The post-FOMC US dollar weakening seems to have been halted at the turn of 2023 and 2024. US dollar index (USDIDX) is trading around 2% above a low from December 28, 2023, while 10-year US yield climbed back above 4.00% today, for the first time since FOMC December meeting. Markets are reversing a big part of the moves made in the final two weeks of the previous year, which could have been exacerbated by thinner end-year liquidity conditions. Also, the moves at the beginning of the year are often heavily influenced by fund flows, and investors may have to wait a bit before markets revert to fundamentals.

Nevertheless, a strong pick-up in US yields and USD strengthening are putting pressure on precious metals prices, who are experiencing another day of a strong sell-off. GOLD and PLATINUM trade 1.3% lower, SILVER slumps 3%, while PALLADIUM drops 1.6%.

GOLD continues to pull back after a failed attempt to deliver a sustained breakout above the $2,070 resistance zone at the end of December 2023. Precious metal drops to a 2-week low today. Price moves have been driven by the US bond market recently (TNOTE - light blue overlay). The nearest support zone to watch can be found in the $2,000-2,010 per ounce area. Source: xStation5

GOLD continues to pull back after a failed attempt to deliver a sustained breakout above the $2,070 resistance zone at the end of December 2023. Precious metal drops to a 2-week low today. Price moves have been driven by the US bond market recently (TNOTE - light blue overlay). The nearest support zone to watch can be found in the $2,000-2,010 per ounce area. Source: xStation5

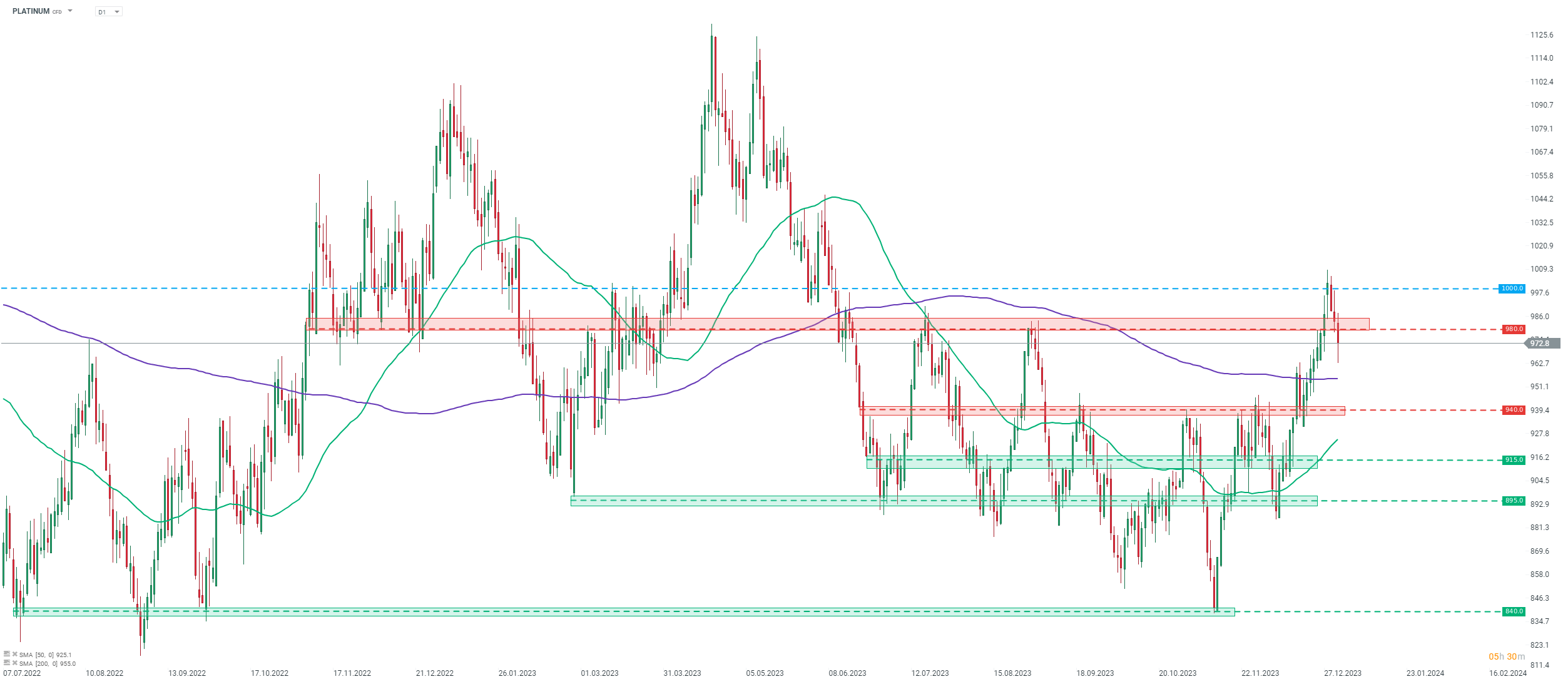

PLATINUM broke above the $1,000 per ounce mark on December 28, 2023, for the first time since the first half of June 2023. However, bulls failed to hold onto this level and price pulled back below it the next day. PLATINUM moved below $980 per ounce price zone today. The next major support to watch can be found in the $940 per ounce area, but bears would need to clear 200-session moving average first (purple line). Source: xStation5

SILVER is a top underperformer among precious metals today, with a 3% drop. SILVER dropped below 50- and 200-session moving averages at the beginning of the day and continued to move lower. Price broke below the $23.30 per ounce support, marked with previous price reactions and the upward trendline. The $22.75 swing area may offer some support should SILVER continue to drop, but a key support zone can be found in the $22.25 area. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30