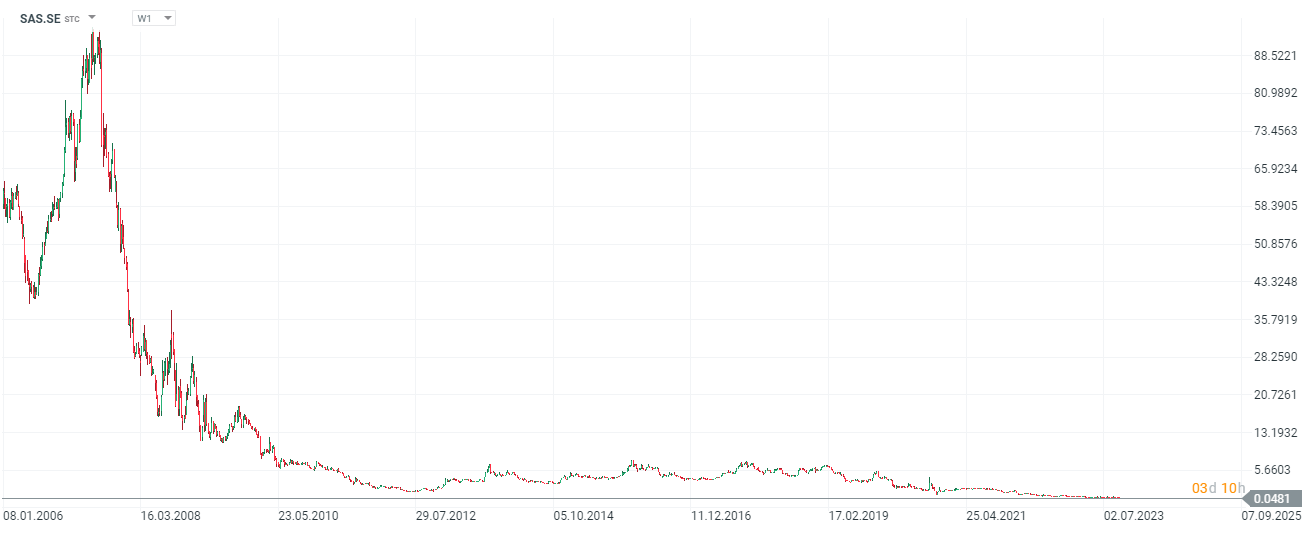

Scandinavia's largest airline SAS (SAS.SE) today informed the market that it will restructure under 'Chapter 11' of US bankruptcy law. This will result in the group being delisted from the stock exchanges and wiping out the current shareholder structure. The capital remaining after the restructuring, according to the company's announcement, is likely to be distributed exclusively to creditors. In effect, SAS shares loses 83%.

What's next for SAS?

-

After the bankruptcy proceedings, investment firm Castlelake (32%), Lind Invest (8.6%) and Air France airline KLM (20%, $1.2 billion investment) along with the Danish Treasury (26%) will become the company's new major shareholders. The company filed for bankruptcy protection in a US court in the middle of last year. It was unable to survive in an environment of rising costs and muted demand, which was also negatively affected by the pandemic.

- The agreed transaction structure valued SAS at $175 million, including $475 million in new unlisted shares and $700 million in secured convertible debt. SAS is expected to eventually join the SkyTeam group (KLM - Air France) and leave the Star Alliance, subject to relevant approvals and finalizing of the 'Chapter 11' process.

SAS shares (SAS.SE), W1 interval. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records