Summary:

-

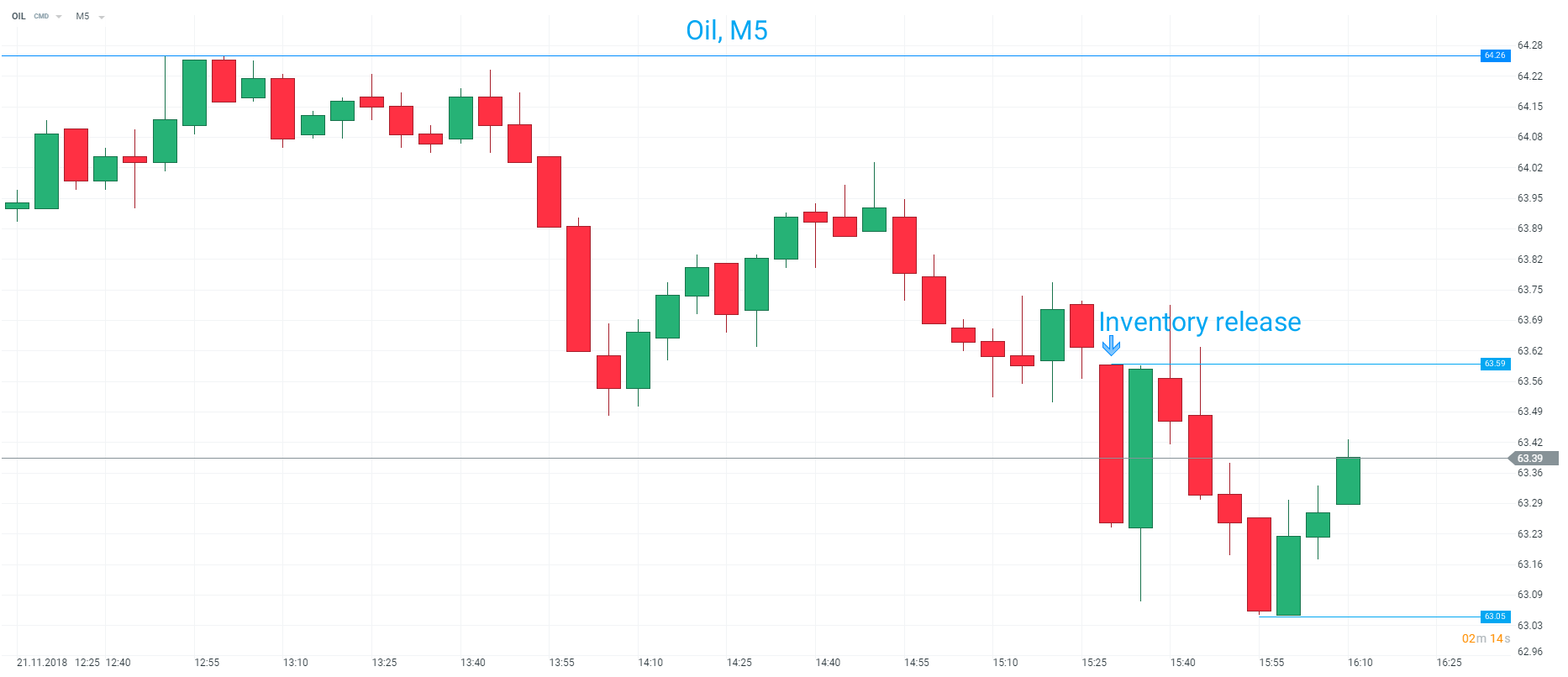

EIA weekly crude oil inventory: +4.9M vs +2.5M exp

-

9th consecutive weekly build

-

Oil higher on the day but still not far key support

Yet another weekly crude oil inventory release from the US has shown a build, with the latest coming in above both the median estimate and also the corresponding private release. The reading of +4.9M was comfortably higher than the median estimate of +2.5M and also last night’s surprise 1.5M drawdown in the API equivalent. The rise is a staggering 9th consecutive increase, but it should be noted that the size of the increase is actually not that high compared to recent prints with only 1 of the last 8 showing a smaller rise.

Given the build the market reaction has been fairly muted with Oil falling a little lower but still remaining higher on the day by a little of 1%. Price had earlier moved up to as high as 64.26 but was drifting back before the data and has since dropped lower near to the $63 handle. Source: xStation

Looking past the headline number the subcomponents of the release were fairly mixed on the whole, with the following listed in the format of actual vs expected unless otherwise stated:

-

Gasoline: -1.3M vs +0.1M

-

Distillates: -0.1M vs -2.5M

-

Production unchanged: 11.7M bpd

The longer term picture for the Oil market remains one of a clear downtrend with just about every indicator supporting this view. However, Tuesday’s low of 61.77 coincides neatly with the bottom seen back in January. It is rare that markets turn immediately after reaching a key swing level even if it does hold eventually. A shorter term double bottom around 61.77 could occur and this would see a longer term one possibly forming but any long positions would need to be careful below there as a breach underneath would open up the possibility of another larger leg lower.

Oil has bounced today but remains under pressure longer term. A double bottom at 61.77 is possibly forming but given the momentum of the recent declines a break below there could see a swift extension lower. Source: xStation

Oil has bounced today but remains under pressure longer term. A double bottom at 61.77 is possibly forming but given the momentum of the recent declines a break below there could see a swift extension lower. Source: xStation