Summary:

-

NZ dollar leads the gains in G10 following the fourth quarter inflation release

-

Bank of Japan stays on hold during its first meeting this year but cuts CPI forecasts

-

Wall Street begins the week with a notable decrease

Steady as she goes

The NZ dollar is gaining almost 0.5% against the US dollar in early European trading after the state data showed price growth during the last quarter of the year stayed unchanged at 1.9% in annual terms. The market consensus had called for a slight decline to 1.8%. However, in quarterly terms we got a significant slowdown to 0.1% from 0.9% seen during the three months through September. The RBNZ own gauge of core inflation held at 1.7% at the same time.

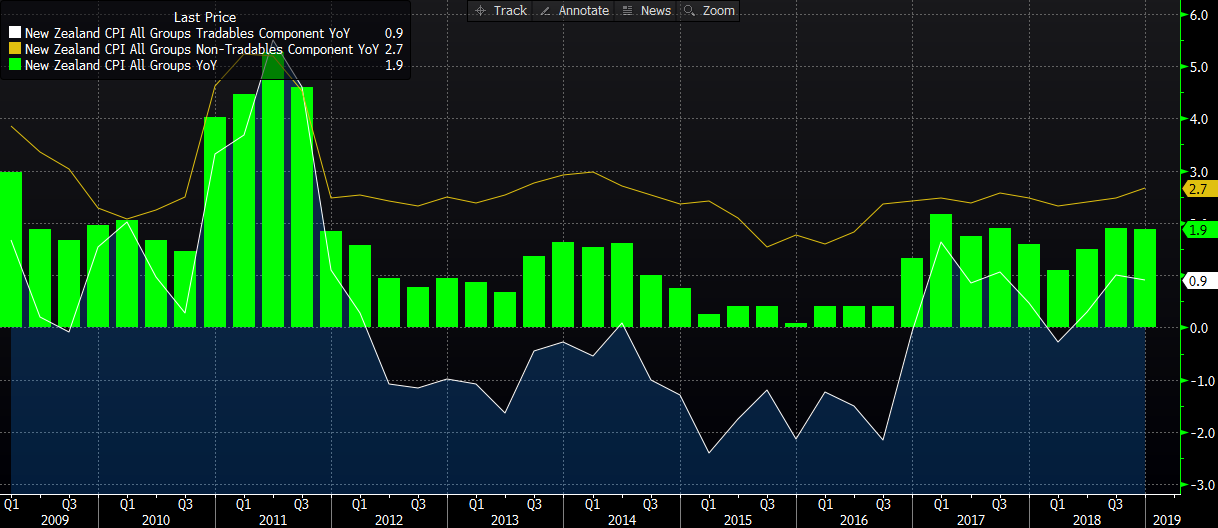

NZ price growth remained stable in the final three months of 2018. The details show some encouraging signals though. Source: Bloomberg

Delving into some details of the inflation release we may notice that tradable prices, being primarily affected by external factors, fell to 1% from 0.9% in annual terms. Nevertheless non-tradable goods, reflecting domestic price pressures, picked up to 2.7% from 2.5% in the previous quarter, reaching the quickest pace of growth since mid-2014. Of course one swallow doesn’t make a spring, however, this report could be classified as reassuring investors being concerned the Reserve Bank of New Zealand could cut rates in the foreseeable future. While we remain far away from any rate hikes, today’s release confirmed a strong obstacle for lower rates. Taking a look at market-based odds regarding movements on rates we may notice that a rate decrease until the year-end is still priced in almost 20%. At the same time markets assign virtually zero chance to see a rate hike. We therefore stick to the view that the kiwi will be mostly driven by changes in a risk environment predominantly tied to the Chinese economy. Looking broader we do not see too many factors behind the much stronger NZD having in mind that it is the third most overvalued currency in the G10 basket, as per our calculations.

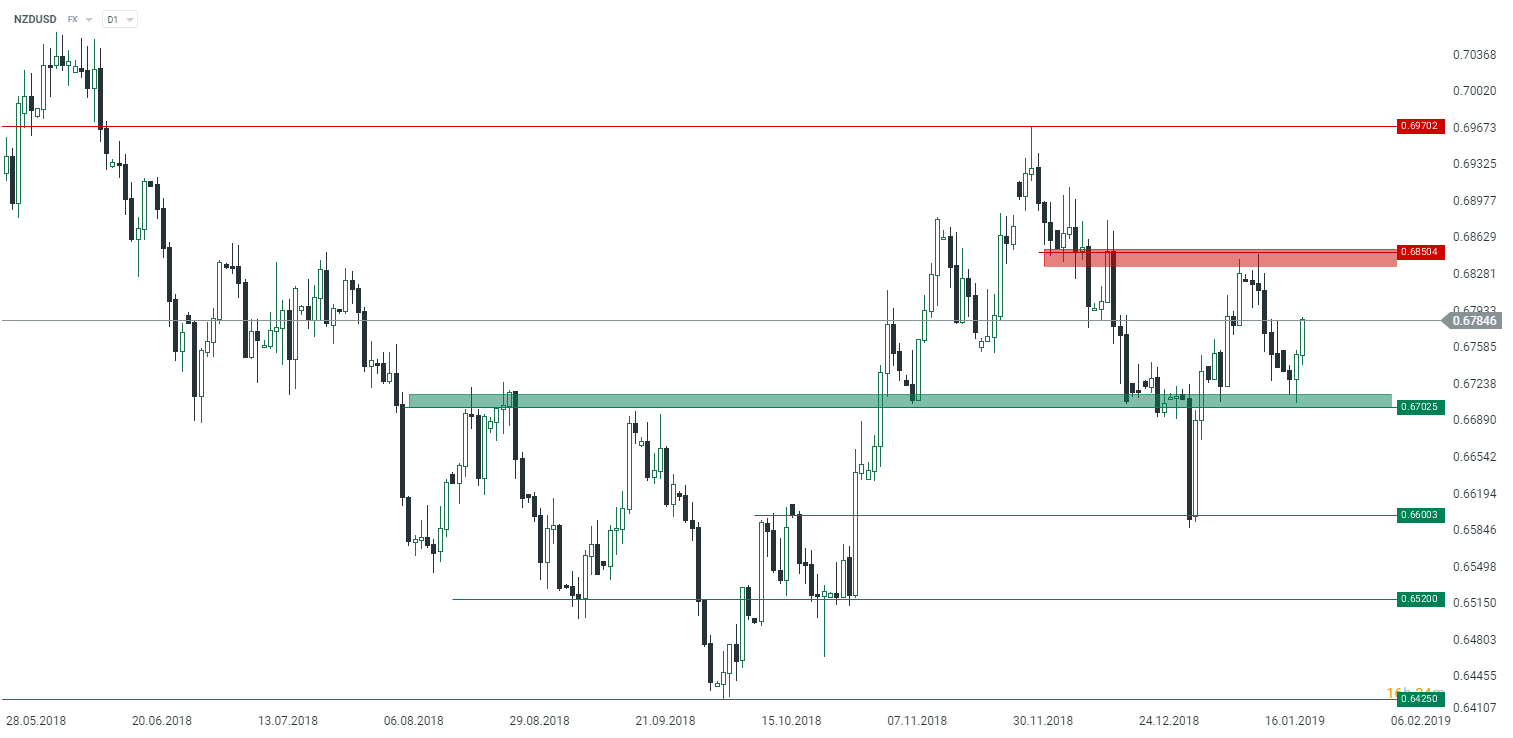

The pair may face more sellers when it approaches closer the supply zone around 0.6850. Then a pullback toward 0.67 could be on the cards. In the long-term the kiwi’s performance will depend on what happens with the US dollar. Source: xStation5

Another cut

During its first meeting this year the Bank of Japan did not take market participants by surprise leaving the settings of monetary policy unchanged. It means that the central bank kept the short-term interest rate target at -0.1% and the target for 10Y JGBs yield around 0%. There were two dissenters (Harada and Kataoka) on the decision concerning the yield curve control mechanism. Beyond the decision itself the quarterly outlook report proved much more interesting. First of all, the BoJ chose to yet again cut its core CPI forecasts foreseeing lower price growth across the curve:

-

0.9% vs. 1.4% in October for the fiscal year 2019/2020,

-

1.4% vs. 1.5% for 2020/2021,

-

0.8% vs. 0.9% for 2018/2019.

The bank added that lower inflation projections reflected slumping oil prices and the potential fallout from slowing global growth. Note that it was the fourth downward revision made by the Bank of Japan since April 2017. The GDP growth estimates were adjusted as well:

-

0.9% vs. 0.8% in October for the fiscal year 2019/2020,

-

1% vs. 0.8% for 2020/2021,

-

0.9% vs. 1.4% for 2018/2019.

It is worth noting that despite outstandingly low interest rates in Japan market participants assign as much as 30% odds to see the BoJ cutting the main rate by the end of this year. We do not think the yen could be influenced by domestic factors in the foreseeable future, instead its valuation should be determined by risk sentiment. The JPY is the fourth most undervalued currency.

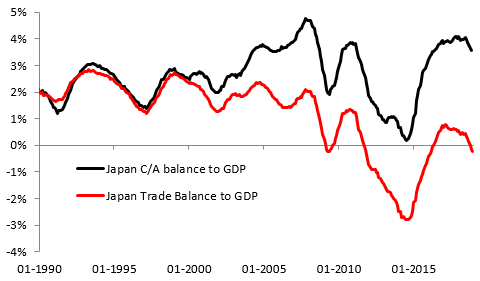

The Japanese economy slips into deficit in the trade balance suggesting a fading foreign demand. Source: Macrobond, XTB Research

Apart from the BoJ decision we also got the trade data for December producing a deficit of 55.3 billion JPY compared to expectations for a deficit of 42.3 billion JPY. Exports fell sharply 3.8% YoY while imports increased 1.9% YoY, both figures experienced substantial drops compared to the prior month’s values. The details are not reassuring at all. While exports to the US rose 1.6% YoY, exports to China decreased as much as 7% YoY, the largest contribution to the steep fall in overall exports in the final month of 2018. Note that the Japan’s economy has entered a deficit in the trade to GDP ratio for the first time since the beginning of 2016 as illustrated by the chart above.

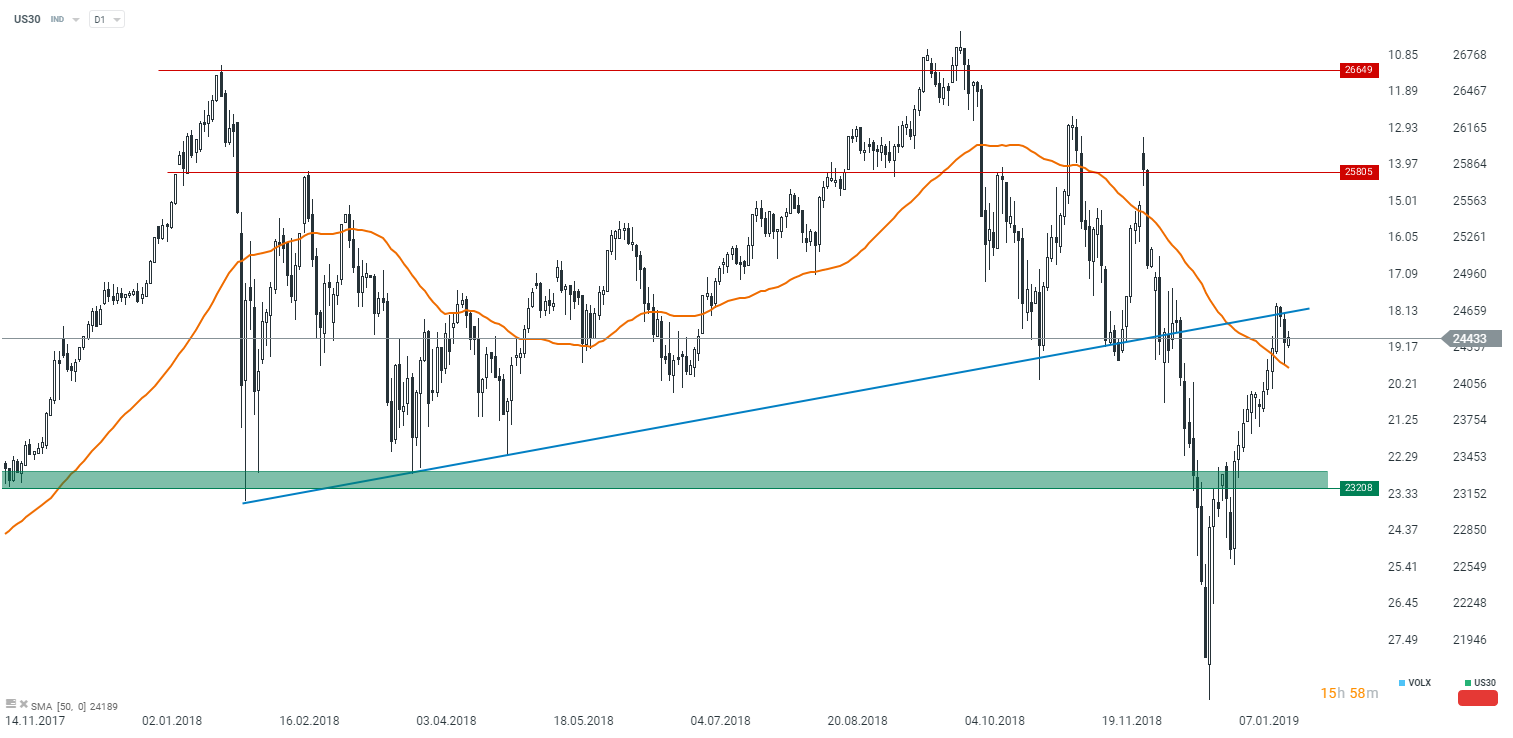

The Dow Jones (US30) failed to stay above the trend line and as a result it moved back on Tuesday. The index lost 1.2% and from the daily chart viewpoint one may expect this decline to be extended. Tuesday’s session brought widespread falls as the SP500 (US500) fell 1.4% and the NASDAQ (US100) plunged 1.9%. Source: xStation5

In the other news:

-

The UK Labour Party could be willing to support a proposal to extend the March 29 deadline for exiting the EU if PM May fails to negotiate a divorce agreement, according to the party’s chief finance spokesman

-

Larry Kudlow suggested that the scope of US trade talks with China was broader and deeper than ever before, however, the final agreement would depend on verification of China’s commitments