There is renewed buzz about one of the world's most important shipping lanes. The world's largest carriers like Maersk Tankers, Moller-Maersk, Hapag Lloyd, MSC and CMA CGM are indicating that their ships will avoid the canal due to recent increased attacks from pirates and increased attacks in Yemen. BP or Equinor also spoke of changes in shipping. In addition, recent storms have led to a reduction in the number of ships carrying Russian Urals oil.

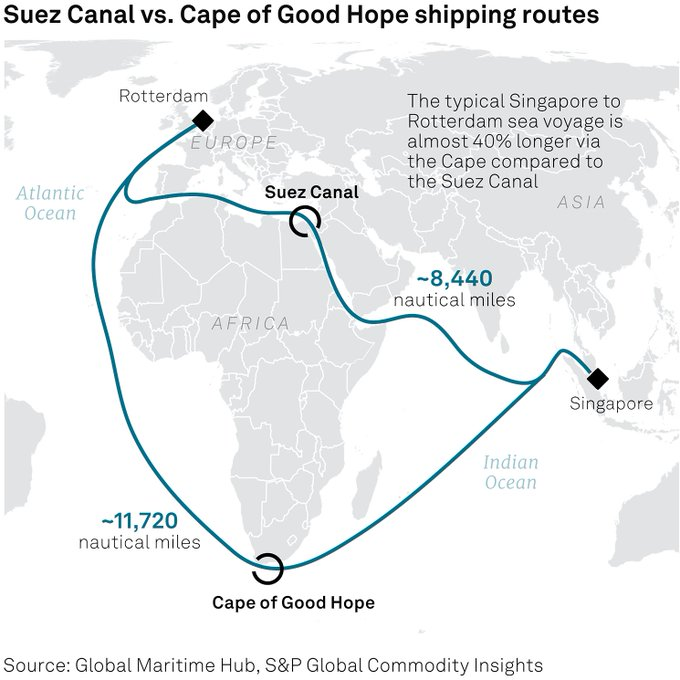

Red Sea is now largely closed to traffic. That's 8.8 million bpd of daily oil transit, and nearly 380 million tons of daily cargo transit. Global traffic now will be rerouted around Cape of Good Hope, adding 40% to voyage distance. Source: S&P Global

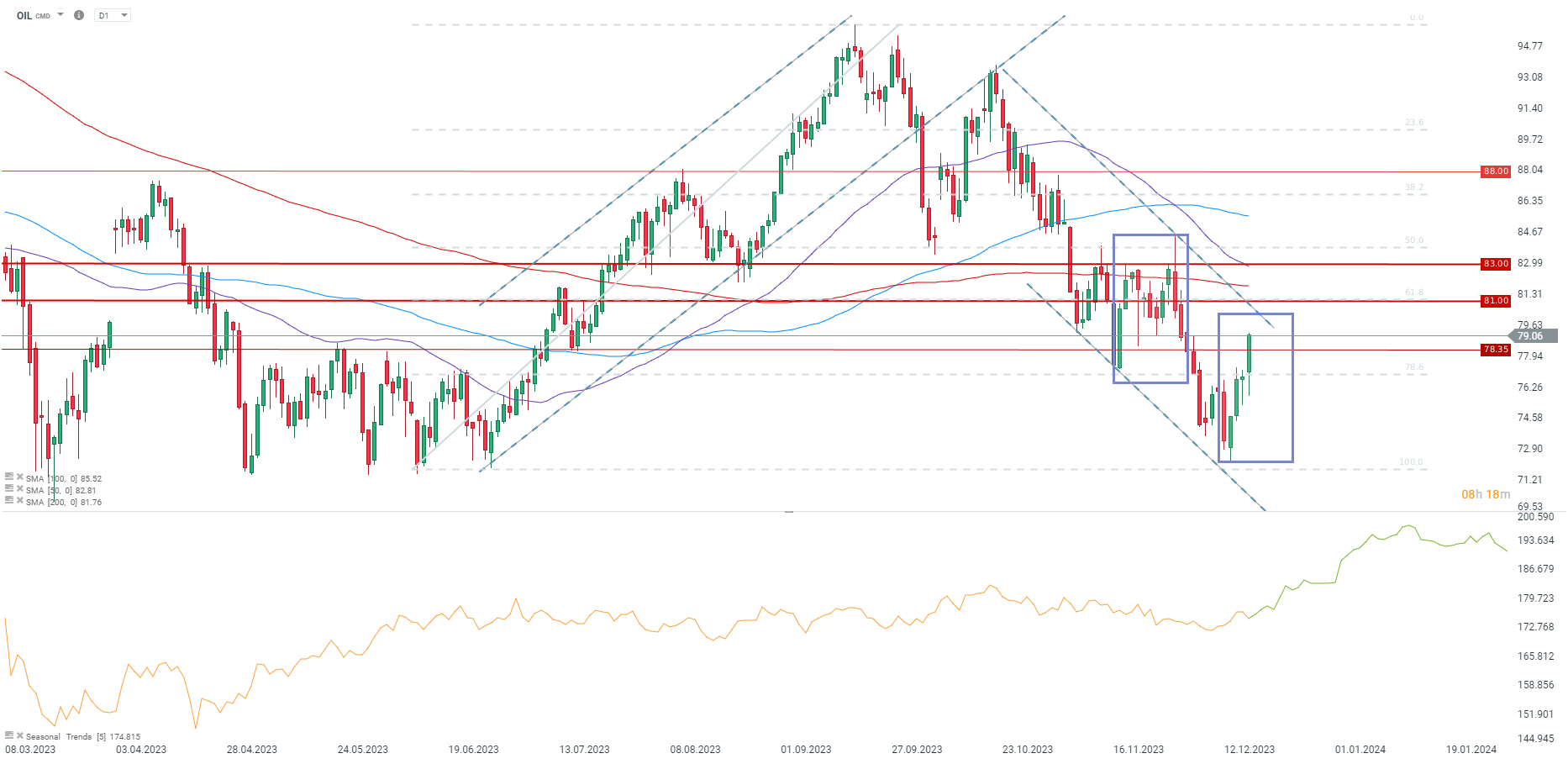

It's worth remembering that these are likely one-time factors, although of course indicators such as seasonality and positioning of speculative investors suggested a short-term bottom in the oil market.

Brent crude oil has already risen nearly 10% from its local low at $72 per barrel. The nearest important resistance will be around $80.3 per barrel, followed by the area around the 200-session average at $82 per barrel. However, if the pressure from export restrictions eases, a correction from the vicinity near $80-81 per barrel is not out of the question.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?