Pinterest (PINS.US) stock fell sharply in late trading Monday after the social media company posted mixed quarterly results, provided weak financial forecasts for the March quarter and announced the resignation of CFO Todd Morgenfeld.

-

Company earned 29 cents a share, beating analysts’ estimates of 27 cents a share

-

Revenue rose 4% YoY to $877 million, missing market expectations of $884.5 million

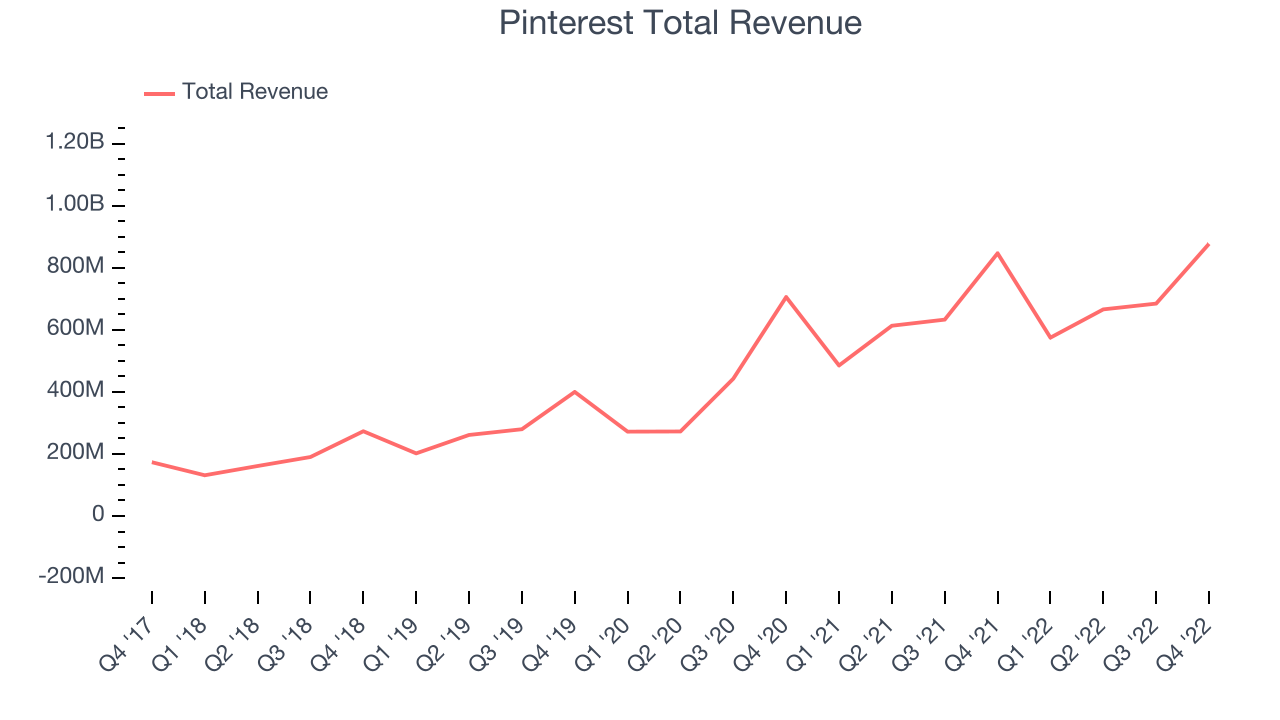

Since 2020 Pinterest's revenue has risen on average nearly 40.0% annually. Company's revenue benefited from the pandemic, however after initial shock growth rates subsequently normalized. Source: Barchart

Since 2020 Pinterest's revenue has risen on average nearly 40.0% annually. Company's revenue benefited from the pandemic, however after initial shock growth rates subsequently normalized. Source: Barchart

-

Monthly average users (MAU) jumped by 4.4% YoY to 450 million, slightly below the consensus projection of 451 million.

-

Europe delivered higher-than-expected MAUs while North America and the Rest of the World missed estimates. The average revenue per user (ARPU) was $1.96, below analysts’ projections of $1.98.

In Q4 the company added 19 million monthly active users, translating to a 4.4% growth year on year. Source: Barchart

In Q4 the company added 19 million monthly active users, translating to a 4.4% growth year on year. Source: Barchart

-

For the Q1 20232 Pinterest forecasts revenue to increase in the "low single digits" compared to last year, "which takes into account slightly lower foreign exchange headwinds than Q4 2022”. Meanwhile analysts were expecting an increase of 6.9%, to $614.5 million.

-

Company authorized a stock repurchase program of up to $500 million of its Class A common stock.

-

Pinterest stock dropped 13.0% after publication of latest quarterly results, however moods reversed after the board indicated on the earnings call that it is expecting margins to grow this year, most likely due to cost-cutting measures.

-

CEO Bill Ready said the company is “staying focused on growing monetization per user, integrating shopping throughout the core user experience, and increasingly driving operational rigor. While the industry as a whole is facing headwinds, we are adapting quickly to a changing macro environment and are committed to creating a more positive online experience for our users and advertisers.”

-

After the earnings call Bernstein lifted the price target to $27.0 per share from $25.0 on the Market Perform-rated PINS stock.

-

“We accept management's POV that we should see margins expand throughout 2023 as revenue leverage emerges and marketing and headcount-related costs come off the books,” said Bernstein analysts.

-

Wolfe Research also increased the price target from $30.0 per share to $33.0 per share with outperform rating.

-

“PINS is making steady progress on key LT initiatives (shopping, video, full funnel objectives). Macro uncertainties remain an overhang on the entire digital ads complex but PINS's top-line growth is showing relative out-performance. As we look ahead, we see potential for acceleration through FY23 as key initiatives scale further,” the Wolfe analysts wrote.

Pinterest (PINS.US) stock tested $25.30 market before the opening bell, however buyers managed to regain control and current price is trading above $27.35 mark, which coincides with 78.6% Fibonacci retracement of the upward wave started in March 2020 and upper limit of the local wedge formation. As long as price sits above this level, another upward wave may be launched towards recent highs at $29.20. Source: xStation5

Rheinmetall earnings: Formidable growth, but the market expected more

From Dependence to Control. Meta’s Development of Proprietary AI Chips

Mixed sentiments on Wall Street amid Iran war🗽Oracle shares surge 10%

Nebius shares surge 10% amid Nvidia $2 bln investment 📈