Peloton (PTON.US) shares plunged more than 4 % after Wedbush Securities downgraded the fitness equipment maker’s stock to “neutral” from “outperform” saying there may be too much competition now for Peloton to keep up the pace as consumers now have a wider spectrum of workout alternatives, as well as the post-pandemic option of out-of-home workouts. Wedbush analysts believe that Peloton is going to need to introduce innovative new products and initiate some savvy marketing if it expects consumers to choose it over the competition.

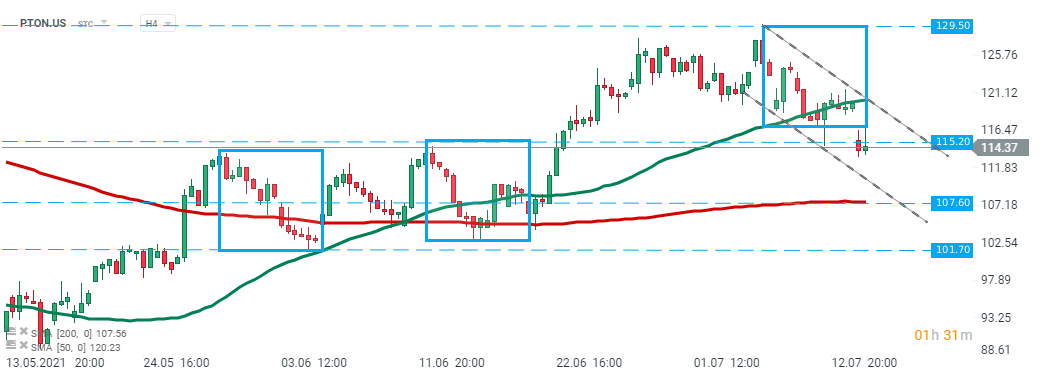

Peloton (PTON.US) stock has been moving in an upward trend since the beginning of May, however, some weakness can be spotted in recent days. Stock failed to break above the upper limit of the descending channel which is strengthened by 50 SMA (green line) and price pulled back below the lower limit off the 1:1 structure and major support at $115.20. In case downward move deepens, 200 SMA (red line) should act as the first support. Should the stock price break below it, the way towards next major support at $101.70 will be left open. Source: xStation5

Peloton (PTON.US) stock has been moving in an upward trend since the beginning of May, however, some weakness can be spotted in recent days. Stock failed to break above the upper limit of the descending channel which is strengthened by 50 SMA (green line) and price pulled back below the lower limit off the 1:1 structure and major support at $115.20. In case downward move deepens, 200 SMA (red line) should act as the first support. Should the stock price break below it, the way towards next major support at $101.70 will be left open. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡