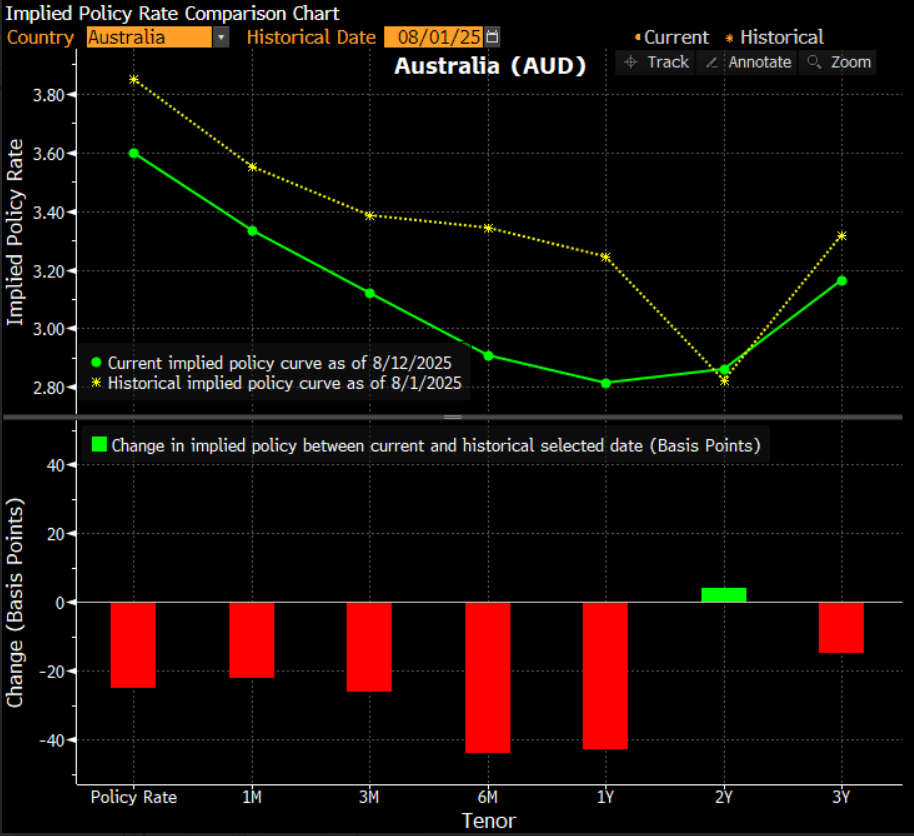

Following market's expectations, the Reserve Bank of Australia decided at today's meeting to lower the interest rate. From 3.85% to 3.6%, an effective reduction of 25 basis points. The AUD-USD pair is reacting with declines.

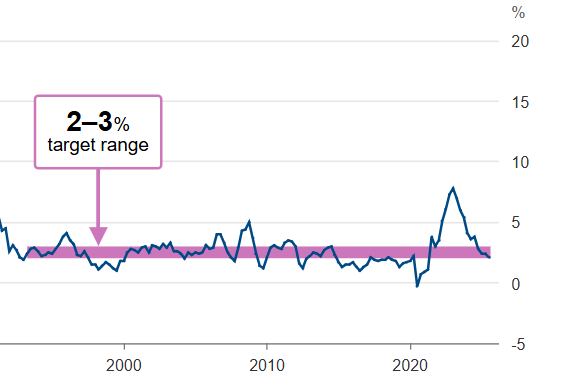

The market consensus indicated an almost certain cut, due to a series of economic variables in Australia. Primarily, the RBA's preferred inflation measure, the "trimmed mean CPI," showed 2.7% and fell within the Bank's target policy range of 2 to 3%. A fact that the bank's management was clearly pleased with. It is also worth mentioning the rising unemployment, currently 4.3%. This supports the central bank's thesis of a cooling economy and justifies the reductions. Additionally, recent tariffs imposed on Australia by Donald Trump may trigger further slowdown.

In light of this information, the market not only expects further reductions but, after the last meeting, sees an acceleration in the pace of policy easing. Currently, the central bank's target interest rate, after the current cycle of rate cuts, is expected to be around 3%

The central bank's president, Michele Bullock, emphasizes the important role of data, including employment and inflation, as sources of RBA policy. Ms. Bullock also mentioned the significant dependence of Australia's situation on foreign markets, especially the USA. She added that the current reductions are already preemptive and are a reaction to the bank's expectations for the economy. Despite market expectations, as of today, the president does not declare larger reductions; these are to be dependent on incoming data.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉