Salesforce (CRM.US) stock fell over 10.0 % on Thursday as news of the surprise departure of co-CEO Taylor and weak financial outlook overshadowed upbeat quarterly figures.

-

The cloud-software company earned $1.40 per share, easily beating FactSet expectations of $1.22. Revenue of $7.84 billion, slightly topped market estimates of $7.83 billion.

-

For the current quarter, Salesforce expects revenue in the region of $7.93 billion to $8.03 billion, a range whose midpoint is the Wall Street consensus call of $8.02 billion. On the other hand, the company forecast earnings per share in a range of $1.35 to $1.37 per share compared to analysts’ estimates of $1.34 per share.

-

Company noticed that corporate technology purchasing decisions were receiving “greater scrutiny” and there was a high level of uncertainty among customers about the demand environment.

-

Salesforce announced that co-Chief Executive Bret Taylor, who had been co-CEO for about one year, will stay with the company only until Jan. 31, 2023 as he intends to join a startup. Marc Benioff will remain as the sole CEO of the company.

-

" With Taylor leaving we can see Benioff potentially getting more aggressive on M&A in the cloud landscape as more private and public vendors struggle in a softer macro backdrop. This is all about the battle vs. Microsoft (MSFT) for market share in the cloud and collaboration space with CRM in a strong position to further build out its product footprint over the coming years." said Wedbush analyst Daniel Ives in a report.

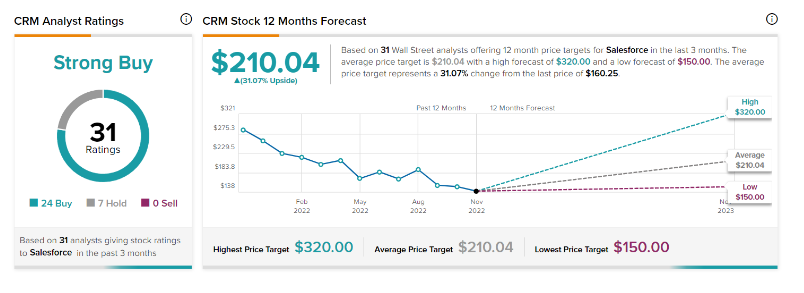

Salesforce stock has a strong buy rating based on 31 analysts’ recommendations with a price target of $210.04, which implies approximately 45.00% upside potential from current price levels. Source: Tipranks

Salesforce stock has a strong buy rating based on 31 analysts’ recommendations with a price target of $210.04, which implies approximately 45.00% upside potential from current price levels. Source: Tipranks

Despite the difficult macroeconomic environment, the company's quarterly results surprised on the upside mainly thanks to rising demand for cloud-based services. Company plans to increase investments and expand its offer in order to increase its market share which should support long-term growth.

Salesforce (CRM.US) stock launched today's session sharply lower as buyers once again failed to break above the major resistance zone around $159.55 which is marked with previous price reactions and 78.6% Fibonacci retracement of the upward wave launched in March 2020. If current sentiment prevails, downward impulse may deepen towards support at $126.00, where the lower limit of the 1:1 structure is located or even to pandemic lows at $116.50. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡