Summary:

- Chinese inflation has increased notably since the start of the year

- PBoC reduces its 7-day reverse repo rate for the first time since 2015

- Overall borrowing costs remain elevated despite recent cuts to major lending rates

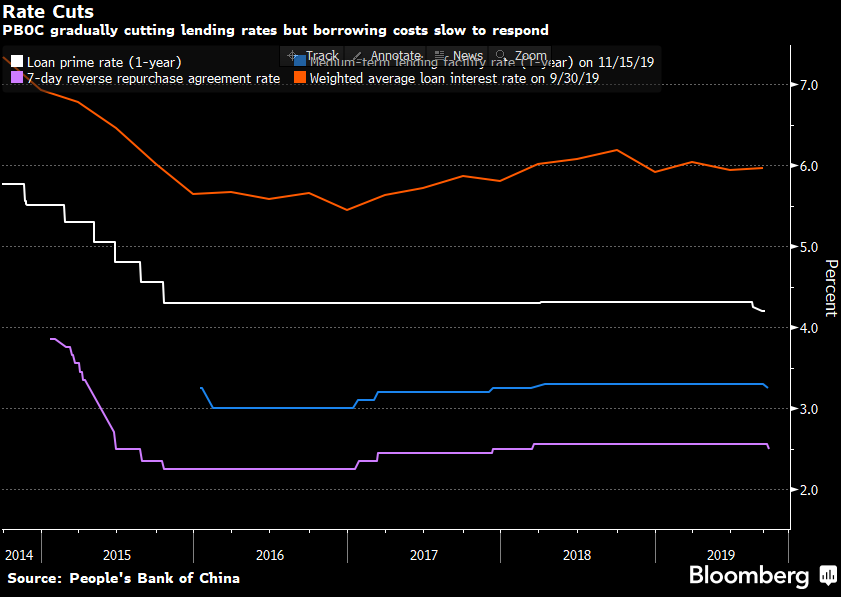

The People’s Bank of China lowered on Monday its 7-day reverse repurchase agreement rate by 5 basis points to 2.5%, the first such a reduction since 2015. Along with this rate cut, the Chinese central bank also injected 180 billion yuan of cash into the financial system via open market operations in order to alleviate liquidity concerns. Moreover, it is worth remembering that this cut came just two weeks after the PBoC cut its medium-term lending facility rate, the mechanism used by lenders for longer-dated funding needs. As one may notice at the chart below, the monetary authorities in Beijing have recently decided to lower borrowing costs trying to help its faltering economy. Nevertheless the PBoC’s strategy has not been successful thus far because the weighted average loan interest rate has been climbing since the beginning of 2017.

Let us remind that the PBoC released on Saturday its quarterly report where it warned on growth risks as well as rising price growth in the world’s second largest economy, which could limit room for yet more accommodative monetary policy. Keep in mind that inflation in China has increased to 3.8% in October from 1.5% in annual terms in January. On the face of it, it could put a limit on the PBoC to make policy easier. However, this price growth has so far been largely driven by exogenous factors (food prices driven predominantly by pork and other kinds of meats due to African swine fever) meaning that rate hikes at this environment could make things even worse. That is why the PBoC is likely to continue loosening policy modestly at least until any second round effects occur.

Some key lending rates in China have ticked down recently, overall borrowing costs have barely changed though. Source: Bloomberg

Some key lending rates in China have ticked down recently, overall borrowing costs have barely changed though. Source: Bloomberg

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)