GameStop (GME.US) stock jumped more than 25% on Tuesday despite lack of any major news, which resembles the elevated volatility that we could observe in early 2021.Stock price is moving higher for the sixth-straight session and recovered all March losses amid rising interest from retail traders.

Today the company was mentioned more than 400 on the WallStreetBets subreddit group, compared to 285 mentioned on Monday, according to Quiver Quantitative, which also noted nearly 800K off-exchange short sales yesterday. GameStop's average session volume over a 100-day period is 2.975 million, according to data from Benzinga Pro, meanwhile during today's session volume jumped above 3.4 million. Retail investors continue to focus on the potential for a short squeeze. Benzinga Pro data shows that over 25.0% of GameStop's total float is currently sold short. \

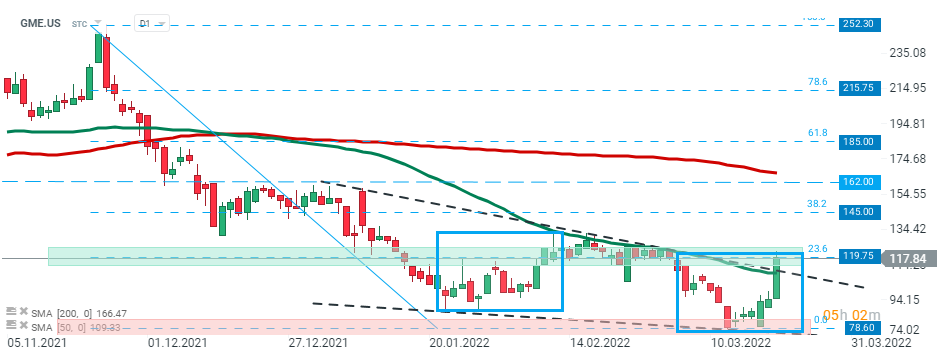

GameStop (GME.US) stock rose sharply during today's session and is currently testing major resistance at $119.75, which is marked with upper limit of the 1:1 structure, 23.6% Fibonacci retracement of the last downward wave. Source: xStation5

GameStop (GME.US) stock rose sharply during today's session and is currently testing major resistance at $119.75, which is marked with upper limit of the 1:1 structure, 23.6% Fibonacci retracement of the last downward wave. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡