Summary:

-

The US and China agreed to postpone imposing higher tariffs at least for a while

-

Russia along with OPEC suggested they would extend the oil pact into 2019

-

Alberta orders to decrease oil production next year

US-China trade battle postponed

A widespread rally has been seen across riskier assets during the first trading hours in the new week. These rises came in response to the G20 summit taking place during the weekend in Argentina where some upbeat results were achieved. Let us recall that expectations ahead of the summit had been pretty low hence a deal reached between the United States and China (a preliminary one) managed to buoy riskier assets across the board. What are the details of the US-China deal? The two nations decided that the US will not ramp up duties on $200 billion of Chinese goods from 10% to 25% on January 1. In exchange for this China pledged to buy “a very substantial” amount of agricultural, industrial and energy products from the US. On top of that, both decided to open up their markets. The accord means that the US will not rise tariffs on Chinese goods for the next 90 days, and if a bilateral agreement is achieved during this time then the ongoing trade battle could be terminated. However, if no deal is reached the US suggested that higher tariffs will come into effect.

Looking at the details of the released joint statement one may arrive at a conclusion that both countries differ when it comes to what was hammered out in Buenos Aires. For example, while the China’s statement says that both teams could speed up talks and work toward scrapping all tariffs and reach a mutually beneficial agreement, the US statement says nothing about it. The same concerns other parts of the accord suggesting that any final agreement during the next three months might be outstandingly hard to work out. Anyway, so far so good, markets cheer that the two countries were able to postpone imposing higher tariffs giving a grain of hope that a further escalation of the trade war could never materialise. As a consequence, stocks in Asia have rallied, high beta currencies have surged and US Treasuries have seen a decline. Twenty minutes past seven (GMT) the Shanghai Composite is gaining 2.7%, the Hang Seng (CHNComp) is rising 2.6%, the Australian benchmark is adding 1.8% while the Japanese NIKKEI (JAP225) closed 1% higher. On the currency front we have Australian and New Zealand dollars surging 0.8% and 0.6% respectively, the US dollar is being offered while the 10Y yield has jumped roughly 5 basis points since its close on Friday.

The SP500 futures are trading 1.8% higher at the time of writing of this analysis but bulls could soon run into the obstacle around 2815 points. This line could be hard to break, however, if they do so room toward 2880 points might be open. Source: xStation5

Oil and related currencies benefit too

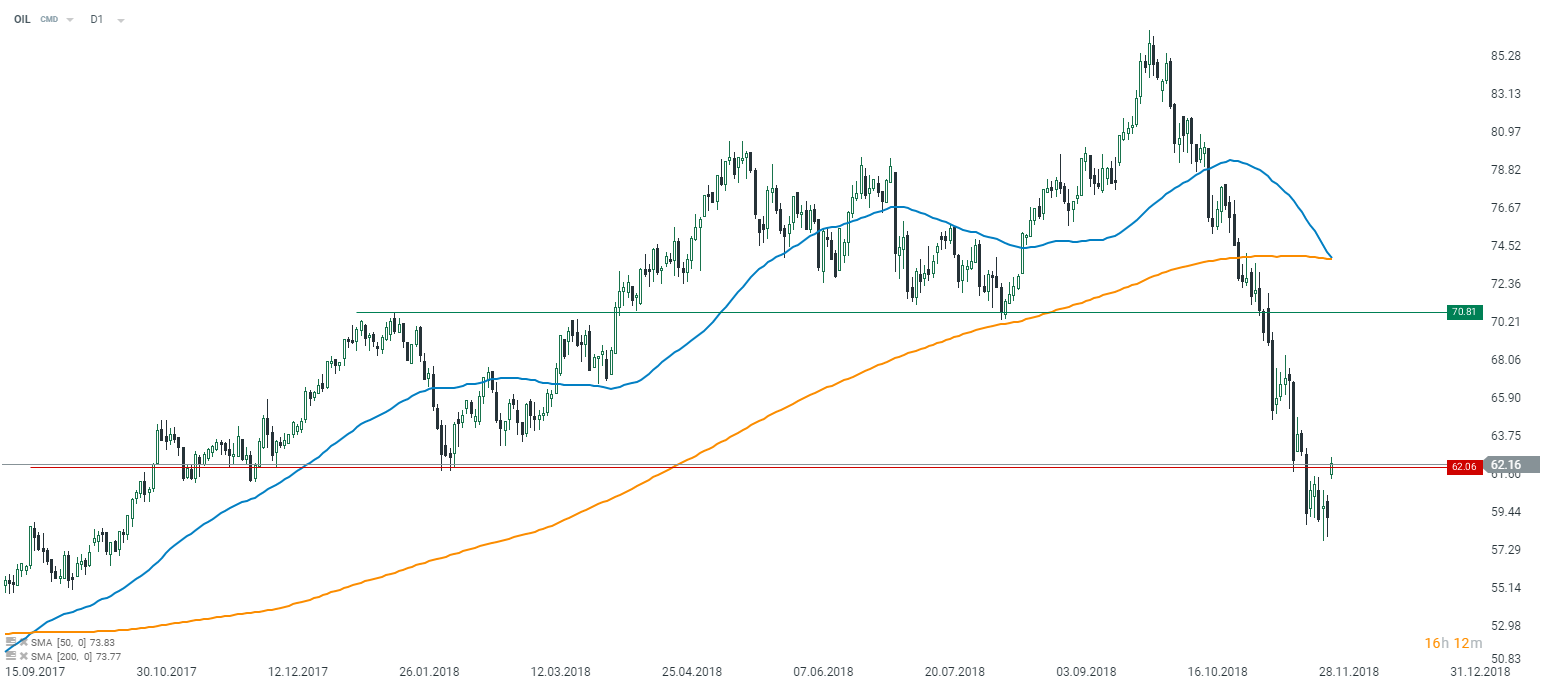

The G20 summit was beneficial not only to stocks and Antipodean currencies but also to oil and other assets being related to the commodity price. It is a result of the announcement from Russian President Vladimir Putin who said that the extension of oil output cuts into 2019 had been agreed between Russia and OPEC (mainly Saudi Arabia), no specific numbers were offered though. It is also unclear if the cuts are increased and more details will be announced during the semi-annual OPEC meeting in Vienna later this week. Either way, the news brought relief to oil prices and as a result both grades are trading approximately 5% higher this morning partly erasing their tremendous falls seen in prior days. In addition to this, we were also offered the encouraging news from Canada where Alberta (a province) has ordered a 8.7% oil production cut beginning on January 1. It would mean a decrease of 325 kbpd in 2019 and these cuts are to remain in place until the 35 million barrels of processed oil currently in storage is shipped, it will happen probably by the spring. Therefore, nobody should be surprised seeing the Canadian dollar jumping 0.7% and the Norwegian krone surging as much as 1.2%. Let us remind that in our recommendation last week we mentioned higher sensitivity of NOK (compared to CAD) to oil price movements.

Brent prices (OIL) have jumped to $62 shortly after the opening and this level could constitute the first major hurdle for bulls. Keep in mind that oil prices could be volatile this week being steered by incoming OPEC-related comments ahead of the meeting in Austria. Source: xStation5

In the other news:

-

The Japanese yen is trading marginally higher against the dollar today as risk-on prevails, Q3 CAPEX increased 4.5% YoY and missed the consensus of 8.5% YoY, the other data showed a huge squeeze on companies’ margins in the past quarter, the November manufacturing PMI rose to 52.2 from 51.8

-

Australian building approvals fell 13.4% YoY in October slightly falling short of the median estimate of a 14% decrease, the manufacturing AIG index plunged in November to 51.3 from 58.3

-

China’s Caixin manufacturing PMI fell in November to 50.2 vs. 50.1 expected

-

Qatar will withdraw from the OPEC from January, according to energy minister, the country will not be committed to OPEC agreements when it leaves the cartel