Rivian (RIVN.US) shares rose more than 50% since the company's stock market debut on Wednesday as more investors are willing to put their money into the EV sector. As a result, a 12-year-old startup that’s never sold a single car, is now worth more than $140 billion — just ahead of Volkswagen (nearly $139 billion), and in third place behind Toyota ($306 billion) and Tesla ($1 trillion). Rivian market cap surpassed amore than century-old General Motors and Ford which happens to be a Rivian shareholder.

Rivian, which is backed by Amazon and Ford, surpassed Volkswagen’s market capitalization of $138.9 billion. Source: Bloomberg

Rivian market cap has soared since last week's IPO. Source: Bloomberg via ZeroHedge

It is worth remembering that Volkswagen delivers approximately 10 million vehicles per year on annual revenue of $300 billion, while Rivian has started delivering some trucks in September, mostly to its own employees. However, the electric-truck maker has ambitious plans to produce 150,000 vehicles at its main factory by late 2023. Still, until Rivian starts booking some sales, and reporting some profits, it is impossible to predict what kind of profit margin the company will be earning on its cars, therefore some caution is advised.

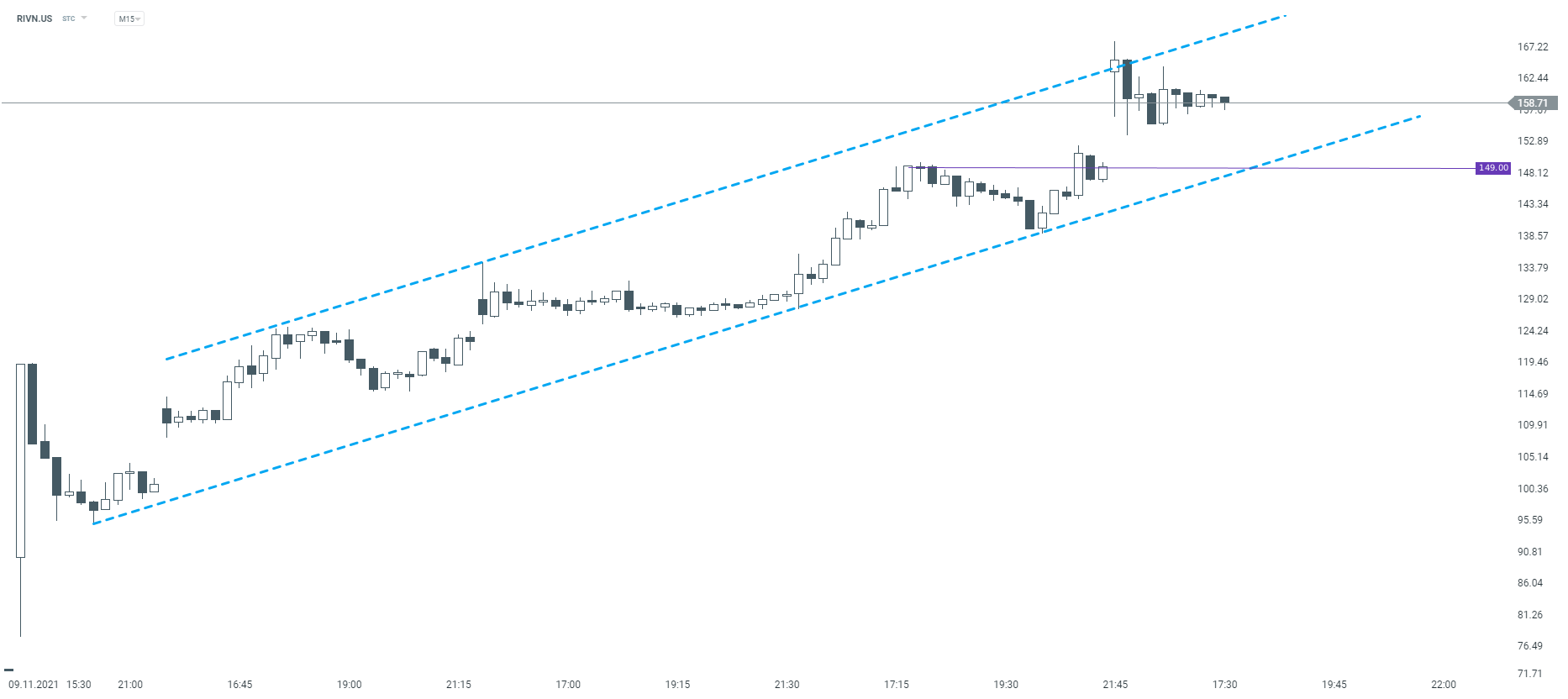

Rivian (RIVN.US) stock price more than doubled in value since last-week’s trading debut. During today's session stock rose more than 11%, however buyers failed to stay above the upper limit of the ascending channel and price pulled back. Nearest support to watch lies at $149.00. Source: xStation5

Rivian (RIVN.US) stock price more than doubled in value since last-week’s trading debut. During today's session stock rose more than 11%, however buyers failed to stay above the upper limit of the ascending channel and price pulled back. Nearest support to watch lies at $149.00. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡