PayPal's (PYPL.US) financial results have disappointed investors. Despite raising its full-year profit forecast, the company slightly lowered its margin growth forecast. Through this, investors assessed an increasingly challenging environment for operating margins and a $2 billion lower volume of payments processed q/q. As a result, shares dived yesterday to levels not seen since the fall of 2017. Management cited macro factors - general consumer weakness and inflation - as reasons for the lower volumes. The payments company's management had previously warned that inflation was hurting business.

Payments processed: $354.5 billion in vs. $357.4 billion in Q4 2022

Revenue: $7.04 billion up 10% y/y

Earnings per share (EPS): $1.17 vs $0.88 in Q1 2022.

Operating margin in the first quarter was 22.7% vs. 20.7% last year.

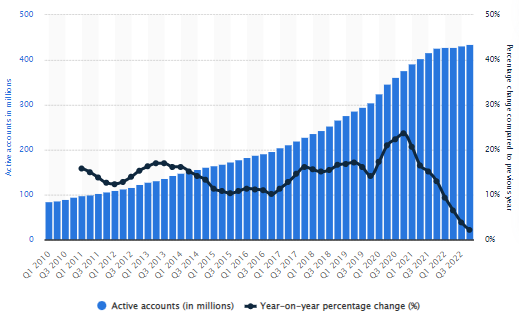

The number of active PayPal users (as of Q3 2023) has increased by more than 100% since 2017; however, the trend of lower and lower y/y growth is worrisome. On the other hand, it is indirectly due to economies of scale - with 430 million users, it is more difficult for the company to grow at a rate adequate to the period when there were 200 million users. Source: Statista

- The company expects earnings growth of about 20% y/y to $4.95 per share, i.e. above the $4.88 Wall Street estimate. At the same time, PayPal expects a 1% increase in operating margin in 2023, compared to 1.25% previously. The company expects higher profits in 2023 thanks to stronger-than-expected e-commerce trends and lower costs.

- Analysts see a risk of declining market share in international payments in the face of Apple Pay business expansion. Higher interest rates have discouraged consumers from spending more. Mizuho analysts pointed out that indebted customers with lower incomes were in a particularly weak position. The results showed that a potential recession in the global economy could further negatively affect the volume of payments processed by PayPal.

AI booster?

The earnings season showed that many companies see AI as an opportunity to reduce costs - especially needed in a challenging environment for margins. Like IBM, PayPal also intends to benefit through it. The company argues that it will make it more efficient. Of course, the market is a competitive place - Wall Street is aware that PayPal's competitors will also use these tools. CEO, Dan Schulman indicated that with its 'unique data sets and scale' AI will be particularly useful to PayPal in supporting efficiency and creating value for consumers. However, the CEO did not elaborate on what exactly would constitute it. He expects, however, that the company's costs will decline year after year. IBM has indicated that AI could completely replace up to 8,000 employees - in PayPal's case, a layoff scenario seems likely.

Payment volume processed by PayPal y/y rose nearly 10% but fell nearly $2 billion q/q and some stagnation is evident. Source: CNBC

PayPal (PYPL.US) shares, W1 interval. The company is deepening the sell-off, which is already close to October 2017 levels. In November 2021, the price settled below the SMA200, signaling weakness that had never before affected the company's share price on such a scale. Supply pushed the bulls off the SMA200 twice, including in the fall of 2022 and in February 2023. The key resistance appears to be $81 where the SMA200 runs. An indicator that can indicate 'attractive momentum' for aggressive investors - PEG ratio, popularized by Peter Lync has fallen to 1.09 and is close to historical lows. Source: xStation5

PayPal (PYPL.US) shares, W1 interval. The company is deepening the sell-off, which is already close to October 2017 levels. In November 2021, the price settled below the SMA200, signaling weakness that had never before affected the company's share price on such a scale. Supply pushed the bulls off the SMA200 twice, including in the fall of 2022 and in February 2023. The key resistance appears to be $81 where the SMA200 runs. An indicator that can indicate 'attractive momentum' for aggressive investors - PEG ratio, popularized by Peter Lync has fallen to 1.09 and is close to historical lows. Source: xStation5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals