- Concerns about the health of China's economy and demand structure put bearish pressure on oil prices

- Investors are pricing in the impact of higher crude supply in US and lower oil demand in China, which has built up significant crude inventories this year

- The geopolitical premium is slowly disappearing because the conflict in Gaza has not spread to Arabic countries. Israeli Defense Minister Galant informed that IDF army gained operational control over Western Gaza

It is unclear whether the decline in contracts is a real harbinger of lower demand in the physical market, but traders are maintaining bearish positioning. Prices did not react today to reports from JP Morgan, which indicated that OPEC+ may increase production cuts. Both OPEC countries and the International Energy Agency (IEA) had predicted a supply cut in the fourth quarter of the year but yesterday's data from the US showed high inventory levels. The U.S. Energy Agency (EIA) reported that U.S. crude oil inventories rose by 3.6 million barrels last week to 421.9 million, significantly beating analysts' forecasts. At the same time, U.S. domestic oil production remained at a record 13.2 million barrels per day (bpd).

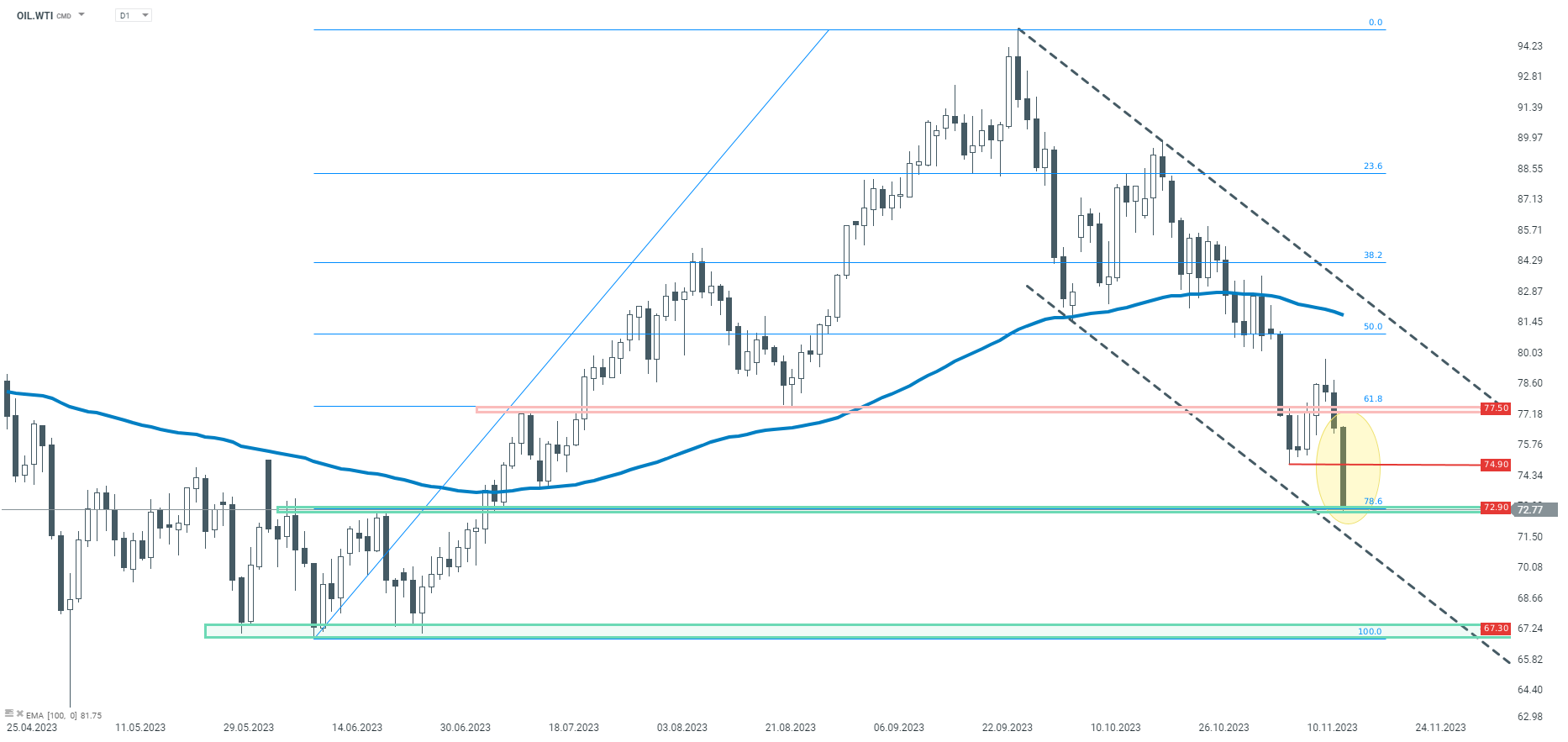

OIL.WTI D1 interval.

From the September highs, the discount on OIL.WTI has already reached more than 23%. Today the price has dived by 5%! Looking at the technical situation, the quotes are moving in a steep downward channel. Currently, the price is testing support at the level of $72.90 resulting from previous price reactions and measuring 78.6% of the last upward Fibo wave, which began in June this year. In the event of a downward breakout, even testing the lows at $67.30 will not be excluded.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30