Yesterday, OPEC published its monthly report on the situation in the global crude oil market. The report shows significant changes in terms of demand - a large reduction in demand in H1, but large increases in H2 2021. Below are the most interesting parts of the report:

Demand in H1 was cut by approx. 0.5 mbd, while in the second half of the year it was increased by almost 1.4 mbd. One can see that China (+2.5 mbd) and Europe (+1.5 mbd) are to record the highest growth during the year. Demand in the United States will be relatively stable, but still below pre-pandemic levels. Source: OPEC

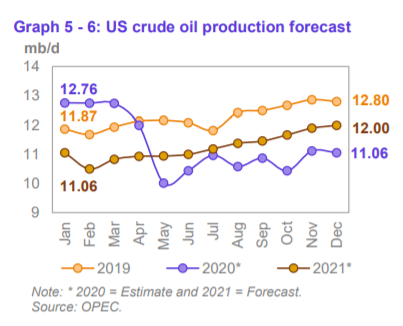

Production in the US will increase by less than 1 million barrels per day during the year. Of course, there is much greater potential for growth in this case, given the current prices. However, at some point a potential increase in global supply will be necessary if we do not want to see a price of $ 100 a barrel. Source: OPEC

Production in the US will increase by less than 1 million barrels per day during the year. Of course, there is much greater potential for growth in this case, given the current prices. However, at some point a potential increase in global supply will be necessary if we do not want to see a price of $ 100 a barrel. Source: OPEC

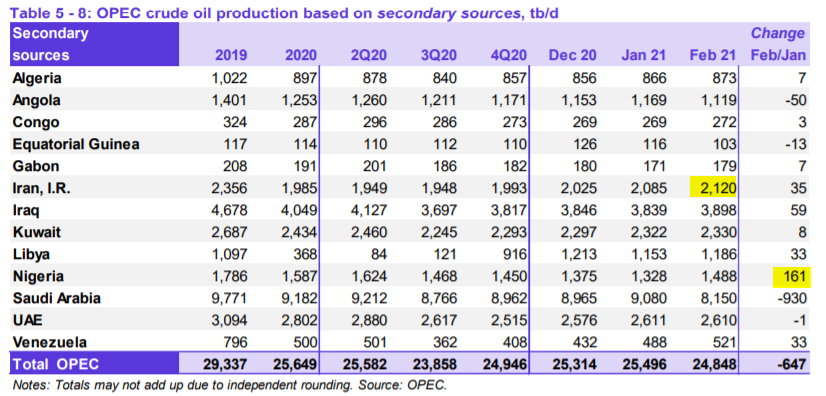

In February, OPEC produced less than 25 mbd. The next months will be similar as Saudi Arabia cuts production by an additional 1 million barrels per day. There is still a lot of potential in Iran, which produces about 2 mbd. Source: OPEC

In February, OPEC produced less than 25 mbd. The next months will be similar as Saudi Arabia cuts production by an additional 1 million barrels per day. There is still a lot of potential in Iran, which produces about 2 mbd. Source: OPEC

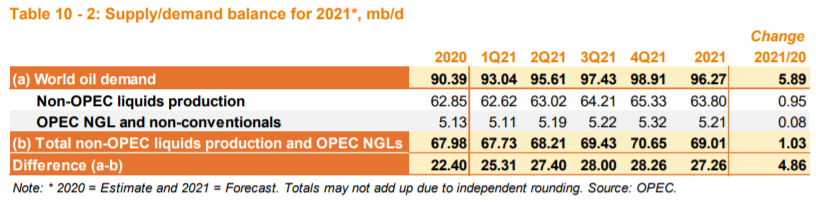

The last line shows the differences between global demand for crude oil and non-OPEC liquids production and the production of other barrel-equivalent oil products (NGL). This difference is called "OPEC oil demand". One can see that with the production level around 25 mbd, the potential deficit on the market may reach over 3 mbd. With such a strong deficit, a scenario where the price of oil rises to $ 100 a barrel is not out of the question, especially if US production does not rebound as expected. In addition, it is assumed that production will rebound in Norway, Brazil or also in Russia (although in this case OPEC assumes limited growth). There is therefore a chance that several factors will lead to a potential increase in the price of crude oil to around $ 100 per barrel. However, this is not the baseline scenario. We assume that OPEC will moderately increase production. However, at the moment everything indicates that the upward trend should be maintained, which may cause the price of Brent crude oil to rise to around $ 80 per barrel. However, such a high price level will be maintained artificially. Source: OPEC

The last line shows the differences between global demand for crude oil and non-OPEC liquids production and the production of other barrel-equivalent oil products (NGL). This difference is called "OPEC oil demand". One can see that with the production level around 25 mbd, the potential deficit on the market may reach over 3 mbd. With such a strong deficit, a scenario where the price of oil rises to $ 100 a barrel is not out of the question, especially if US production does not rebound as expected. In addition, it is assumed that production will rebound in Norway, Brazil or also in Russia (although in this case OPEC assumes limited growth). There is therefore a chance that several factors will lead to a potential increase in the price of crude oil to around $ 100 per barrel. However, this is not the baseline scenario. We assume that OPEC will moderately increase production. However, at the moment everything indicates that the upward trend should be maintained, which may cause the price of Brent crude oil to rise to around $ 80 per barrel. However, such a high price level will be maintained artificially. Source: OPEC

Daily Summary: CPI down, Markets Up

3 markets to watch next week (24.10.2024)

US OPEN: Macroeconomic data sends markets to new heights

BREAKING: Final US UoM consumer sentiment drops🗽Inflation expectations higher