Volatility in the markets is rather low today. In fact, the biggest focus today is on CO2 permits, which are heading towards the €100 per contract level. Nevertheless, in the case of oil, it is worth noting that the recent recovery has cooled slightly after concerns over Omicron subsided. WTI crude oil is reacting to resistance in the form of a downward trendline. In addition to the technicals themselves, the Iraqi oil minister spoke today. He indicated that strategic stockpiles from the US are affecting oil negatively, but the impact is minimal.

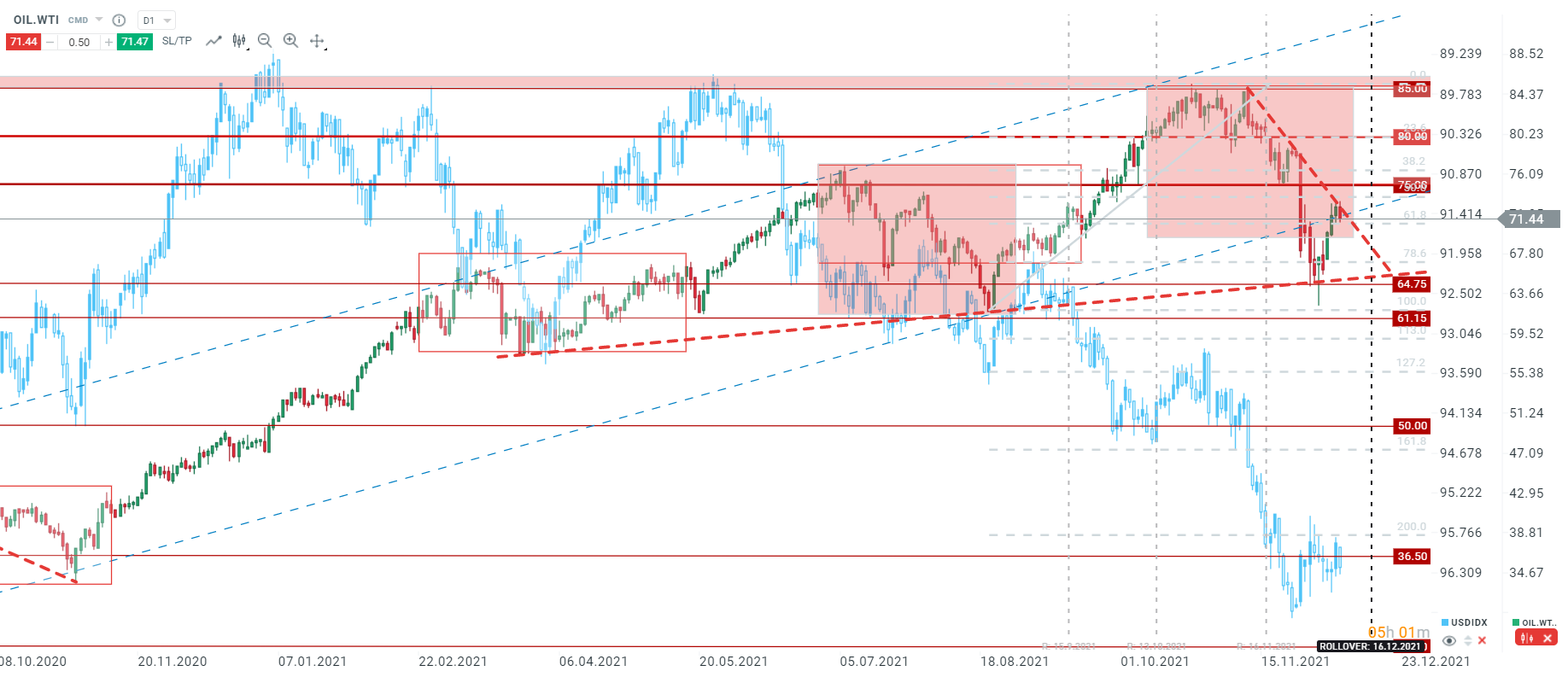

Oil is reacting negatively to the downtrend line and the area of the 50.0 retracement of the previous upward impulse. The key resistance zone is around $75, while support is between $71-72. Source: xStation5

Oil is reacting negatively to the downtrend line and the area of the 50.0 retracement of the previous upward impulse. The key resistance zone is around $75, while support is between $71-72. Source: xStation5

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause