 0.15%.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)