Summary:

-

Pound jumps after Barnier comments on Brexit deal timing

-

EU ready to give Barnier mandate to close Brexit deal

-

GBPUSD hits 1-month high back above 1.30

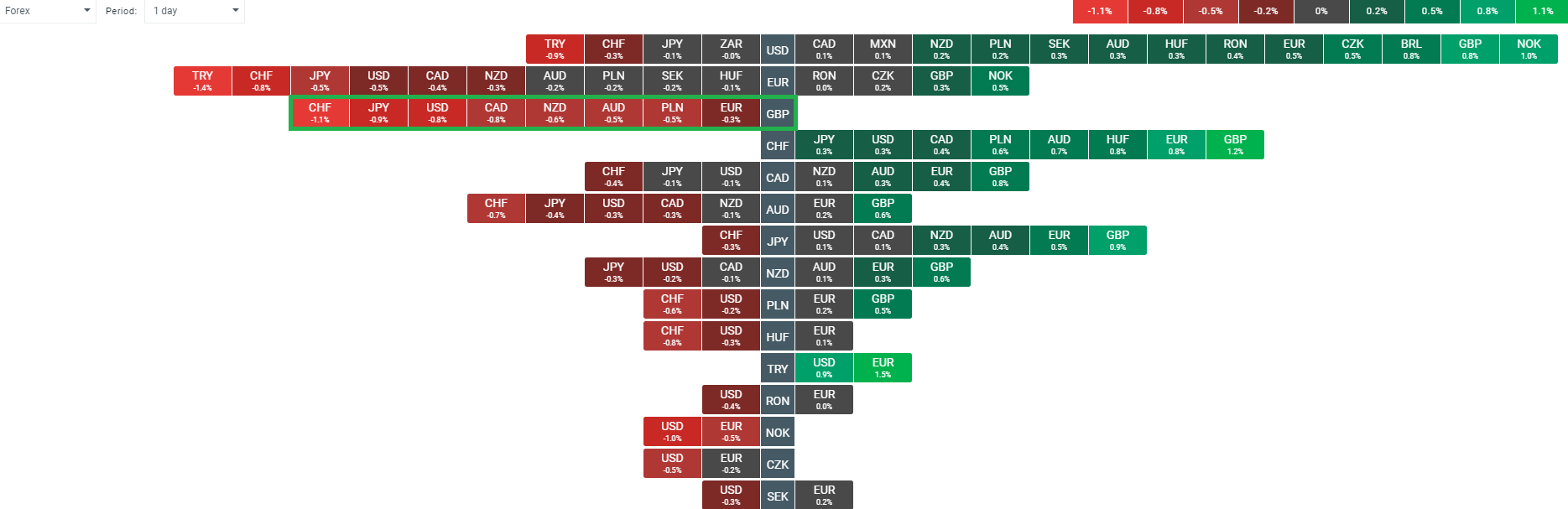

The pound is enjoying a good day of gains with dual developments on the Brexit front seeing a flurry of buying in sterling.The largest gains can be seen against the Swiss Franc and the Japanese Yen with an appreciation on the day of 1.1% and 0.9% respectively while the pound is higher against all of its peers. Only the Norwegian Krone is outperforming as you can see from the USD column, with this rising due to an earlier higher than expected inflation print.

The GBP is rising against all of its peers today as you can see from the heatmap. The largest gains are vs the CHF and JPY. Source: xStation

The pound was already trading slightly higher on the day after the latest UK GDP figures beat forecasts but the real reason for the appreciation seems to be the latest Brexit news. Reports that the EU’s top Brexit negotiator, Michel Barnier, said it would be “realistic” for a deal to be forged by early November saw a flurry of buying in the pound with the GBPUSD surging by more than 100 pips in a short space of time. There’s been a clear increasing sensitivity in the pound to comments regarding Brexit in recent weeks with 3 clear occasions when the GBPUSD pair has spiked higher following positive Brexit-related comments.

GBPUSD has rallied strongly on 3 occasions in recent weeks following positive Brexit-related comments. Note however that the past 2 occasions have failed to see much by the way of follow through to the upside. Source: xStation

Looking at other GBP pairs the GBPNZD is of particular interest after the cross rose to its highest level in more than 2 years. The market has now recaptured the 78.6% fib retracement of the decline seen since the Brexit at 1.9850 and could look to recoup the entire loss from 2.0710 going forward. The last year has seen a broad range from around 1.8700-1.9850 contain price but the latest break higher could be deemed an important development from a technical perspective.

GBPNZD has hit its highest level in over 2 years today and in breaking above the 78.6% fib of the decline following the Brexit vote has opened up the possibility of the entire loss from 2.0710 to be recouped. Source: xStation

GBPNZD has hit its highest level in over 2 years today and in breaking above the 78.6% fib of the decline following the Brexit vote has opened up the possibility of the entire loss from 2.0710 to be recouped. Source: xStation