Two weeks ago, there was a sharp rise in milk prices in New Zealand. The GDT index increased by 15%, while milk powder prices jumped even more. During today's session, prices are falling. This is the first decline after 8 weeks of increases. This suggests that the increase from 2 weeks ago may have been a one-off incident. Nevertheless, we will now take a closer look at these prices and the potential for further appreciation of the New Zealand dollar.

Prices are dropping almost 4%. One can see that the amount of milk sold is slightly higher compared to the minimum amount available at the auction. Source: GDT

Prices are dropping almost 4%. One can see that the amount of milk sold is slightly higher compared to the minimum amount available at the auction. Source: GDT

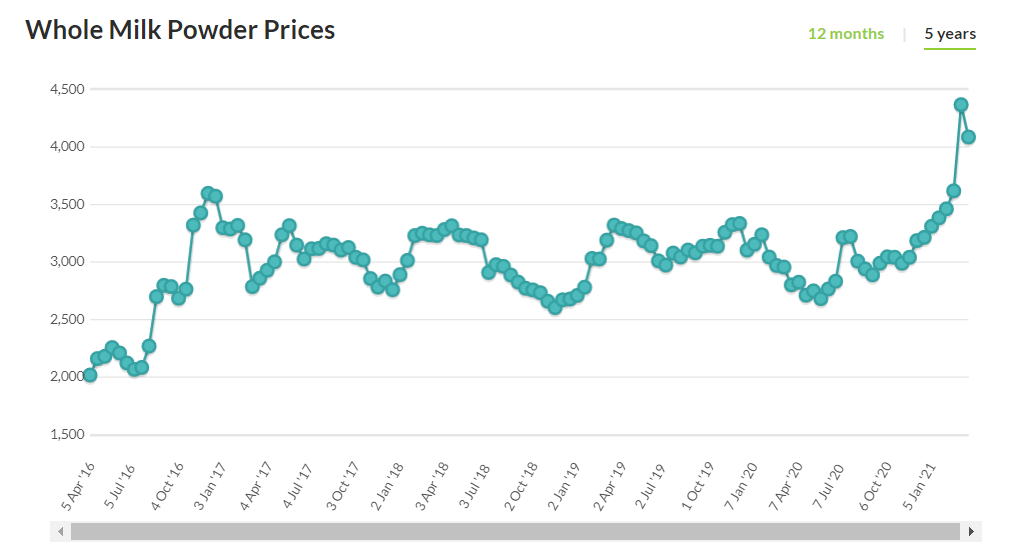

The price of powdered milk drops the most, by over 6%. Nevertheless, prices remain above $ 4,000 per tonne. Source: GDT

The price of powdered milk drops the most, by over 6%. Nevertheless, prices remain above $ 4,000 per tonne. Source: GDT

NZDUSD is doing a bit worse since the end of February. This is obviously the effect of the rising US dollar related to the strong rise in yields. As one can see, the milk price peak has also coincided with the local NZDUSD high around 0.7300. Source: xStation5

NZDUSD is doing a bit worse since the end of February. This is obviously the effect of the rising US dollar related to the strong rise in yields. As one can see, the milk price peak has also coincided with the local NZDUSD high around 0.7300. Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?