Crude prices have had a strong run over the past few sessions, jumping over 10% off the intraday lows reached on December 13, 2023. An attempt was made to break above the $80 per barrel area yesterday, but bulls failed to hold onto those gains and oil finished yesterday's trading below this key level. Another attempt to break above $80 area was made this morning, but it also has failed, and pullback was resumed. Declines accelerated in the early afternoon when it was reported that Angola decided to leave OPEC cartel.

Country has been member of the group since 2007 and was one of the countries (alongside Nigeria and Congo) that has struggled to meet output targets for years. Recent disagreements within the OPEC group seem to have been the last straw as the country decided to exit group of oil producers. Angola itself is not a major oil producers, with daily output slightly exceeding 1.1 million barrels. However, this shows that unity of the oil producers group is fragile and more countries may decide to leave it should key players, like Saudi Arabia, keep pushing for deeper output cuts.

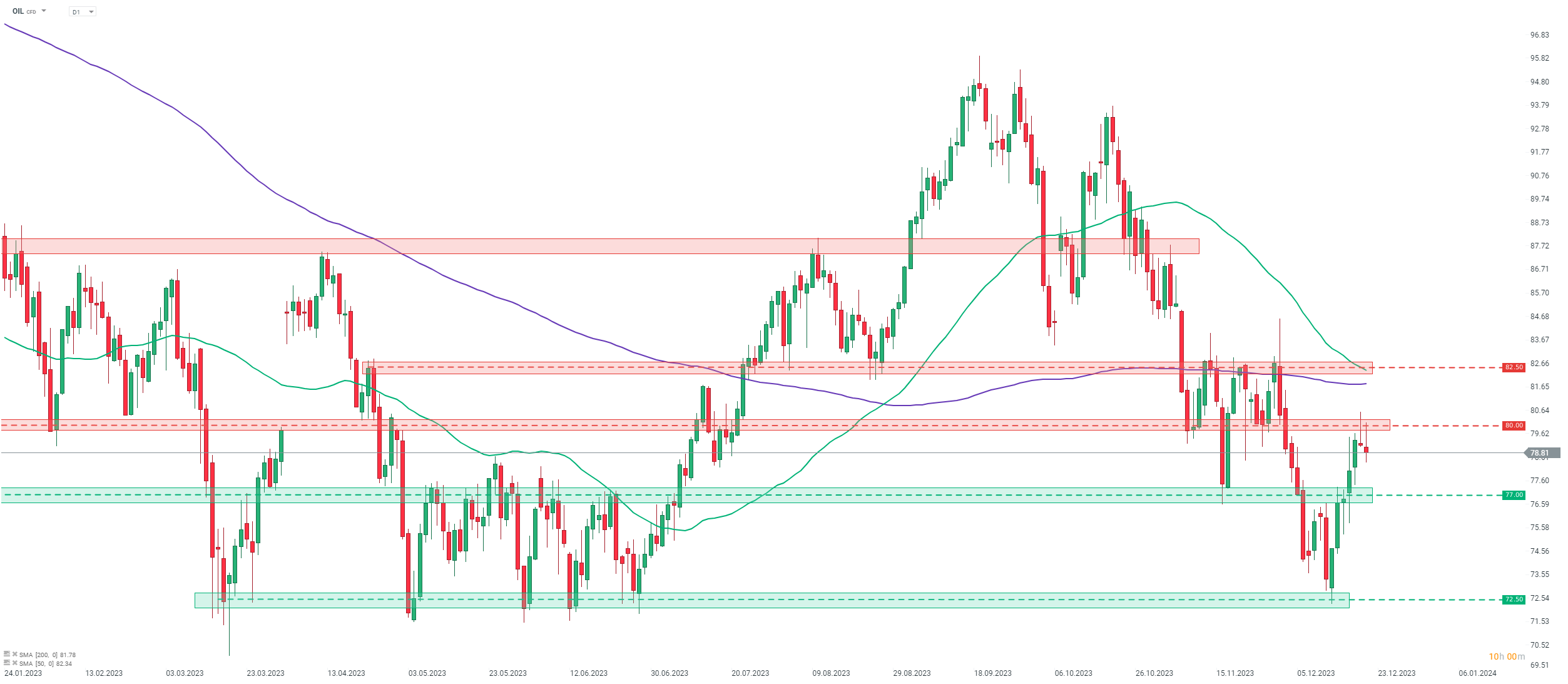

Taking a look at Brent chart (OIL) at D1 interval, we can see that a bearish pin bar pattern was painted yesterday near an important resistance zone. A technical setup begins to favour bears, with price struggling to paint a higher high, which would snap a downtrend sequence.

Source: xStation5

Source: xStation5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Silver surges 5% 📈

Morning wrap: Tech sector sell-off (06.02.2026)