Pepsi (PEP.US) stock rose over 1.5% before the opening bell after the beverage and snack giant posted better than expected quarterly figures, mainly thanks to price increases. Company also decided to raise its annual dividend.

-

Pepsi reported EPS growth of up 9.1% YoY to $1.67 on revenue of $28 billion (11.0% YoY increase). Analysts were expecting EPS of $1.65 on sales of $26.8 billion.

-

Organic sales volumes fell 2% following average price increases of around 16% in Q4

-

Pepsi’s net income dropped 60% to $535 million, largely due to a $1.5 billion impairment charge for its SodaStream brand and other assets.

-

Company lifted its annualized dividend by 10% to $5.06 per share.

Highlights of Pepsi Q4 financial results. Company's anticipates that economic slowdown may have a negative impact on its results in the current quarter. Source: Alpha Street

Highlights of Pepsi Q4 financial results. Company's anticipates that economic slowdown may have a negative impact on its results in the current quarter. Source: Alpha Street

-

In Q1 company forecasts core earnings of around $7.20 per share, below market consensus of $7.12 signaling multiple price hikes were likely to dampen demand for its products amid a cost-of-living crisis.

-

Organic sales are expected to increase by 6% .

-

"We are pleased with our results for the fourth quarter and the full year as our business remained resilient and delivered another strong year of growth," said CEO Ramon Laguarta. " Moving forward, we will continue to focus on driving growth and winning in the marketplace while developing advantaged capabilities to fortify our businesses for the long-term."

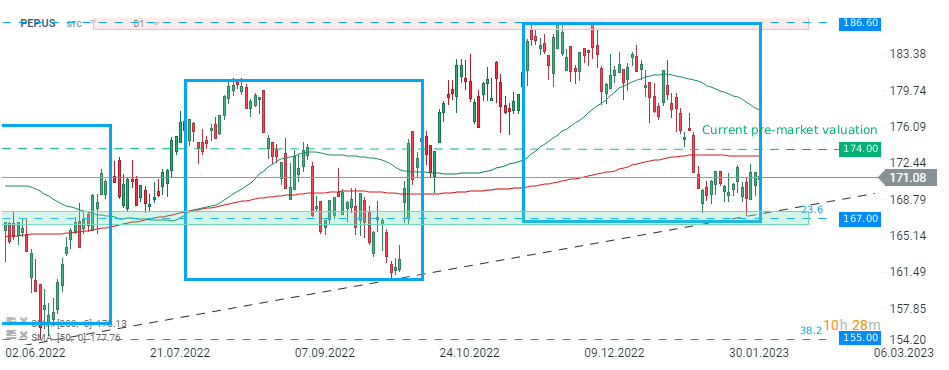

Pepsi (PEP.US) stock recently bounced off key support at $167.00, which is marked with lower limit of the 1:1 structure, 23.6% Fibonacci retracement of the bullish move started in March 2020 and long-term upward trendline. As long as price sits above this level, bullish move may accelerate towards all-time high at $186.60. Source: Station5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street