- The company has been consistently delivering massive revenue growth alongside exceptionally high profitability.

- Expectations are so elevated that even the strongest companies may struggle to meet them.

- What should investors focus on during the earnings call and in the results?

- Technical analysis

- The company has been consistently delivering massive revenue growth alongside exceptionally high profitability.

- Expectations are so elevated that even the strongest companies may struggle to meet them.

- What should investors focus on during the earnings call and in the results?

- Technical analysis

One of the valuation leaders among technology and AI companies will publish its earnings after the close of Monday’s trading session in the U.S. Palantir, a controversial provider of AI-driven data analytics and surveillance solutions for governments and major corporations, is facing another demanding earnings release.

Since its peak, the stock has declined by more than 25%. Despite this, with a market capitalization exceeding $340 billion, its P/E ratio remains above 300. With expectations and valuations stretched to such extremes, even the slightest disappointment could trigger a significant sell-off.

The company has beaten market consensus on both EPS and revenue nine consecutive times, yet this has not always translated into share price gains. This reflects the dynamics that emerge when valuation multiples reach such elevated levels.

For Q4 2025, the market expects EPS of approximately $0.23 and revenue exceeding $1.30 billion. As is typical for Palantir, these expectations are several percentage points higher than in the previous quarter. It will also be crucial for the company to deliver on its commitment to 61% year-over-year revenue growth.

The company faces as many opportunities as risks. Supporting the valuation are strong customer retention metrics and a balanced mix between commercial and government contracts.

At the same time, even a minor slowdown in growth within one of the key segments, by just 1–2%, could prove devastating for the valuation. Trust among U.S. allies in software originating from Silicon Valley is also weakening, which could affect the pace of product adoption outside the United States.

Forward guidance and management commentary will be just as important as the financial metrics themselves. Any statements suggesting a deceleration in growth could trigger a sharp market reaction. Conversely, sentiment could quickly shift in the opposite direction.

Growth forecasts significantly exceeding current assumptions, acceleration in deployment cycles, or a jump in the value of the order backlog could help the company regain its previous valuation highs. Particular attention will also be paid to new initiatives linked to the armed forces, such as the ongoing software development program for the U.S. Navy.

The company continues to demonstrate growth at a scale and consistency rarely seen in financial market history. Regardless of one’s opinion about the firm, it is one of the few companies on Wall Street that fully understands AI, its strategic applications, and executes its strategy with remarkable discipline.

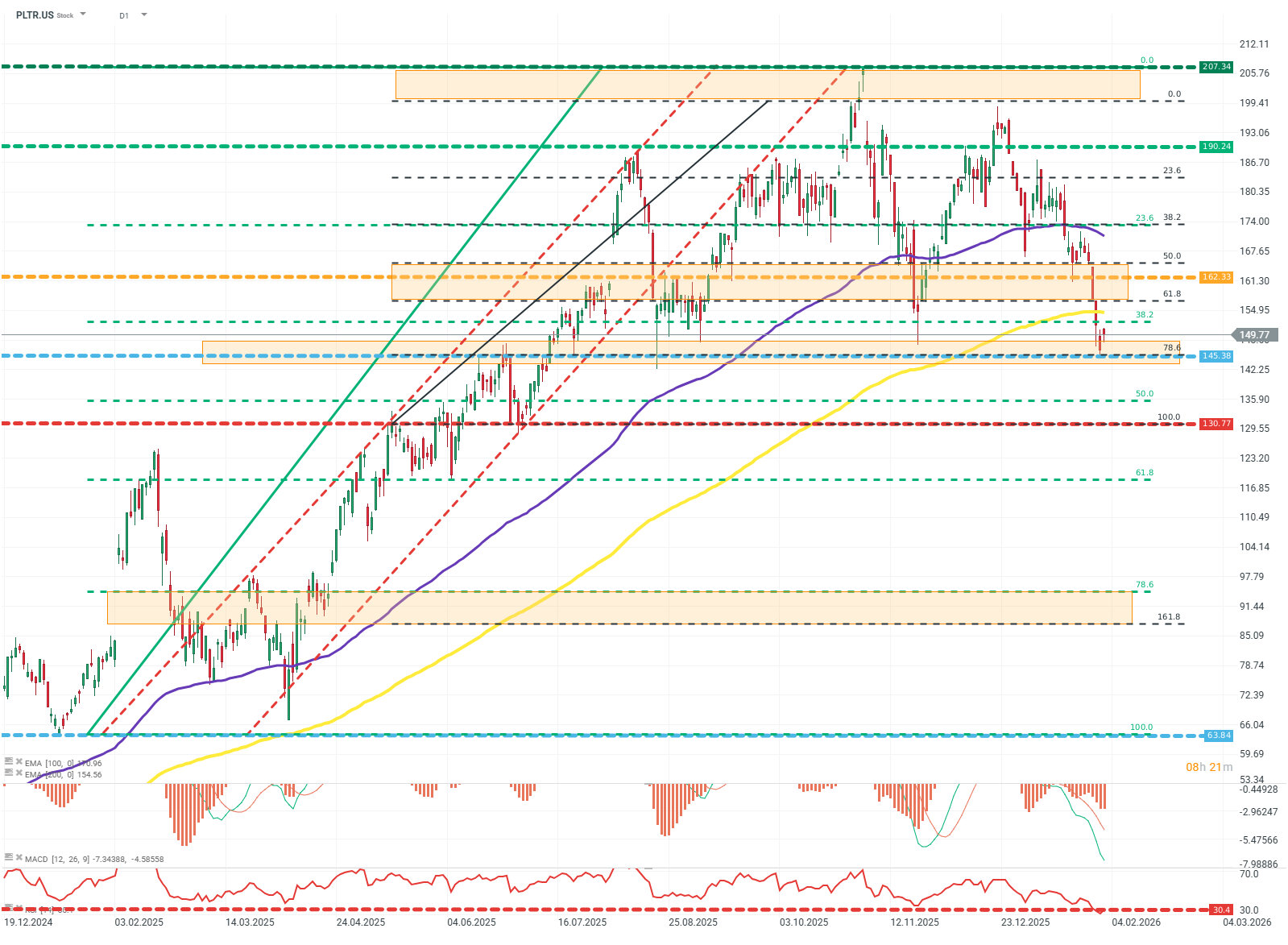

PLTR.US (D1)

The stock is currently trading within a key support zone around $145. The momentum of the EMA averages continues to support the uptrend, while RSI indicates extreme overbought conditions. MACD remains on the negative side. The next major support level is near $100.

Source: xStation5.

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

Daily summary: The market looks for direction, oil and metals under pressure

IBM Goes Against the Tide: Three Times More Entry-Level Employees