Silver gains over 1% today, similarly to platinum. Palladium, on the other hand, gains over 2%, while gold gains 0.5%. This is the effect of a very weak US dollar, although at the same time we do not observe a decrease in yields. The dollar is losing primarily against the yen, as the head of the Bank of Japan announced possible interest rate hikes at the next meeting, which will take place in a week, after the Fed's decision. Therefore, there is a chance that the huge divergence between the Fed and BoJ policy will decrease.

Looking at the chart, we observe a clear drop in USDJPY (inverted axis), which supports a rebound in silver. Silver rebounds from the vicinity of the lowest level since August 21. Of course, it is worth noting that a similar upward movement was visible on Friday, but it was significantly reduced by the end of the session. If high levels are maintained today, the next important resistance will be the 23.6% retracement of the last downward wave and the 200-session average located slightly above at 23.4 USD.

It is worth remembering that the yen is considered a "safe" currency along with USD, which is why we often observe a positive correlation between yen changes and the prices of precious metals, such as silver. Source: xStation5

It is worth remembering that the yen is considered a "safe" currency along with USD, which is why we often observe a positive correlation between yen changes and the prices of precious metals, such as silver. Source: xStation5

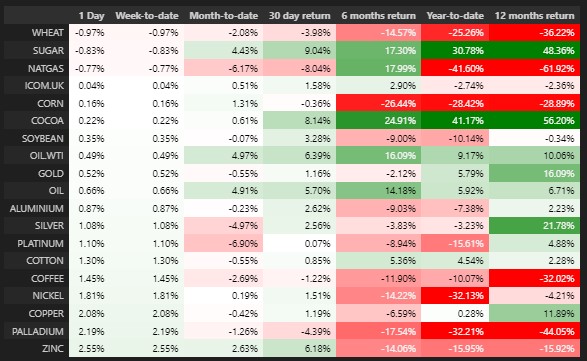

Silver is gaining 1% today, but we can see that there are even larger increases on other metals. Besides, we see that silver has been rather weak this year, although not as weak as industrial metals. Source: XTB

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?