Oracle has captivated the market with its results. Before the market's opening, the company is up by over 30%, generating a capitalization of more than 200 billion dollars. The company did not meet market expectations regarding EPS and revenues, but the details of the report reveal why the market reacted with such euphoria. After Broadcom and Alphabet, the market decided to elevate Oracle to another ATH. The good streak of technology companies seems to have no end.

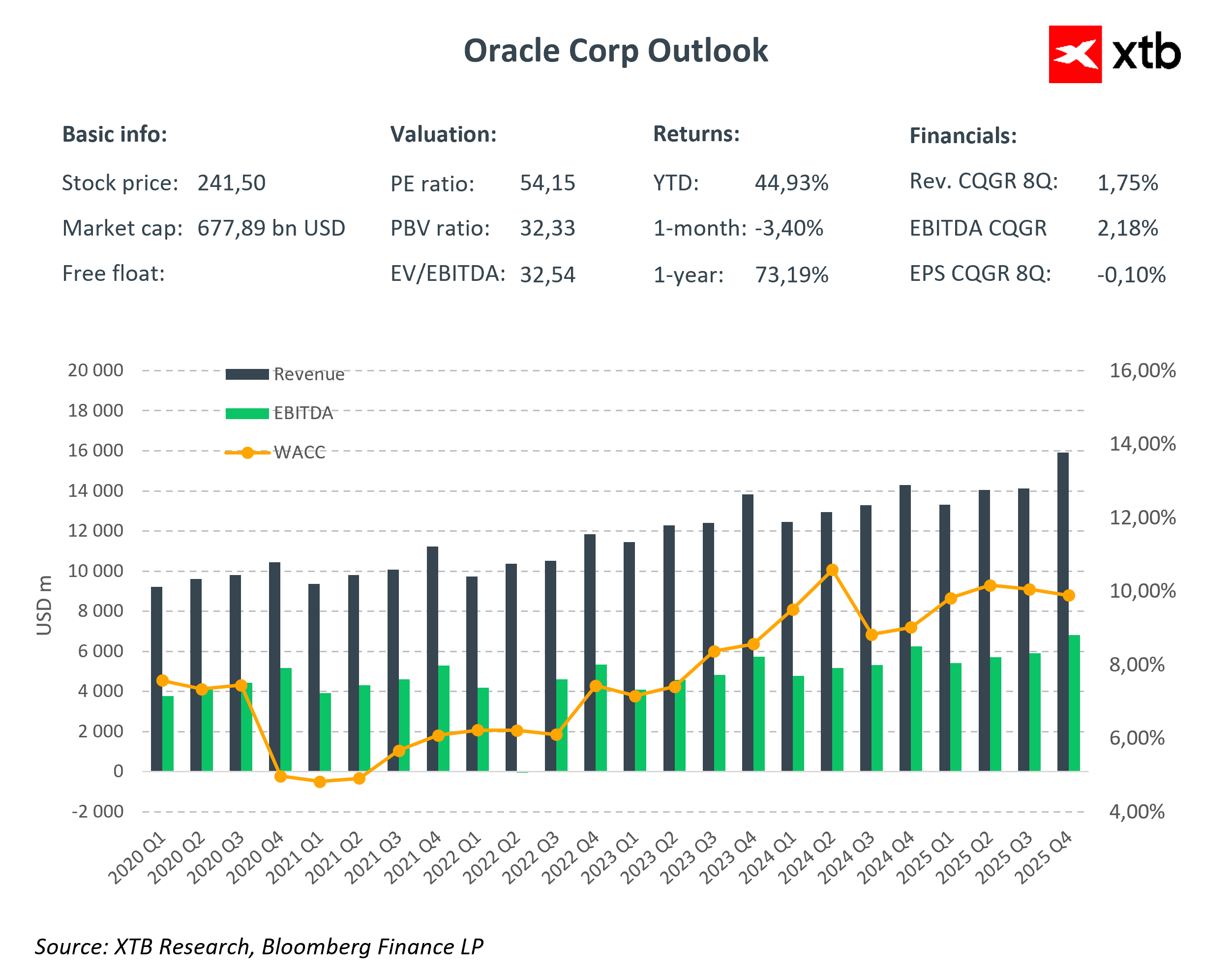

Analysts' consensus predicted EPS at the level of 1,48$ and revenues of 15 billion dollars. Both indicators were below expectations. The published figures were 1,47$ EPS and 14,9 billion in profits. It is worth recalling that the market had already accounted for — mainly seasonal — a decline in results compared to the previous figures of 1,7$ and 15.9 billion dollars.

What prompted the market to react so euphorically to the company's valuation?

While the total revenues were below expectations, what turned out to be important for investors was their structure. Primarily:

- Growth in revenues from IaaS (Cloud Infrastructure): an impressive increase of 55% year over year.

- Growth in revenues from SaaS (Cloud Applications): an increase of 11% year over year.

Additionally, the company boasted a colossal backlog of orders, known as RPO. It reached as much as 455 billion dollars, representing a 359% increase year over year!

Such enormous revenue security not only validates the company's high valuations but also realizes the most optimistic growth forecasts.

Additional shareholder interest was attracted by the mention of the "Stargate" project, a project worth 500 billion dollars, in which Oracle collaborates with OpenAI. This is not the end of mentions of lucrative cooperation with industry giants. Revenues from "Multi-Cloud," i.e., partnerships with AWS, Google Cloud, and Azure, increased 15-fold year over year.

This indicates an interesting trend among industry leaders, who seem to prefer collaboration over competition.

The company also positively surprised with its investment expenditures. An increase from 35 billion compared to 25. This shows that the company does not intend to slow down its extremely dynamic growth pace.

Analysts and commentators agree that this is a strategic and historic turning point in the company's history. Oracle has shown that its transformation from a database leader to a powerhouse in the field of cloud and databases is not only possible but is already a reality.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡