Remy Cointreau (RCO.FR) stock jumped over 11% during today's session after the French drinks group announced that earnings doubled in the first half of the year thanks to strong demand for its premium cognac in China, the United States and Europe, price effects and good cost control. The group recorded operating profit of 212.9 million euros ($238.5 million) in the six months to Sept. 30, twice that of the same period last year. Net profit came to EUR134 million, more than doubling on the year.

Eric Vallat, Remy Cointreau’s CEO, commented: “It has been an amazing semester for Rémy Cointreau, reflecting our market share gains and the solid progress made on our strategic priorities. These results will reinforce our ability to become the worldwide leader in exceptional spirits".

As a result of the strong first half performance, the company raised its full-year outlook and now expects "very strong" organic growth in current operating profit in the 2021/22 financial year. It had previously targeted "strong" growth. However Remy warned, that second-half earnings will be affected by higher spending on marketing and communication and by inventory management in the year’s final quarter. The company did not provide any specific earnings forecasts for the full year.

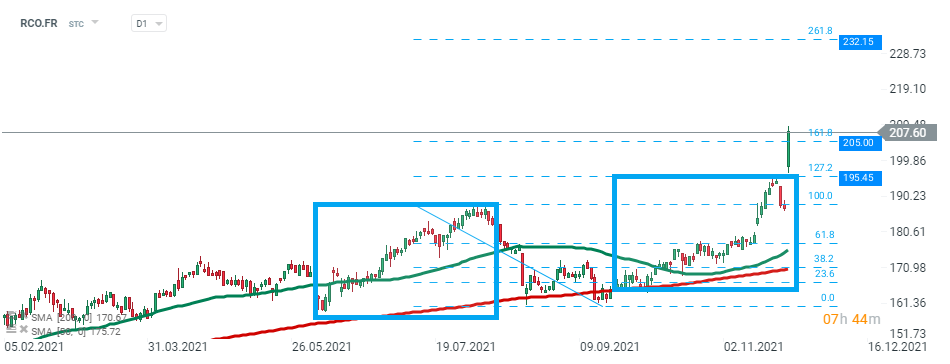

Remy Cointreau (RCO.FR) stock launched today's session sharply higher, tested support at €195.45 and then skyrocketed to new all-time high at €205.00. If current sentiment prevails, upward move may accelerate towards €232.15 which coincides with 261.8% external Fibonacci retracement of the last downward wave. Source: xStation5

Daily summary: The beginning of the end of disinflation?

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US Open: Rising oil and PPI pressure Wall Street 📉 Technology and financial stocks drop

Dell surges 12% amid AI driving 40% revenue growth 📈