-

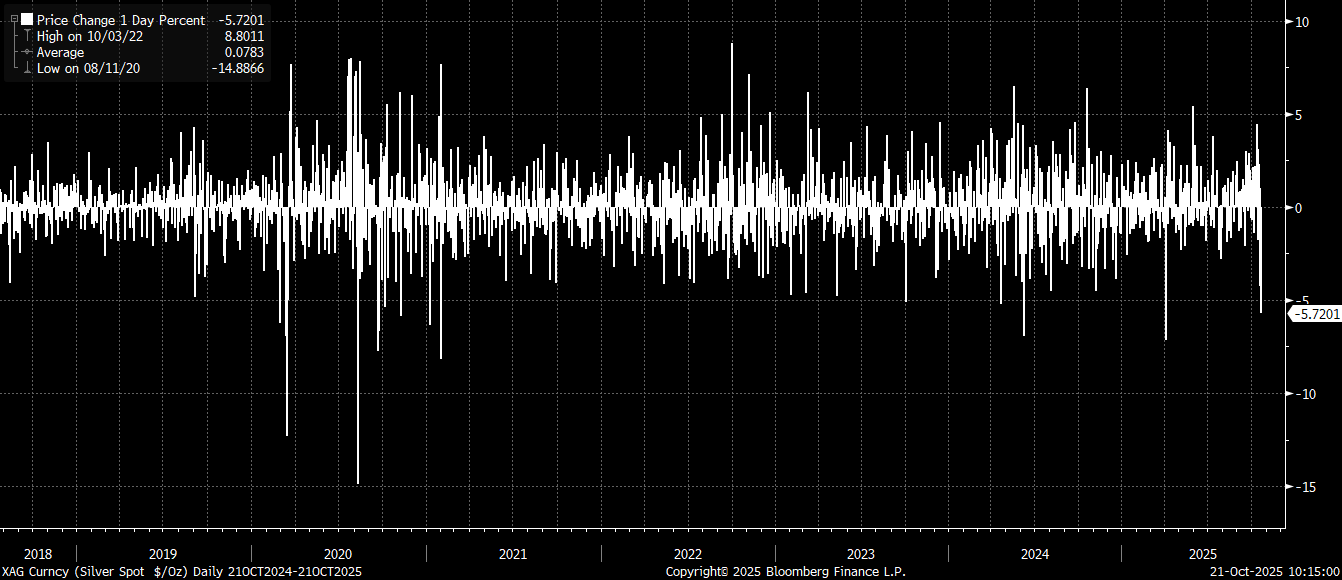

Silver tumbles nearly 5%, dropping below the $50 level for its largest single-day loss since April.

-

The correction follows a surge of retail FOMO, often seen as a contrarian signal by seasoned investors.

-

Key factors include easing US political risk, renewed US-China trade optimism, and a technical breach of the accelerated uptrend line.

-

Silver tumbles nearly 5%, dropping below the $50 level for its largest single-day loss since April.

-

The correction follows a surge of retail FOMO, often seen as a contrarian signal by seasoned investors.

-

Key factors include easing US political risk, renewed US-China trade optimism, and a technical breach of the accelerated uptrend line.

The correction follows a period where images of queues outside physical bullion shops circulated globally, suggesting a surge of FOMO (Fear of Missing Out) among retail clients previously unfamiliar with precious metals. The entry of the least experienced investors into a market is frequently considered a contrarian signal.

While the market's underlying fundamentals remain robust, pullbacks are a regular feature, especially when several catalysts align:

- US Political Risk Eases: News emerged yesterday of a potential deal between Republicans and Democrats this week, paving the way for the US government to resume operations. This development potentially removes a layer of geopolitical risk from the market.

- Trade Optimism: Donald Trump has declared that a trade agreement with China will be "magnificent," and he plans to meet with Xi Jinping at the APEC summit later this month.

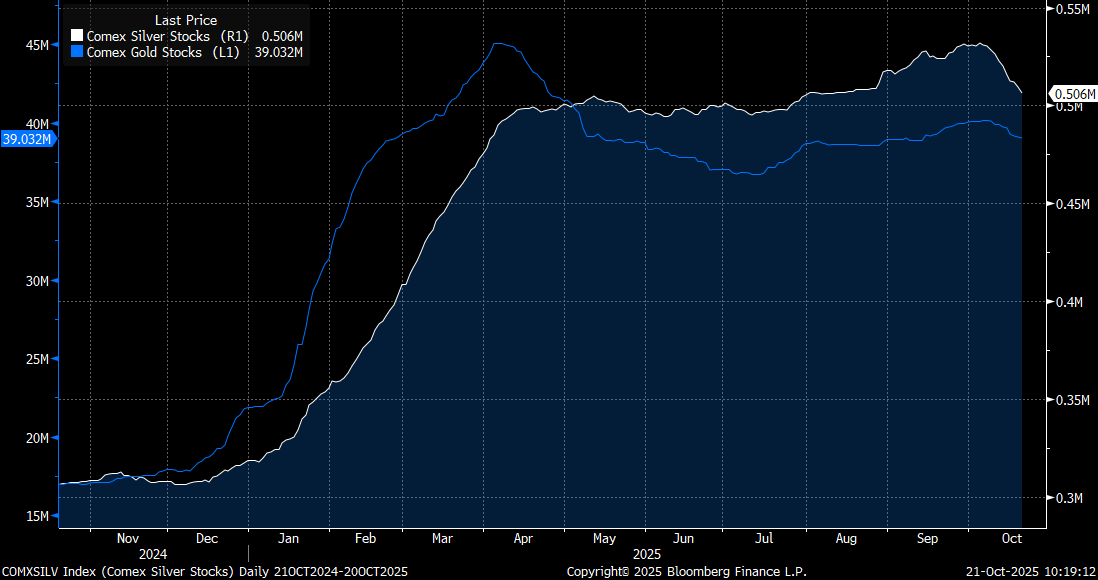

- COMEX Inventory Shift: Silver inventories at COMEX have begun to decline, a trend that could signal the metal's return to London.

Silver is recording its largest daily decline since April. Historically, movements of this magnitude have been exceedingly rare. Source: Bloomberg Finance LP

The drop in COMEX silver inventories could signify a normalization of the situation on the exchange and the return of some metal to London. Source: Bloomberg Finance LP

Technical Snapshot

The price is retreating significantly today, falling not only below $50 per ounce but also breaching the 2011 peaks. Furthermore, the accelerated upward trend line, initiated in the second half of September, is being broken. Should this correction extend beyond a one-off profit-taking event, the next key support level will be around $47 per ounce, coinciding with the 30-day moving average.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report